Let’s look at some historical issues.

These are some recent cases and findings that highlight the issue of life insurance companies policies and abusive practices.

From Indiana:

“The Indiana Court of Appeals: Lincoln appealed the class certification on Count Three, and Bezich cross-appealed the denial of certification on Counts One and Two. On June 2, 2015, a three-judge appellate panel ruled that class certification was proper for all three of Bezich’s claims. Thus the panel reversed the trial court ruling on Counts One and Two, and affirmed the trial court ruling on Count Three. The panel sent the case back to the trial court for further proceedings. In its discussion of Count Three, the panel said:

Finally, we cannot help but comment upon the absurdity of Lincoln’s own interpretation of the COI rate provision, which is that the Ensemble II allows Lincoln to unilaterally increase rates on customers to reflect a change in mortality factors but offers no parallel commitment to decrease rates despite an overwhelming improvement in mortality. We have grave doubts that any policyholder of average intelligence would read the COI rate provision to confer on Lincoln that sort of “heads we win, tails you lose” power. [Italics in original.] “– Joseph Belth, Ph.D.

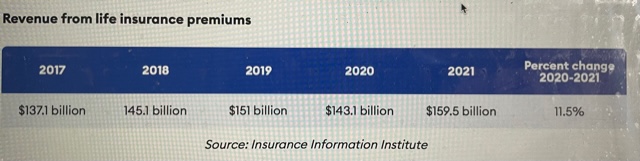

The use of annuities in life insurance has increased in recent years, advertised as a way to safely increase your money. I mean, who doesn’t like the sound of that? It’s no surprise that life insurance is making big money gains.

“Life insurance companies paid out $78.4 billion to life insurance beneficiaries and $88.1 billion in annuity benefits in 2019. This follows an industry shift from traditional life insurance toward annuities. In 2021, annuities accounted for 48% of life/annuity premiums written.

How much a life insurance company pays out on a specific claim depends, of course, on the terms of the policy.” – Forbes

But recent lawsuits show the methods sold to people may not be what they get. Of course our courts cannot be used for disappointing returns, but what we are talking about here is not that. It’s the deceptive and misleading practices. And yet lawmakers are doing little to help policy holders get protections.

As many of these insurance companies have big money at their disposal, fighting lawsuits are not a problem. Individuals however, have to have the money and inclination to fight abusive practices and results, which can be a problem for many.

Life insurance is supposed to help people at a challenging time. Having processes in place within that sector that is transparent and fair is crucial. With big money on the table though, oversight of this growing moneymaker in life insurance is key to keep people from listening to their lesser angels. That would surely give policy holders the peace of mind these plans are designed to give.