Hyatt Hotels Corp. has finalized the long-anticipated Hyatt $2B Playa sale, completing the divestiture of a vast real estate portfolio to Tortuga Resorts in a deal that redraws the company’s balance sheet and its future in all-inclusive hospitality.

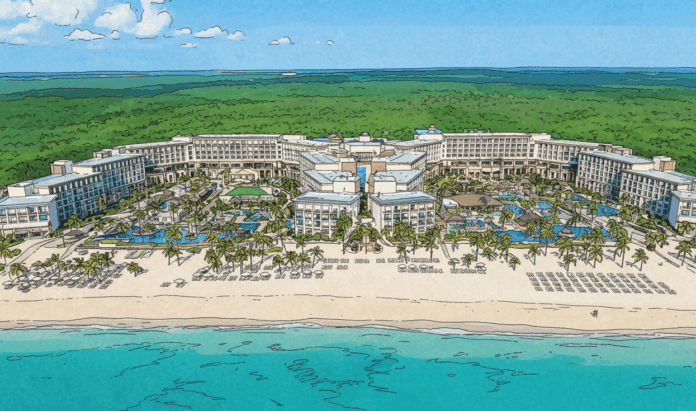

The closing, announced Dec. 30, transfers ownership of 14 all-inclusive resorts across Mexico, the Dominican Republic and Jamaica, a transaction first unveiled in late June.

A Deal Years in the Making

Tortuga Resorts is a joint venture between an affiliate of Denver-based KSL Capital Partners and Mexican family office Rodin. Under the agreement, Hyatt could collect up to $143 million in additional earnouts if performance benchmarks are reached. Hyatt also retained $200 million in preferred equity in Tortuga as part of the arrangement.

The portfolio originally comprised 15 properties, but Hyatt disclosed during its third-quarter earnings call that one — Playa del Carmen in Mexico — was sold separately to an undisclosed buyer on Sept. 18 for $22 million.