If you go to Cardone Capital’s website you will find the following:

“Equal Opportunity Investing with Grant Cardone ACCESS THE HIGHEST-QUALITY REAL ESTATE INVESTMENTS.”

It also directs people to learn more about how to invest with their IRA or 401k with a simple text message.

It says it levels the playing field for all investors.

“Grant Cardone has been investing in real estate for over 35 years and has never lost money on a multifamily real estate investment. Since 2016, Cardone Capital has raised over $1 billion across 22 funds from over 13,000 accredited and non-accredited investors. Cardone Capital’s real estate portfolio consists of 11,903 apartment units across 36 multifamily properties along with over 500,000 square feet of commercial office space.” – Cardone Capital Website

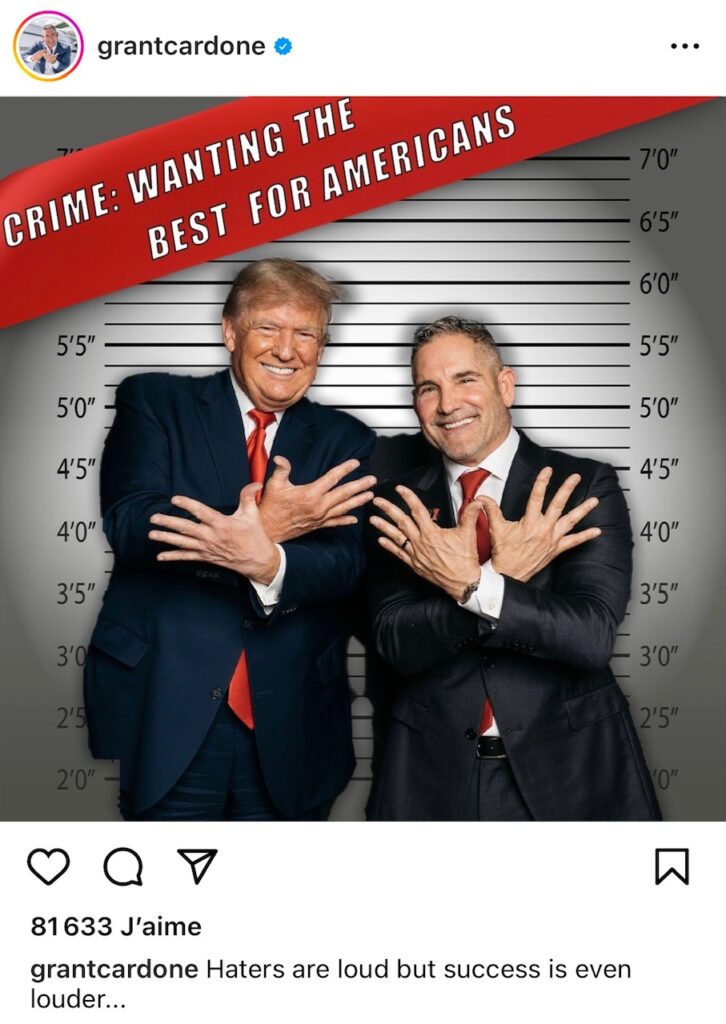

“In siding with Pino, Lynn determined that Cardone’s social media posts promoting his crowd-funded investments are subject to federal securities regulations that guard against misstatements and omissions.” – The Real Deal

Cardone’s book titles also include things like, “Sales Strategies to Dominate Your Market and Beat Your Competition” “Over 100 Ways to Ink The Deal” “Sell or Be Sold: How To Get Your Way in Business and in Life”. What remains to be seen in court is if he took some of his own teachings too far.

As many successful business owners have turned into guru like personalities on social media, will this rein in how they talk about business to their followers? Or has it just exposed how business has always been done and that our systems and regulation overall need update?