In a high-stakes acquisition that reverberated through the global security and engineering industries, CVC Capital Partners announced Wednesday that it has reached a £2 billion ($2.7 billion) agreement to buy Smiths Detection from Smiths Group PLC — a move framed as a major strategic pivot for the FTSE 100 company.

The transaction, steered by legal heavyweights Latham & Watkins LLP for CVC and Freshfields LLP for Smiths Group, will be funded through CVC’s Capital Partners IX fund.

CVC executives Dominic Murphy and Conor Keogh hailed Smiths Detection as a critical infrastructure guardian whose technologies “play a crucial role in helping protect people and critical infrastructure worldwide.” They added that CVC intends to accelerate the company’s next growth phase through deep investments in engineering, innovation and aftermarket support.

A Global Leader in Aviation and Infrastructure Security

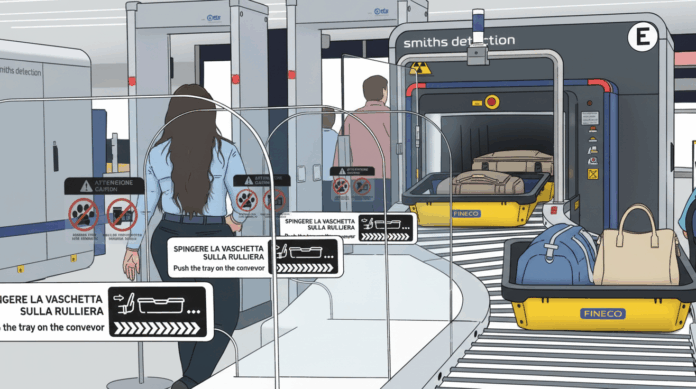

Smiths Detection occupies a commanding position in the aviation safety market, powering the screening of carry-on bags, checked luggage, and air cargo. Its technologies are deployed across 47 of the world’s 50 largest airports, making it a dominant force in global threat-detection systems.

For the fiscal year ending July 31, the company reported: