Breaking News

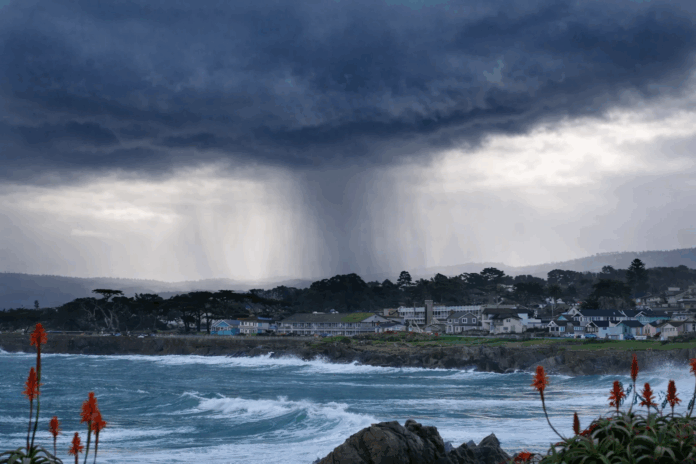

- The storm arrived in the dead of night, just before Christmas, with rain and wind so fierce it sounded like a freight train tearing through the Central Coast.

- In the darkness, trees snapped, debris scattered, and entire neighborhoods braced for damage they could not yet fully see.

- As daylight reveals the aftermath, another question looms alongside the flooding—how insurance companies will respond when policyholders need them most.

An atmospheric river arriving just before Christmas is threatening homes, infrastructure, and lives—while putting insurance coverage, claims handling, and exclusions under a harsh spotlight.

By Samuel Lopez | USA Herald – I was on the Central Coast of California when the first wave of this Christmas storm moved in shortly after midnight. The wind-driven rain was relentless, hammering buildings and bending trees until large branches broke free. With sunrise still hours away, the scope of the destruction remained unclear, but the intensity of the storm left little doubt that damage assessments would follow quickly once daylight arrived.

According to publicly released forecasts from state and federal weather agencies, this storm system is being fueled by a strengthening atmospheric river offshore, delivering heavy rain across much of California through Christmas Day. Officials warn that flash flooding and mudslides are increasingly likely as already saturated ground loses its capacity to absorb additional rainfall. In mountainous regions, small streams are expected to swell into dangerous rivers capable of washing out roads and isolating communities.

Southern California faces an especially dangerous scenario. Forecast models project that coastal and urban areas could receive multiple months’ worth of rain in a matter of days. The downtown area of Los Angeles alone is expected to receive several inches of rainfall this week—well above historical December averages. Rainfall rates could approach two inches per hour at peak intensity, a threshold that can overwhelm storm drains, flood streets, and cause water to rush through neighborhoods with little warning.

Meanwhile, the Sierra Nevada is expected to receive feet of snow, raising the risk of road closures and stranded motorists during a major holiday travel period. Emergency officials have cautioned residents and travelers to avoid unnecessary travel and to prepare for rapidly changing conditions.

Beyond the immediate safety concerns, this storm is already raising serious questions about insurance coverage and claims handling. Homeowners and business owners facing flood damage may soon learn that not all losses are treated equally under their policies. Standard homeowners insurance policies typically exclude flood damage, requiring separate flood insurance policies for coverage. Mudslides, debris flows, and water intrusion often fall into gray areas that can lead to disputes between insurers and policyholders.

According to publicly available policy language and prior claims data, insurers frequently distinguish between “flood,” “surface water,” and “rain-driven damage,” distinctions that can significantly affect whether a claim is approved or denied. For policyholders, those technical definitions—rarely considered until disaster strikes—can become financially decisive.

Insurance companies operating in California are also under pressure from regulators and lawmakers who have criticized delays and denials following prior catastrophic events. Past wildfire and flood disasters have generated litigation alleging bad faith claims handling, insufficient investigations, and failure to communicate clearly with insureds. This storm, arriving at a time when many carriers have already reduced exposure or exited certain markets, could intensify scrutiny of how claims are processed in the days and weeks ahead.

From an industry standpoint, storms of this magnitude highlight the growing tension between climate-driven risk and the traditional insurance model. Atmospheric rivers are becoming more frequent and more intense, increasing loss severity while shrinking the margins insurers rely on to remain profitable. As a result, policyholders may face higher deductibles, narrower coverage, or outright non-renewals—often after experiencing the very losses insurance is meant to protect against.

For now, residents are focused on safety, cleanup, and survival through Christmas Day. But once the water recedes, the next phase begins—documenting damage, filing claims, and navigating a system that can be as unforgiving as the storm itself.

***

USA Herald continues to provide independent, in-depth reporting and analysis you won’t find anywhere else. Readers who want access to exclusive insights, developing investigations, and original reporting are encouraged to join the free USA Herald newsletter. Signing up takes just a moment and helps support ethical, transparent journalism.