Key Developments

- Astronomical rarity: Only the third interstellar object to pass through our solar system, comet 3I/ATLAS is a rarity worth paying attention to, prompting insurance companies to reassess their cosmic risk models

- No direct threat: Comet 3I/ATLAS poses no threat to Earth and will remain far away. The closest it will approach our planet is about 1.8 astronomical units (about 170 million miles, or 270 million kilometers)

- Insurance industry awakening: With a strong solar max in 2025 that could increase satellite failures, counting as “space weather” losses, insurers face mounting pressure to develop comprehensive space risk frameworks

USA HERALD – The discovery of interstellar comet 3I/ATLAS in July 2025 has reignited discussions within the insurance industry about preparedness for cosmic events, even as the comet itself poses no direct threat to Earth or satellites. While 3I/ATLAS poses no threat of impact and will pass through our Solar System and continue on its long journey through the galaxy, its presence underscores the growing complexity of space-related risks that insurers must navigate.

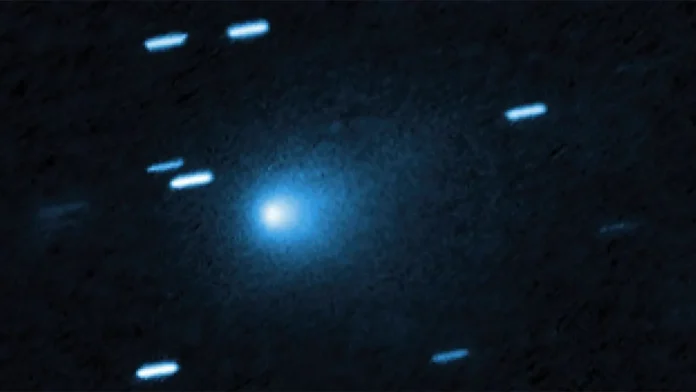

This comet was spotted by the Asteroid Terrestrial-impact Last Alert System (ATLAS) station in Chile in July 2025, marking only the third confirmed interstellar object to enter our solar system. 3I/ATLAS will reach its closest point to the Sun around Oct. 30, 2025, at a distance of about 1.4 au, well beyond any dangerous proximity to Earth-orbiting infrastructure.

The comet’s unusual nature has captured scientific attention. The comet poses no threat to Earth, astronomers said. However, its unusual trajectory will likely bring it close to Jupiter, Mars and Venus, providing unprecedented opportunities for study while remaining safely distant from critical satellite infrastructure.

The appearance of 3I/ATLAS comes at a time when the insurance industry is grappling with escalating space-related risks. The risk assessment complexity grows in line with the volume of space debris. Clauses specific to space debris mitigation measures, collision avoidance protocols, and EOL disposal plans are now entering insurance policies.

Space insurance has evolved to address multiple threat vectors. In-Orbit Insurance covers malfunctions, design failures, power loss, and collisions with space debris or micrometeoroids. It can reimburse the cost of repairs or a replacement satellite and may cover lost revenue if a satellite’s mission fails.

For terrestrial impacts, Falling objects—including satellites, asteroids, meteors and space debris—are covered under standard homeowners and business insurance policies, though the adequacy of such coverage for large-scale events remains questionable.

Industry executives report significant market stress. About half of new satellite launches now have insurance, said Denis Bousquet, an executive in AXA XL’s space business, down from historical levels as premiums rise and coverage becomes more restrictive.

NASA’s official assessment provides the most authoritative source on 3I/ATLAS’s trajectory and risk level. The agency’s July 3, 2025 statement categorically rules out any Earth impact threat. European Space Agency observations have corroborated these findings through multiple tracking systems.

The European Space Agency (ESA) reacted promptly to the discovery of comet 3I/ATLAS on 1 July 2025. Soon after they were alerted to its existence by automated detection systems, ESA astronomers began using ground-based telescopes in Hawaii, Chile, and Australia to monitor its progress.