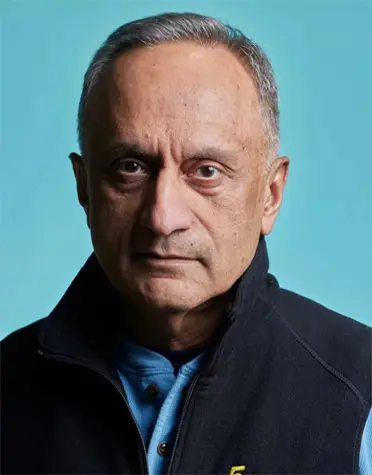

Manoj Bhargava: From Monk to Billionaire Now Facing Tax Evasion & Monopoly Allegations

A Controversial Transformation: Who Is Manoj Bhargava?

Once revered as a monk-turned-billionaire and philanthropist, Manoj Bhargava, the founder of 5-Hour Energy, is now under intense legal scrutiny. Known for his vow to donate over 90% of his wealth, Bhargava is being investigated by the IRS, the Senate Finance Committee, and private litigants for alleged tax evasion and anti-competitive behavior.

The Alleged Tax Scheme: Bhargava’s $624 Million Donation Under Fire

IRS Accusations of Tax Avoidance

Bhargava is accused of donating a $624 million stake in his company to a Michigan charity linked to his personal spiritual guru. The IRS claims this donation was a sham transaction—a sophisticated scheme to evade taxes while retaining control over the partnership through a promissory note (IOU).

Legal Red Flags Raised by the IRS

- Sham TransactionsThe IRS argues the donation and buyback lacked genuine economic substance. (Reference: Gregory v. Helvering, 293 U.S. 465)

- Lack of Bona Fide GiftUnder Treas. Reg. §1.170A-1(b), donations must be irrevocable. Bhargava’s control over the asset suggests otherwise.

- Valuation DisputesThe $624 million valuation of the stake may have been inflated or manipulated, according to the IRS.

Foreign Accounts and FBAR Violations

Swiss Bank Accounts and Offshore Trusts

The Senate Finance Committee is investigating whether Manoj Bhargava failed to disclose foreign accounts in Switzerland and Singapore. If proven, this would be a serious violation of the Foreign Bank Account Reporting (FBAR) rules under 31 U.S.C. §5314.

$255 Million Transfer to Swiss Accounts

Senator Ron Wyden has highlighted Bhargava’s alleged transfer of $255 million to Swiss bank accounts, still under his control via a close associate. This could result in record-setting FBAR penalties exceeding $125 million.

The $1 Billion Lawsuit: Vitamin Energy vs. 5-Hour Energy

Antitrust and False Advertising Claims

Filed in November 2024, Vitamin Energy is suing Bhargava and 5-Hour Energy for:

- Violations of the Sherman Antitrust Act (15 U.S.C. §1)

- False advertising under the Lanham Act (15 U.S.C. §1125)

Vitamin Energy accuses Bhargava of using his market dominance to eliminate competition and mislead consumers.

Legal Representation and Impact

Law firm Evia Law PLC, represented by Steven Susser and Jessica Fleetham, is pursuing $1 billion in damages. If proven, these claims could significantly affect Bhargava’s business empire.

Offshore Financial Structures and Hidden Wealth

Alleged $1.4 Billion Transfer to Singapore Trust

Court documents suggest that Bhargava’s Michigan charity transferred $1.4 billion to a private Singapore trust, raising questions about his intent to evade U.S. tax obligations.

Potential Violations and Civil Penalties

U.S. citizens are legally obligated to disclose a foreign financial accounts exceeding $10,000. Bhargava’s alleged non-compliance could lead to massive civil penalties under 31 U.S.C. §5321.

Legal Analysis and Broader Implications

IRS Enforcement: Substance Over Form Doctrine

Tax law prioritizes the substance of a transaction over its form. If Bhargava’s actions show continued control, the IRS can disregard formalities and impose penalties accordingly.

Risk to Bhargava and 5-Hour Energy

- Civil penalties and back taxes could total hundreds of millions.

- Reputation damage could harm brand trust and public image.

- Investor confidence may falter amidst legal instability.

- Future financial dealings of Bhargava’s companies may face more regulatory scrutiny.

High-Profile Comparisons and Global Crackdown

Similar Cases of Billionaire Tax Evasion

- Robert Brockman: Accused of concealing $2 billion offshore (case dismissed due to death).

- Pictet Bank: Admitted aiding $5.6 billion in tax evasion; paid $123 million settlement.

Allegations and Consequences: What Lies Ahead?

The accusations against Manoj Bhargava reveal a potential pattern of:

- Fraudulent donation and repurchase tactics

- Use of offshore accounts for wealth concealment

- Monopolistic practices and false marketing

While these are still allegations, the legal consequences could include:

- Back taxes & civil penalties

- $1B in damages from the Vitamin Energy lawsuit

- Long-term reputational damage

Fact Check and Sources

Verified Details

- Vitamin Energy Lawsuit: Filed November 2024 (Michigan federal court)

- Senator Wyden’s Letter: Sent to Swiss Bank Pictet

- Forbes Analysis: Offers a critical view of IRS enforcement strategy

Conclusion

Manoj Bhargava‘s journey from spiritual seeker to billionaire entrepreneur has taken a dramatic turn. Whether these accusations lead to convictions or settlements, the implications for tax law, corporate ethics, and philanthropic accountability are profound. The world will be watching as this case unfolds.

Bonus Resource

For an in-depth legal breakdown of the allegations against Manoj Bhargava, including citations and business implications, visit the author’s Patreon page for exclusive content.