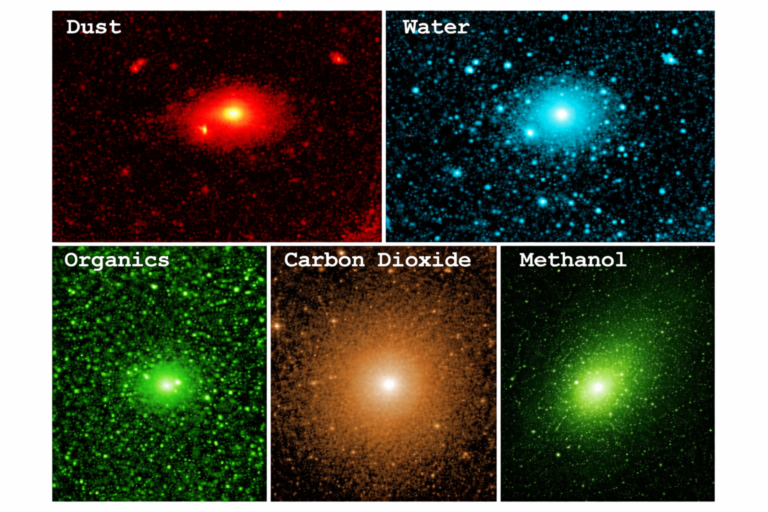

3I/ATLAS Shocks Astronomers With Fuel-Like Methanol Molecule At Extraordinary Levels

The chemistry also appears more complex than a simple release from the nucleus alone. According to the ALMA findings, hydrogen…

By – Samuel LopezLIRG Agrees Delegated Underwriting Authority with Mandarin Re

“Deal Covers Property Facultative, Treaty, and ILW contracts” Miami, Florida – March 10, 2026: Algorithmic Insurance Services, Inc.…

By – Rochdi RaisWar Abroad, Risk At Home: Why Americans Are Quietly Reviewing Insurance Policies As Global Conflicts Expand

[USA HERALD] – As the United States confronts rising geopolitical tensions and the possibility of military engagement on multiple fronts…

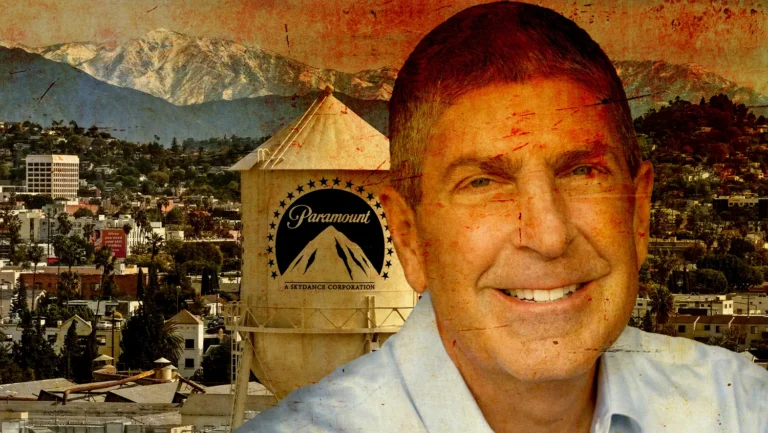

By – Samuel LopezParamount President PR $150M Lawsuit Sparks Explosive Allegations

Meeting Ends Without Deal According to the complaint, Cipriani and Shell met Feb. 2 at a lawyer’s office in an…

By – Rachel MooreSpaceX’s Starship V3 Test Delayed as NASA Pushes Faster Lunar Lander Development

NASA Urges Faster Progress for Artemis While SpaceX fine-tunes its next launch, pressure is mounting from NASA, which is relying…

By – Rachel MooreAR-15 Rihanna Home Attack: Armed Suspect Fires Shots at Singer’s Beverly Hills Residence

Suspect’s Criminal History Records reviewed by The Times show Ortiz has had several encounters with law enforcement in her home…

By – Rachel MoorePentagon-Anthropic AI Dispute Explodes Into Federal Lawsuits Over AI Safety Policies

A Rare and Controversial Blacklist National security experts say the government’s designation is highly unusual. Supply-chain risk labels are typically…

By – Rachel MooreG7 Oil Reserve Release Considered as Iran War Disrupts Global Energy Supply

A Historic Supply Shock According to analysts at consulting firm Rapidan Energy Group, the closure of the strait has triggered…

By – Rihem AkkoucheOpenAI Acquires Promptfoo to Strengthen AI Security and Testing Tools

Recruiting the Minds Behind AI Infrastructure OpenAI has also strengthened its technical bench through high-profile hires. In February, the company…

By – Rihem AkkoucheISIS New York Attack Charges Filed After Alleged Bomb Plot at NYC Protest

Investigators Cite Allegiance to ISIS Court documents detail disturbing statements allegedly made by the suspects. Investigators say Balat wrote a…

By – Rihem AkkoucheUmbrella Armory filed for Chapter 7 as Gun Industry Slowdown Claims Another Casualty

Gun Industry Faces Cooling Demand The broader firearms market has also begun to cool. “The industry’s fortunes tend to rise…

By – Rihem AkkoucheIran’s Power Shift: Iran’s Supreme Leader Mojtaba Khamenei Emerges at the Center of Authority

From Clerical Roots to Security Power Born in 1969 in Mashhad, Mojtaba Khamenei pursued religious studies in Tehran after the…

By – Rihem AkkoucheIran’s Power Shift: Iran’s Supreme Leader Mojtaba Khamenei Emerges at the Center of Authority

From Clerical Roots to Security Power Born in 1969 in Mashhad, Mojtaba Khamenei pursued religious studies in Tehran after the…

By – Rihem AkkoucheIPIC Theaters Files for Bankruptcy as Luxury Cinema Chain Seeks Lifeline

Early Embrace of Streaming Studio Films As streaming platforms expanded their ambitions in feature films, iPic distinguished itself by being…

By – Rachel MooreUS Cuba Economic Deal Emerges as Trump Administration Eyes Major Policy Shift

Skepticism From Former U.S. Officials Despite the administration’s optimism, some former U.S. officials who have worked on Cuba policy privately…

By – Rachel MooreAmazon FCC Denial of SpaceX Plan Urged in Satellite Showdown

Amazon Suggests Proposal May Be Publicity Move Amazon’s filing goes even further, suggesting that the proposal could be more about…

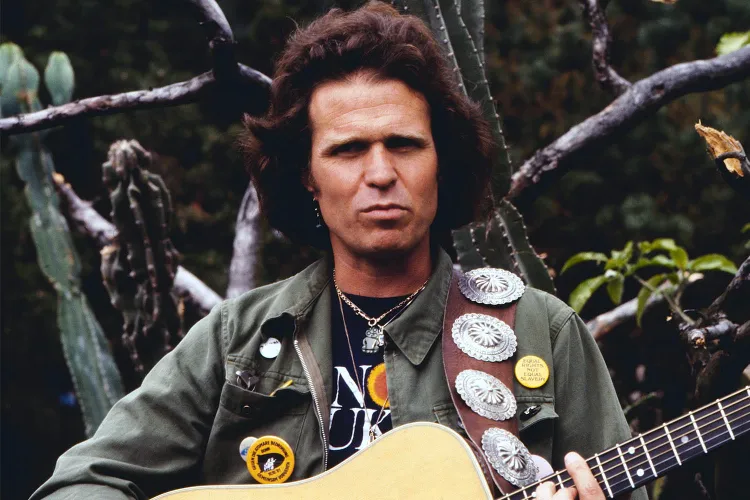

By – Rihem AkkoucheCountry Joe McDonald Died at 84, Woodstock Legend and Protest Voice Falls Silent

Reflecting on Woodstock’s Lasting Legacy Looking back decades later, McDonald said he never initially grasped the historical magnitude of his…

By – Rihem AkkoucheThe Northern Lights Return

The Northern Lights have a chance to be visible from several northern U.S. states on Tuesday night, forecasters at the…

By – Jackie AllenThe Northern Lights Return

The Northern Lights have a chance to be visible from several northern U.S. states on Tuesday night, forecasters at the…

By – Jackie AllenFebruary Unemployment Up as Job Losses Surprise Economists

According to the BLS: Producer prices rose 2.9% year-over-year through January 2026 Core PPI increased 3.6%, excluding food and energy…

By – Jackie AllenLate-Night Attack by Venezuelan National at Florida Beach

Officials noted that the suspect had overstayed his work visa at the time of the attack. For more details on…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

On the Republican side, most lawmakers appear to back Trump’s strategy. Sen. Tom Cotton (R-Ark.), chair of the Senate Intelligence…

By – Jackie AllenU.S. And Israel Launch Major Strikes On Iran — What It Means For America

Continuation of military strikes if Iran persists in retaliatory attacks. Diplomacy or ceasefire negotiations if international pressure increases. A broader…

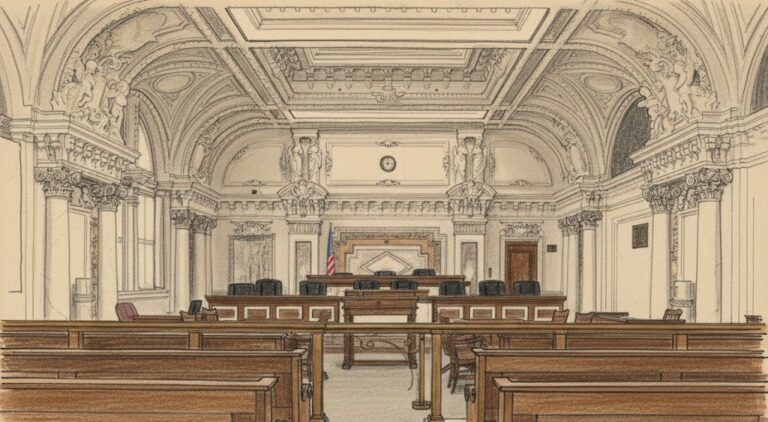

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

BNSF declined to comment on the decision. Judges Consuelo M. Callahan, Morgan B. Christen and Andrew D. Hurwitz sat on…

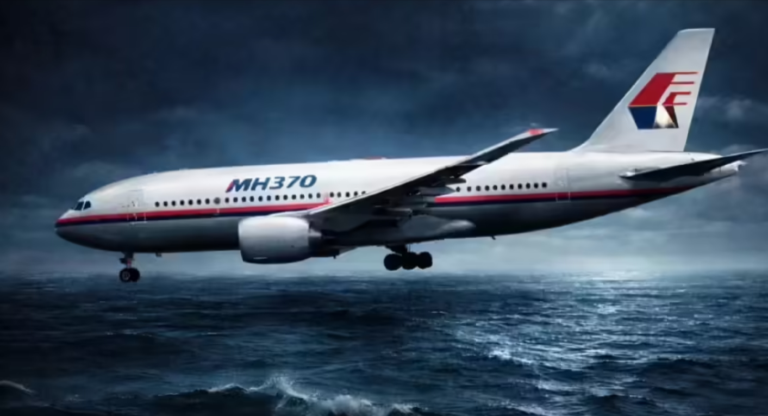

By – Tyler BrooksMalaysia Airlines MH370 Disappearance Remains Unsolved After New Ocean Search

Families Demand Continued Search Relatives of passengers aboard the missing flight say the latest setback should not mark the end…

By – Rihem AkkoucheBlast at US Embassy in Oslo Triggers Terrorism Investigation

Officials Condemn Incident Norwegian officials quickly condemned the attack and reaffirmed their commitment to protecting diplomatic facilities. Foreign Minister Espen…

By – Rihem AkkoucheIran’s Supreme Leader Selection Nears as War Intensifies Across the Region

Temporary Leadership Governs Amid Crisis Until the succession becomes official, Iran is being governed by a temporary three-member leadership council,…

By – Rihem AkkoucheKanye West’s Malibu Mansion Trial Takes Dramatic Turn in Court

Ye Clarifies His Name and Design Ideas “It’s Just Ye” During questioning, the rapper also paused proceedings briefly to clarify…

By – Rihem AkkoucheKuwait Cuts Oil Production as Gulf Tanker Threats Disrupt Global Energy Flow

Risk of $100 Oil Looms Analysts warn the situation could deteriorate quickly. Kaneva said Gulf producers could exhaust available storage…

By – Rihem AkkoucheOpenAI’s Caitlin Kalinowski Resigns Over Controversial Pentagon AI Agreement

Pentagon Talks and AI Industry Tensions The agreement between OpenAI and the Department of Defense surfaced just over a week…

By – Rihem AkkoucheWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

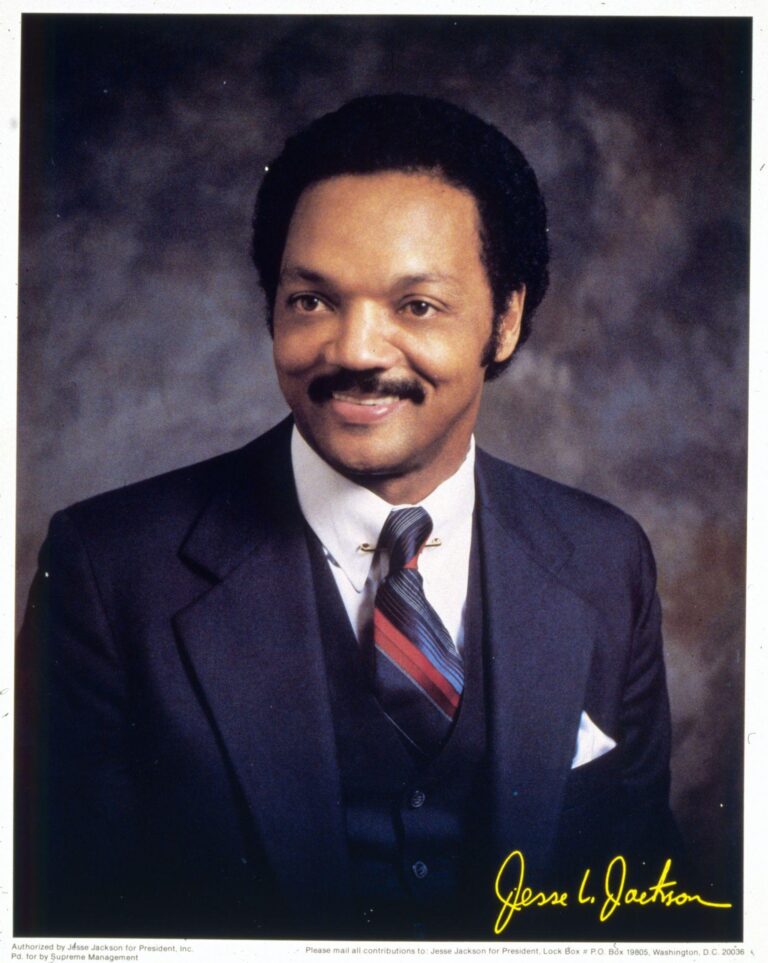

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

Even in later years, as illness softened his voice and slowed his step, Jackson remained active. In 2021, he was…

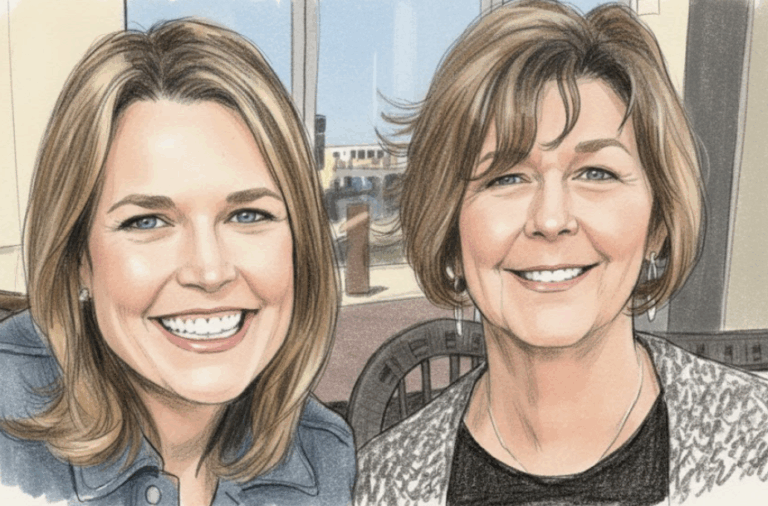

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

Community Support Grows as Search Continues As the investigation intensifies, the local community has rallied around the family. Neighbors and…

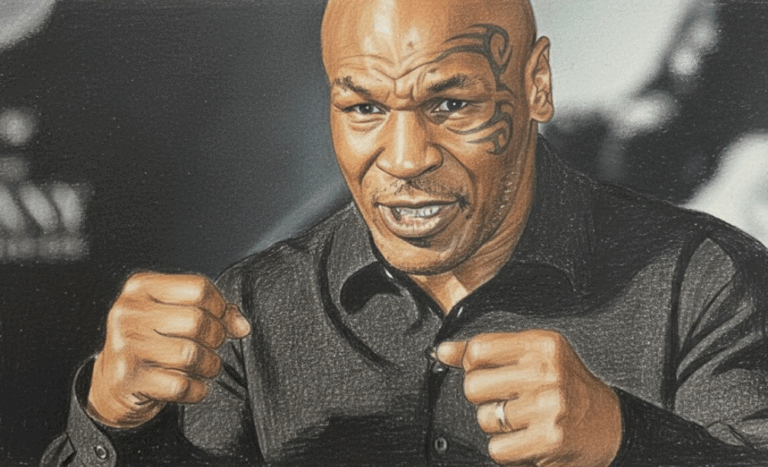

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

Lowdon has previously spoken about Andretti’s early encouragement during the team’s formation stages, noting that the racing legend asked him…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

With 13 days complete at the 2026 Milan Cortina Winter Olympics, Norway sits atop the overall medal standings, collecting 34…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

When Amber Glenn finishes her routine, the arena usually rises with her. The music builds, her blades carve a tight…

By – Tyler BrooksOlympic Villages Run Out of Condoms at 2026 Milan-Cortina Games

Condom supplies in the Olympic Villages at the 2026 Winter Games have been temporarily depleted, the Milan-Cortina organizing committee confirmed,…

By – Tyler BrooksArizona Authorities Escalate Search for Savannah Guthrie’s Mom to a Criminal Investigation

USA TODAY’s live coverage: https://www.usatoday.com Pima County Sheriff’s Office: https://www.pimasheriff.org NBC News reporting: https://www.nbcnews.com As the investigation continues, officials say…

By – Jackie AllenWhat is Aegosexuality?

This early classification, however, sparked significant criticism. Advocates argue that placing aegosexuality in this category not only misunderstood the experience…

By – Jackie AllenNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!