Crisis Insights:

- Massive selling of U.S. bonds by China could spike interest rates, disrupt markets, and escalate into global financial turmoil.

- The International Emergency Economic Powers Act (IEEPA) provides President Trump significant authority to freeze Chinese assets in retaliation.

- Potential consequences include severe economic impacts for both nations, highlighting a scenario of mutually assured financial destruction.

By Samuel Lopez – USA Herald

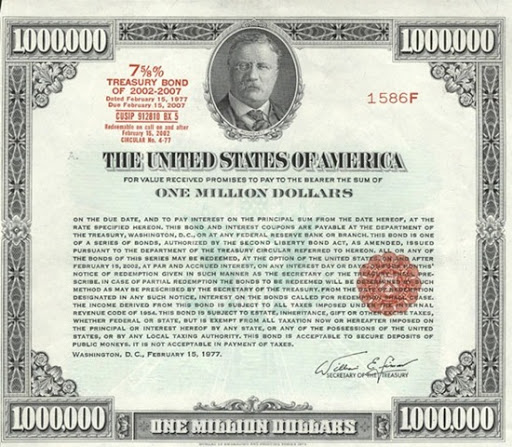

Fears are escalating across financial and political circles amid speculation that China might retaliate against President Trump’s imposing 125% tariffs by massively dumping its holdings of U.S. Treasury bonds. Such a dramatic move would undeniably shock global markets, yet the scenario poses substantial risks for both China and the United States. In the face of such an economic confrontation, President Trump could potentially leverage expansive executive powers, specifically under the International Emergency Economic Powers Act (IEEPA).

The Domino Effect of a Massive Bond Sell-off

If China were to rapidly liquidate its substantial holdings of U.S. Treasury bonds, currently valued at approximately $775 billion, the immediate effects could ripple dangerously through the U.S. economy. Bond prices would plummet, sharply driving up yields. A sudden surge in interest rates would not only increase borrowing costs for the U.S. government but also significantly raise rates on mortgages, car loans, credit cards, and business financing.

Yet, China’s maneuver wouldn’t be risk-free. By unloading vast amounts of Treasuries swiftly, Beijing would substantially undermine the value of its remaining holdings. Furthermore, China’s currency, the yuan, would appreciate sharply, undermining the competitiveness of Chinese exports globally, essential making Chinese goods too expensive. Domestically, such financial disruption could precipitate significant economic instability, job loss, closure of factories and corporations, and would likely destabilize the Chinese banking system and industrial sectors.

Economists characterize this scenario as a “mutually assured financial destruction” where both nations suffer catastrophic economic damage.

Trump’s Potential Countermeasures Under IEEPA

Faced with a hypothetical crisis of this magnitude, President Trump could invoke the International Emergency Economic Powers Act (IEEPA). This powerful legislation provides the executive branch sweeping authority to impose stringent economic measures against foreign adversaries.

Under the IEEPA framework, President Trump would first declare a national emergency, potentially designating China as an acute threat to U.S. national security. Subsequently, through an executive order, Trump could direct the U.S. Treasury’s Office of Foreign Assets Control (OFAC) to freeze or block all Chinese assets held in American financial institutions, and could instruct financial institutions overseeing these bonds to disregard Beijing’s directives to sell additional U.S. bonds.

This type of economic warfare isn’t unprecedented. The IEEPA has historically been used effectively to freeze Iranian assets during the 1979 hostage crisis and Russian assets following the invasion of Ukraine.

The Mechanics of Freezing Chinese Assets

The process of freezing assets would involve OFAC directing U.S. banks—such as JPMorgan Chase, Citibank, and others holding China’s Treasury bonds—to halt all transactions involving Chinese entities immediately. This tactic would block China from selling or liquidating its U.S. holdings, effectively neutralizing any attempted economic sabotage.

Further intensifying pressure, the Trump administration could leverage diplomatic channels to coordinate with allies like Japan, the United Kingdom, Switzerland, and the European Union, urging them to impose similar freezes, effectively isolating China’s global financial operations.

This scenario would echo the recent 2022 move against Russia, where the freezing of hundreds of billions in Russian reserves severely restricted Moscow’s economic flexibility.

Political and Strategic Considerations

Legally, invoking IEEPA is straightforward; the necessary statutes exist clearly within U.S. law. Politically and strategically, however, such actions would represent a drastic escalation akin to economic warfare. It could provoke severe retaliatory measures from Beijing, ranging from targeted sanctions against U.S. corporations operating in China to cyber warfare, further destabilizing global geopolitical dynamics.

Therefore, despite possessing powerful economic tools, policymakers recognize that invoking such measures would only be feasible in genuinely extreme scenarios, such as during direct military confrontations or severe geopolitical crises.

Bottom Line

While China possesses the means to significantly disrupt the U.S. economy through massive bond sell-offs, this nuclear option carries dire reciprocal consequences. Both nations stand to lose profoundly in such a confrontation, making gradual, incremental financial moves far more likely. The U.S. retains robust legislative tools to counteract economic attacks, notably through the IEEPA, underscoring the complex balance of economic power and mutual vulnerability that defines contemporary U.S.-China relations.

Fact-Check and Sources: