Kelly Warner Law Firm Blames USA Herald for Arizona Bar Investigation

5/17/17 Based on the information released in The Washington Post article on 5/17/17, the USA Herald publishes another in-depth article that…

By – USA HeraldAaron Kelly Law Firm Resorts To Attacking Former Client Again On KellyWarnerLaw.com – Pattern Recognized

Professor Volokh thereafter filed a bar complaint against Dan Warner with the Arizona Bar. This eventually led the ABA to…

By – Jeff WattersonArizona Bar Opens Investigation on Attorney Aaron Kelly

Volokh, as part of his investigative work, had a private investigator research the defendants in some of theallegedly fraudulent…

By – Paul O'NealUS Military Reportedly Used Claude (Anthropic AI model) in Iran Strike Operations Despite Policy Ban

The controversy reflects the growing intersection between artificial intelligence and modern warfare. Analysts warn that as AI systems become embedded…

By – Tyler BrooksIs This the Beginning of the End of Xbox? Revenue Drop, AI Pivot, and Console Future Spark ‘Sunset’ Debate Among Gamers

However, company representatives have not officially announced any plan to discontinue Xbox consoles. Microsoft’s AI Vision and Gaming Integration Strategy…

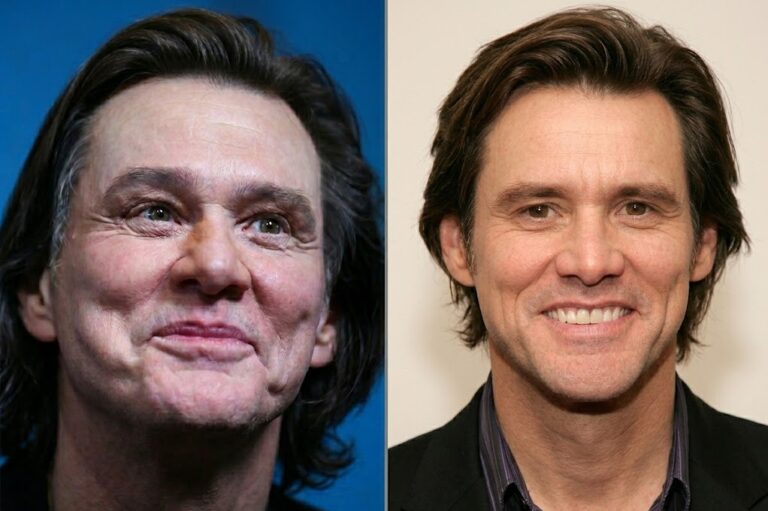

By – Ahmed BoughallebJim Carrey Clone Theory Goes Viral After Paris Awards Appearance: ‘Is That Really Him?’ — Online Fans Question “Body Double” Claim, Eye Color Shift, and Facial Changes Spark Heated Debate

Social Media Reaction Split Between Skepticism and Reality Online discussions quickly divided into two groups. Some users insisted something felt…

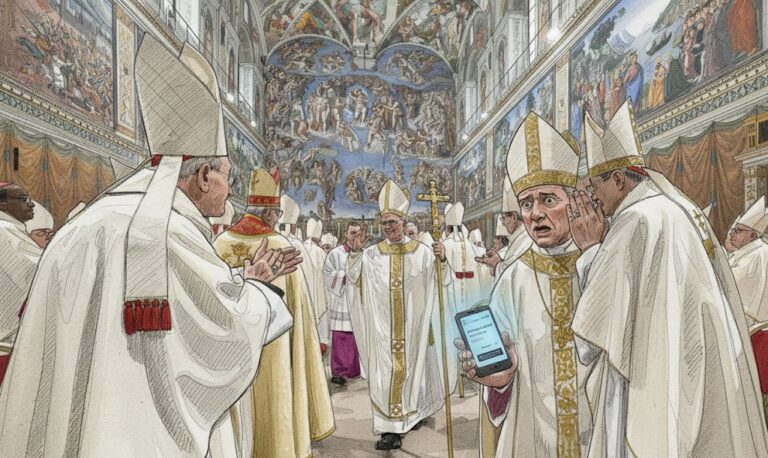

By – Ahmed BoughallebCardinal Reportedly Brought Mobile Phone Into Secret Vatican Conclave That Chose Pope Leo XIV

On the fourth ballot, he secured decisive backing. His election broke long-held assumptions that the College of Cardinals would avoid…

By – Tyler BrooksGameStop Reportedly Exploring Major Acquisition, With eBay Named as Possible Target

For now, the rumored deal remains speculative. But the conversation alone underscores a larger transformation underway at GameStop—one that could…

By – Ahmed BoughallebWhy WhatsApp’s Privacy Policy Is Under Legal Fire in India

One of the most significant directives barred WhatsApp from sharing user data with other Meta companies for five years. However,…

By – Ahmed BoughallebUS Military Reportedly Used Claude (Anthropic AI model) in Iran Strike Operations Despite Policy Ban

The controversy reflects the growing intersection between artificial intelligence and modern warfare. Analysts warn that as AI systems become embedded…

By – Tyler BrooksIs This the Beginning of the End of Xbox? Revenue Drop, AI Pivot, and Console Future Spark ‘Sunset’ Debate Among Gamers

However, company representatives have not officially announced any plan to discontinue Xbox consoles. Microsoft’s AI Vision and Gaming Integration Strategy…

By – Ahmed BoughallebJim Carrey Clone Theory Goes Viral After Paris Awards Appearance: ‘Is That Really Him?’ — Online Fans Question “Body Double” Claim, Eye Color Shift, and Facial Changes Spark Heated Debate

Social Media Reaction Split Between Skepticism and Reality Online discussions quickly divided into two groups. Some users insisted something felt…

By – Ahmed BoughallebCardinal Reportedly Brought Mobile Phone Into Secret Vatican Conclave That Chose Pope Leo XIV

On the fourth ballot, he secured decisive backing. His election broke long-held assumptions that the College of Cardinals would avoid…

By – Tyler BrooksGameStop Reportedly Exploring Major Acquisition, With eBay Named as Possible Target

For now, the rumored deal remains speculative. But the conversation alone underscores a larger transformation underway at GameStop—one that could…

By – Ahmed BoughallebWhy WhatsApp’s Privacy Policy Is Under Legal Fire in India

One of the most significant directives barred WhatsApp from sharing user data with other Meta companies for five years. However,…

By – Ahmed BoughallebUS Military Reportedly Used Claude (Anthropic AI model) in Iran Strike Operations Despite Policy Ban

The controversy reflects the growing intersection between artificial intelligence and modern warfare. Analysts warn that as AI systems become embedded…

By – Tyler BrooksIs This the Beginning of the End of Xbox? Revenue Drop, AI Pivot, and Console Future Spark ‘Sunset’ Debate Among Gamers

However, company representatives have not officially announced any plan to discontinue Xbox consoles. Microsoft’s AI Vision and Gaming Integration Strategy…

By – Ahmed BoughallebJim Carrey Clone Theory Goes Viral After Paris Awards Appearance: ‘Is That Really Him?’ — Online Fans Question “Body Double” Claim, Eye Color Shift, and Facial Changes Spark Heated Debate

Social Media Reaction Split Between Skepticism and Reality Online discussions quickly divided into two groups. Some users insisted something felt…

By – Ahmed BoughallebCardinal Reportedly Brought Mobile Phone Into Secret Vatican Conclave That Chose Pope Leo XIV

On the fourth ballot, he secured decisive backing. His election broke long-held assumptions that the College of Cardinals would avoid…

By – Tyler BrooksGameStop Reportedly Exploring Major Acquisition, With eBay Named as Possible Target

For now, the rumored deal remains speculative. But the conversation alone underscores a larger transformation underway at GameStop—one that could…

By – Ahmed BoughallebWhy WhatsApp’s Privacy Policy Is Under Legal Fire in India

One of the most significant directives barred WhatsApp from sharing user data with other Meta companies for five years. However,…

By – Ahmed BoughallebJim Carrey Clone Theory Goes Viral After Paris Awards Appearance: ‘Is That Really Him?’ — Online Fans Question “Body Double” Claim, Eye Color Shift, and Facial Changes Spark Heated Debate

Social Media Reaction Split Between Skepticism and Reality Online discussions quickly divided into two groups. Some users insisted something felt…

By – Ahmed BoughallebNASA Pushes Lunar Return to 2028 Amid Artemis Program Timeline Revision

Despite the delays, the agency emphasized that the revised schedule prioritizes reliability over speed. The new approach is intended to…

By – Ahmed BoughallebU.S. And Israel Launch Major Strikes On Iran — What It Means For America

Continuation of military strikes if Iran persists in retaliatory attacks. Diplomacy or ceasefire negotiations if international pressure increases. A broader…

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

BNSF declined to comment on the decision. Judges Consuelo M. Callahan, Morgan B. Christen and Andrew D. Hurwitz sat on…

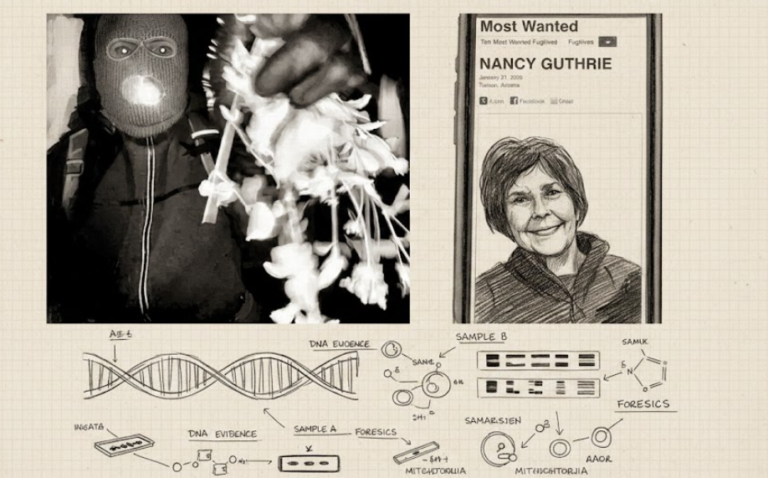

By – Tyler BrooksMissing DNA Evidence May Limit Investigation Into Nancy Guthrie Case, Sources Suggest

Representatives from FamilyTreeDNA emphasized that the company operates under strict privacy standards and does not directly conduct investigative work for…

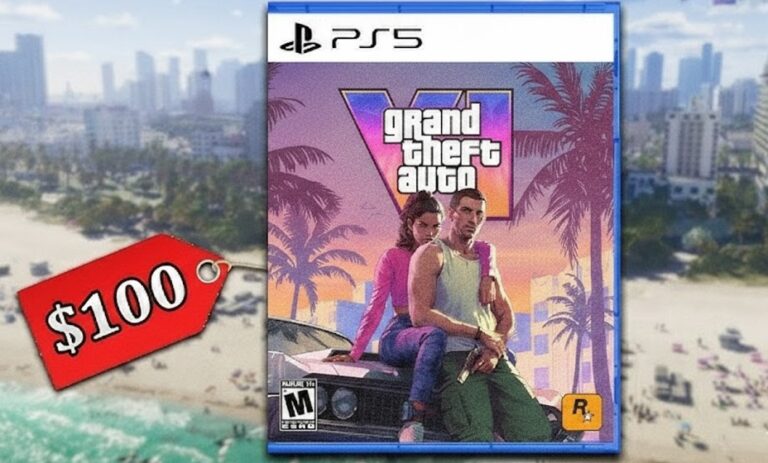

By – Ahmed BoughallebGrand Theft Auto 6 Targets November 2026 Launch as Price Leak Fuels $100 Debate

Underwater exploration is also expected to play a larger role, supported by new tools and environmental systems designed to enhance…

By – Ahmed BoughallebIs This the Beginning of the End of Xbox? Revenue Drop, AI Pivot, and Console Future Spark ‘Sunset’ Debate Among Gamers

However, company representatives have not officially announced any plan to discontinue Xbox consoles. Microsoft’s AI Vision and Gaming Integration Strategy…

By – Ahmed BoughallebJim Carrey Clone Theory Goes Viral After Paris Awards Appearance: ‘Is That Really Him?’ — Online Fans Question “Body Double” Claim, Eye Color Shift, and Facial Changes Spark Heated Debate

Social Media Reaction Split Between Skepticism and Reality Online discussions quickly divided into two groups. Some users insisted something felt…

By – Ahmed BoughallebCardinal Reportedly Brought Mobile Phone Into Secret Vatican Conclave That Chose Pope Leo XIV

On the fourth ballot, he secured decisive backing. His election broke long-held assumptions that the College of Cardinals would avoid…

By – Tyler BrooksGameStop Reportedly Exploring Major Acquisition, With eBay Named as Possible Target

For now, the rumored deal remains speculative. But the conversation alone underscores a larger transformation underway at GameStop—one that could…

By – Ahmed BoughallebWhy WhatsApp’s Privacy Policy Is Under Legal Fire in India

One of the most significant directives barred WhatsApp from sharing user data with other Meta companies for five years. However,…

By – Ahmed BoughallebOil Prices Surge After U.S.–Iran Strikes Raise Fears of Global Supply Disruptions

By – Tyler Brooks

FDA Announces Recall of Rhino Choco VIP 10X Supplement After Undeclared Erectile Dysfunction Drug Found in Chocolate Product

Undeclared active drug compounds in sexual enhancement products have been an ongoing concern for health authorities. These products are often…

By – Ahmed BoughallebWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

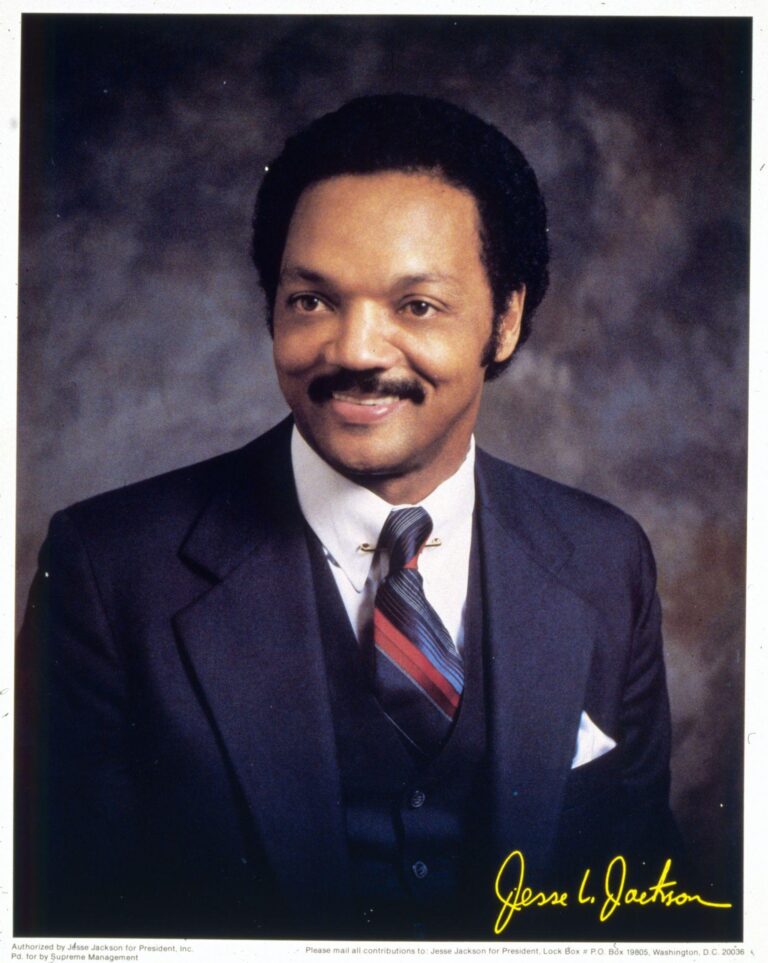

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

Domestically, he applied sustained pressure on corporations to diversify their leadership ranks and invest in minority communities. He publicly challenged…

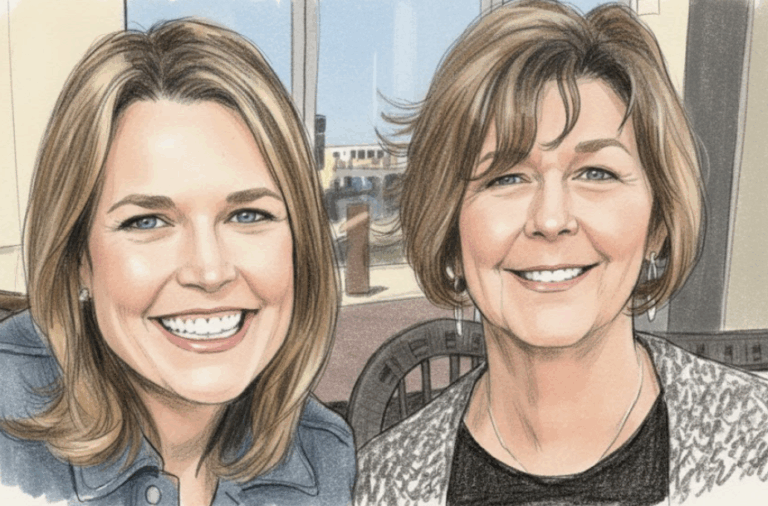

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

Savannah Guthrie Concerned about Ongoing Investigation With the case entering its second week, investigators remain focused on integrating physical evidence…

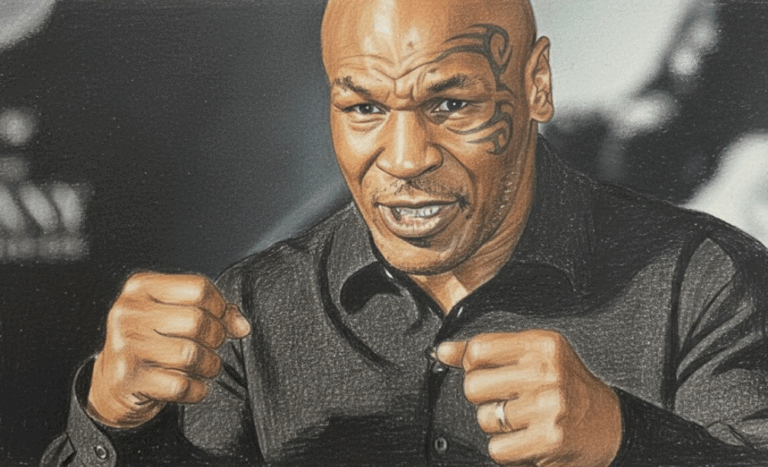

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

That persistence ultimately paid off, culminating in the green light for Cadillac’s 2026 entry. Leadership and Vision Team principal Graeme…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

Upcoming Medal Events Medal competition continues Friday, February 20, with several key finals scheduled. Events awarding medals include: Women’s ski…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

By – Tyler Brooks

Olympic Villages Run Out of Condoms at 2026 Milan-Cortina Games

Condom supplies in the Olympic Villages at the 2026 Winter Games have been temporarily depleted, the Milan-Cortina organizing committee confirmed,…

By – Tyler BrooksArizona Authorities Escalate Search for Savannah Guthrie’s Mom to a Criminal Investigation

USA TODAY’s live coverage: https://www.usatoday.com Pima County Sheriff’s Office: https://www.pimasheriff.org NBC News reporting: https://www.nbcnews.com As the investigation continues, officials say…

By – Jackie AllenWhat is Aegosexuality?

This early classification, however, sparked significant criticism. Advocates argue that placing aegosexuality in this category not only misunderstood the experience…

By – Jackie AllenNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!