A federal judge on Tuesday blocked the White House from cutting off funding to the Consumer Financial Protection Bureau, ruling that the agency must continue receiving money from the Federal Reserve to ensure it can pay its employees.

U.S. District Judge Amy Berman Jackson said the CFPB’s funding stream remains valid even though the Federal Reserve is currently operating at a paper loss. She rejected a new legal argument advanced by the White House that sought to prevent the bureau from accessing funds it has relied on since its creation.

The ruling came just days before the CFPB was expected to face a potential funding shortfall that could have left it unable to meet payroll obligations.

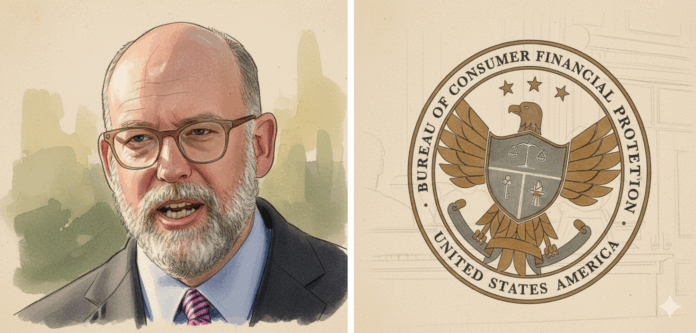

At the center of the case is whether Russell Vought, the administration’s budget director and acting CFPB director, has the authority to effectively shut down the agency by starving it of funds and laying off its workforce. The bureau has largely been dormant since President Donald Trump returned to office, with most employees barred from performing substantive work and agency operations focused on unwinding prior regulatory actions.

Vought has publicly stated that he intends to dismantle the CFPB. Earlier this year, the White House issued a reduction in force order that would have furloughed or terminated a large portion of the bureau’s staff.

The National Treasury Employees Union, which represents CFPB workers, challenged those layoffs in court and secured a preliminary injunction halting the job cuts while the case proceeds.

In recent weeks, the administration attempted to sidestep that injunction by arguing that the CFPB can no longer draw funds from the Federal Reserve because the central bank currently has no “combined earnings.” The CFPB receives funding through quarterly transfers from the Fed rather than congressional appropriations.

The Federal Reserve has reported operating losses since 2022 as a result of higher interest payments to banks while holding lower-yield bonds acquired during the pandemic. Those losses are recorded as a deferred asset that the Fed expects to offset over time.

The White House argued that those accounting losses mean there are no earnings available to fund the CFPB, despite the bureau having operated under the same funding structure since 2011, including during Trump’s first term.

White House lawyers warned the court in November that the CFPB could run out of funds by early 2026 and said the agency does not expect to receive congressional appropriations.

Judge Jackson said the administration’s interpretation of “combined earnings” was unsupported and appeared designed to evade the court’s earlier injunction rather than resolve the dispute on the merits. A trial on whether the union can sue over the attempted layoffs is scheduled for February 2026.

“It appears that defendants’ new understanding of ‘combined earnings’ is an unsupported and transparent attempt to starve the CFPB of funding,” Jackson wrote, calling it another effort to accomplish what the court had already barred.

Jennifer Bennett of Gupta Wessler LLP, who represents CFPB employees, welcomed the ruling.

“We’re very pleased that the court made clear what should have been obvious,” Bennett said. “The administration cannot justify abandoning the agency’s obligations or violating a court order by manufacturing a lack of funding.”

The White House did not immediately respond to a request for comment.