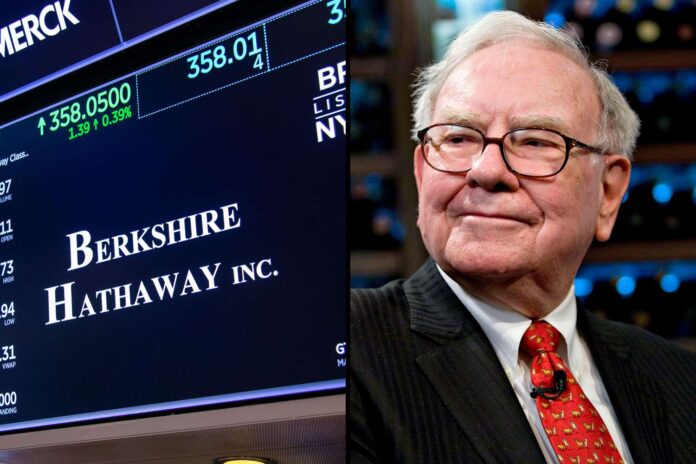

USA HERALD (September 12, 2025) — When a Berkshire Hathaway-owned construction supplier loses a high-stakes antitrust battle, the fallout doesn’t stop at the courthouse door — it bleeds into the insurance arena, where multimillion-dollar coverage fights ignite.

That’s exactly what Johns Manville Corp. now faces. The Denver-based insulation giant says Liberty Mutual, Swiss Re, and Allianz are all shirking their contractual obligations to cover a staggering $22.2 million judgment stemming from an antitrust suit brought by competitor Thermal Pipe Shields. In a new lawsuit filed in Colorado federal court, Johns Manville accuses the insurers of breach of contract, bad faith, and calculated delay tactics.

Thermal Pipe Shields sued Johns Manville in 2019, alleging that the Berkshire subsidiary abused its near-total 98% monopoly in the calcium silicate insulation market. According to TPS, Johns Manville not only blocked fair competition but also disparaged TPS products to choke off its growth.

The case went to trial, and by May 2024, the jury dropped the hammer: a $6.7 million verdict that ballooned into $20.3 million after treble damages were applied. With attorney fees added, the final tally hit $22.2 million. Johns Manville didn’t deny the judgment — instead, it turned to its insurers, expecting coverage under policies specifically designed to handle claims for “personal and advertising injury,” including the publication of disparaging statements.

But instead of stepping up, Johns Manville says its insurers pulled back.

Liberty Mutual’s fire insurance arm agreed to defend Johns Manville — but its specialty and excess carriers balked. Ironshore Specialty Insurance Co., Liberty Insurance Corp. (which once insured Johns Manville’s now-merged subsidiary Industrial Insulation Group), Swiss Re Corporate Solutions, and Allianz Global Risks all either refused outright or deflected responsibility.

The stakes are not small. Johns Manville argues that disparagement occurred squarely during policy periods and under policy language that unmistakably covers “disparaging material.” Swiss Re and Allianz, who issued umbrella policies, were supposed to step in if Liberty refused coverage. But the company says they’ve done the opposite: digging in their heels, hiding behind policy interpretation, and leaving Johns Manville to front the entire payout.