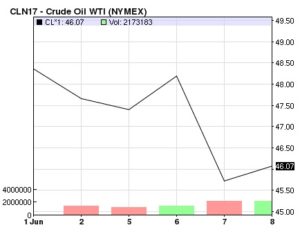

This week, West Texas Intermediate crude prices fell by 5% to a level of $45.72 per barrel before recovering to $46.07. The sharp fall of almost $2.50 in a day was prompted by an Energy Information Administration report regarding the level of US crude oil inventories. In the week that ended on June 2, crude stocks had increased by a massive 3.3 million barrels.

The recent decline in oil prices is part of a trend that has been fuelled by several factors.

Source – Nasdaq

A booming shale industry

The US shale industry has been steadily increasing production levels. In 2017, its output is expected to be 9.2 million barrels per day, up 300,000 b/d from the previous year. Production levels are expected to rise by an additional 500,000 b/d in 2018.

Drilling activity has picked up sharply especially in areas such as the Permian Basin in Texas. The acting administrator of the Energy Information Administration, Howard Gruenspecht, points out that “… the total number of active rigs drilling for oil in the United States has more than doubled in the past 12 months.”