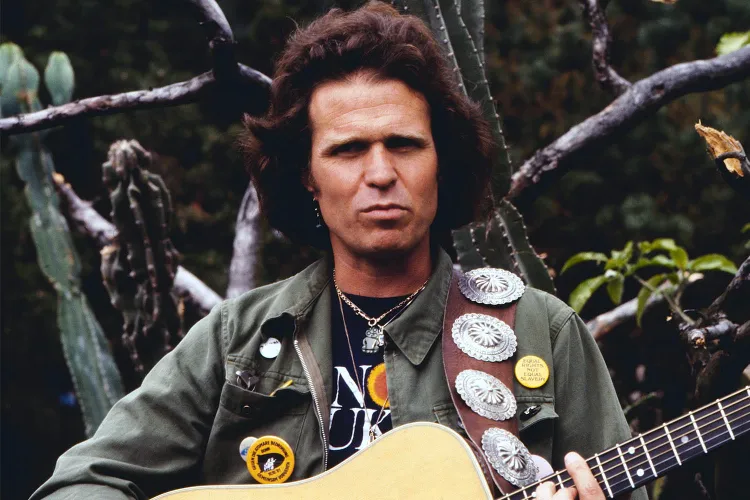

Country Joe McDonald Died at 84, Woodstock Legend and Protest Voice Falls Silent

The music world is mourning as Country Joe McDonald died at the age of 84, closing the chapter on a…

By – Rihem AkkoucheThe Northern Lights Return

The Northern Lights have a chance to be visible from several northern U.S. states on Tuesday night, forecasters at the…

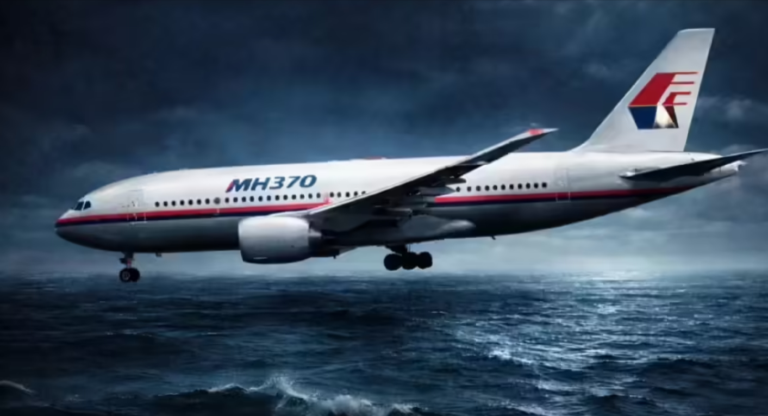

By – Jackie AllenMalaysia Airlines MH370 Disappearance Remains Unsolved After New Ocean Search

More than a decade after one of aviation’s greatest mysteries began, the Malaysia Airlines MH370 disappearance remains unsolved as a…

By – Rihem AkkoucheFebruary Unemployment Up as Job Losses Surprise Economists

February Unemployment Up as the latest labor market data revealed weaker-than-expected job growth and a slight increase in the national…

By – Jackie AllenBlast at US Embassy in Oslo Triggers Terrorism Investigation

An early morning blast at US embassy in Oslo has sparked a sweeping investigation by Norwegian authorities, who say terrorism…

By – Rihem AkkoucheIran’s Supreme Leader Selection Nears as War Intensifies Across the Region

The shadow of war hangs over Tehran as Iran’s Supreme Leader selection moves closer to public announcement following the death…

By – Rihem AkkoucheIran’s Supreme Leader Selection Nears as War Intensifies Across the Region

The shadow of war hangs over Tehran as Iran’s Supreme Leader selection moves closer to public announcement following the death…

By – Rihem AkkoucheLate-Night Attack by Venezuelan National at Florida Beach

A Late-night attack by a Venezuelan National has left a Florida community shaken after authorities say a 26-year-old man ambushed…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

Trump’s War in Iran was triggered open conflict, casualties, and renewed constitutional debate in Washington. The crisis intensified following reports…

By – Jackie AllenKanye West’s Malibu Mansion Trial Takes Dramatic Turn in Court

The courtroom drama surrounding Kanye West’s Malibu mansion trial took an unusual turn Friday as the artist now legally known…

By – Rihem AkkoucheKuwait Cuts Oil Production as Gulf Tanker Threats Disrupt Global Energy Flow

In a move that underscores the growing shockwaves across global energy markets, Kuwait cuts oil production after tanker traffic through…

By – Rihem AkkoucheOpenAI’s Caitlin Kalinowski Resigns Over Controversial Pentagon AI Agreement

The debate over artificial intelligence and national security intensified this week as OpenAI’s Caitlin Kalinowski resigns, stepping away from her…

By – Rihem AkkoucheOpenAI’s Caitlin Kalinowski Resigns Over Controversial Pentagon AI Agreement

The debate over artificial intelligence and national security intensified this week as OpenAI’s Caitlin Kalinowski resigns, stepping away from her…

By – Rihem AkkoucheTornadoes Damage in Michigan Leaves Multiple Dead as Severe Storms Sweep Across U.S.

Deadly storms carved a destructive path across the Midwest and southern Plains, leaving communities reeling after tornadoes damage in Michigan…

By – Rihem AkkoucheUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

The US draft AI chip sales rules being considered by the administration of Donald Trump could dramatically reshape the global…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

A sweeping restructuring is underway in the theme park world as the Six Flags amusement parks sale moves forward, marking…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

The push to establish humanity’s long-term presence in orbit just received a powerful boost. Vast $500M Funding was announced Thursday…

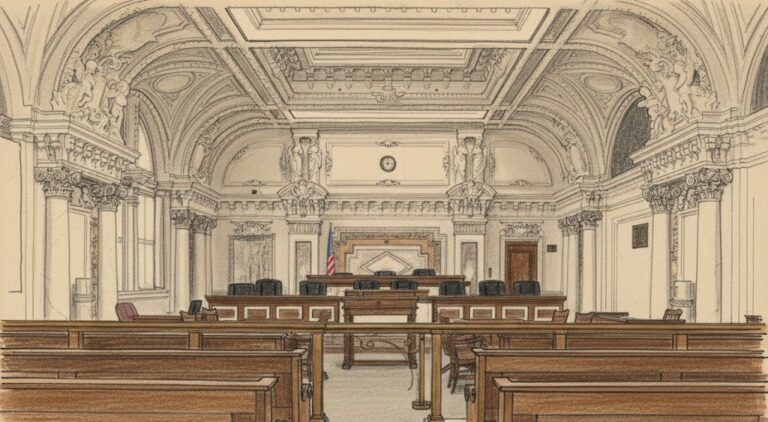

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

The Alexander Brothers Sex-Trafficking Trial reached a critical turning point Thursday as jurors in Manhattan federal court began deliberations in…

By – Rihem AkkoucheU.S. And Israel Launch Major Strikes On Iran — What It Means For America

TEHRAN, Iran – In a dramatic escalation of global tensions, the United States and Israel launched coordinated military strikes against Iran…

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

The U.S. Court of Appeals for the Ninth Circuit has thrown out an $8 million jury verdict against BNSF Railway…

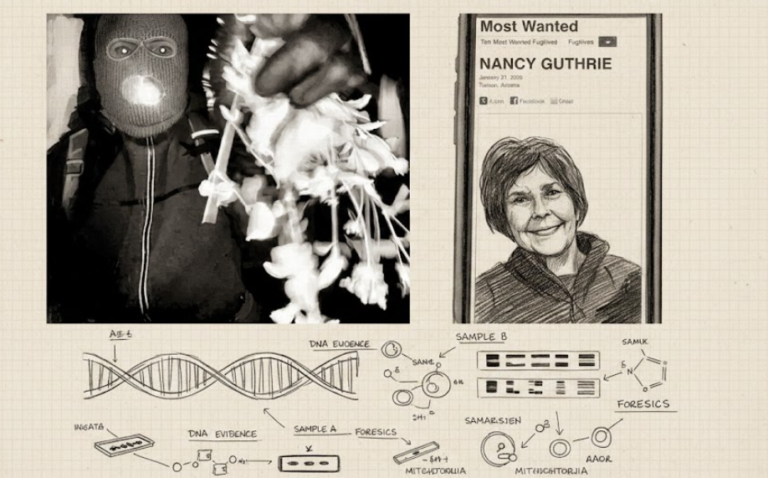

By – Tyler BrooksMissing DNA Evidence May Limit Investigation Into Nancy Guthrie Case, Sources Suggest

Investigators examining DNA recovered from the home of Nancy Guthrie are uncertain whether the biological material will provide enough information…

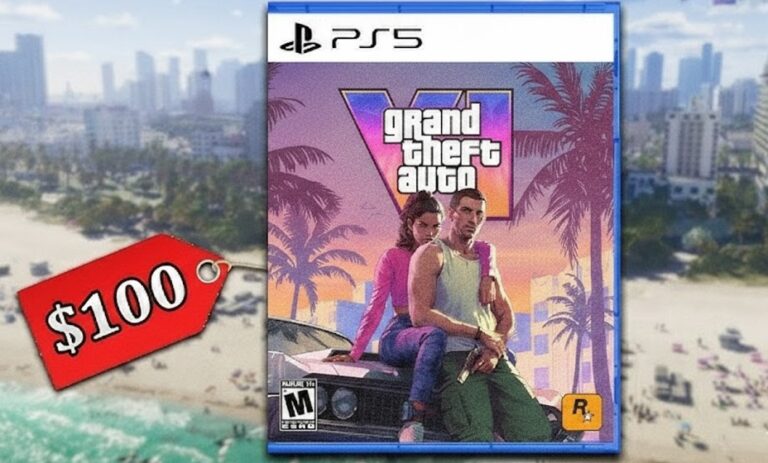

By – Ahmed BoughallebGrand Theft Auto 6 Targets November 2026 Launch as Price Leak Fuels $100 Debate

After years of speculation, teaser trailers and headline-making leaks, Grand Theft Auto VI now has a confirmed global release date:…

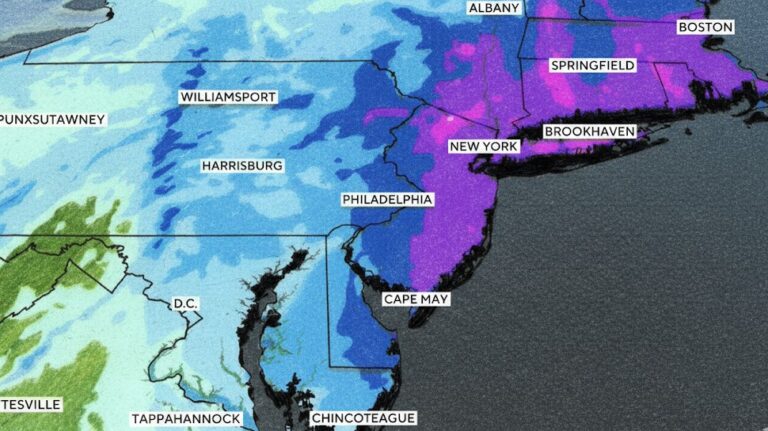

By – Ahmed Boughalleb40 Million Under Blizzard Warnings as Major Winter Storm Threatens U.S. East Coast

More than 40 million people are under blizzard warnings as a powerful winter storm moves across the eastern United States,…

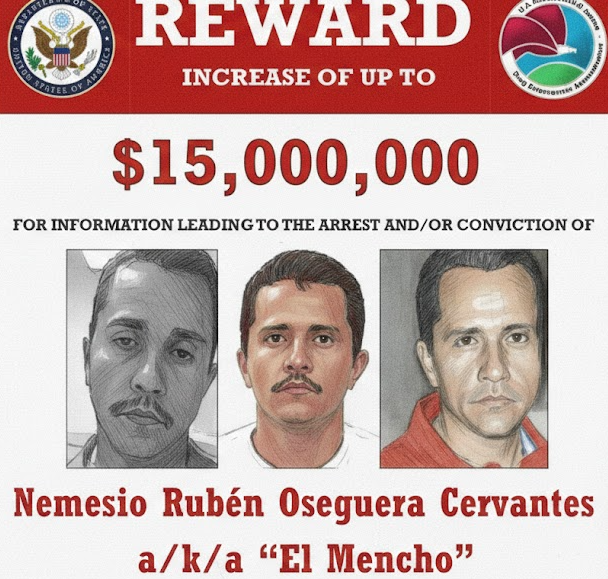

By – Tyler BrooksViolence Erupts Across Mexico After Cartel Leader “El Mencho” Killed in Military Raid, Triggering Roadblocks, Transport Disruptions, and Security Alert Across Several States

Violent clashes spread across western Mexico after security forces killed Nemesio Rubén Oseguera Cervantes, known as “El Mencho,” during a…

By – Ahmed BoughallebAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

The Alexander Brothers Sex-Trafficking Trial reached a critical turning point Thursday as jurors in Manhattan federal court began deliberations in…

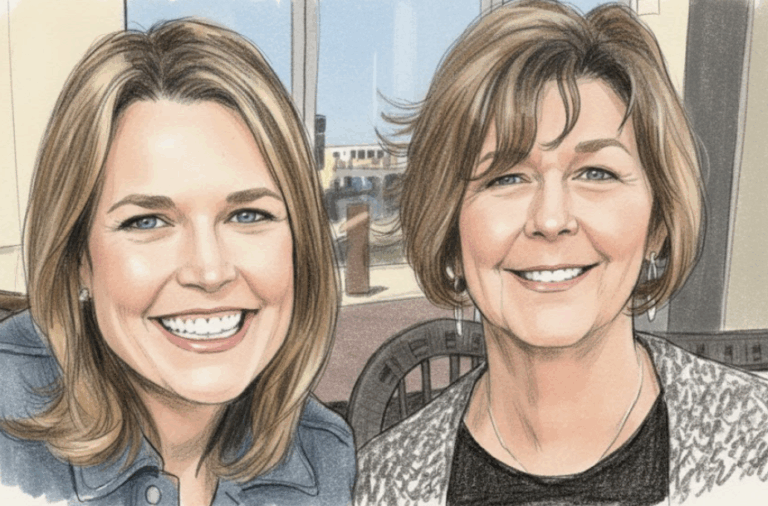

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

The Savannah Guthrie return to NBC appears to be taking shape behind the scenes, even as the beloved morning anchor…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

A rapidly expanding wave of lawsuits over import duties gained new momentum this week as courts began shaping the aftermath…

By – Rihem AkkoucheTrump, Bondi TikTok Assets Sale Suit Ignites New Legal Battle in Washington

A newly formed anti-corruption organization has launched a legal challenge that is already sending shockwaves through Washington. The Trump, Bondi…

By – Rihem AkkoucheTrump Fires Kristi Noem in Surprise Cabinet Shake-Up

In a dramatic political shake-up that rippled through Washington on Thursday, President Donald Trump dismissed Homeland Security Secretary Kristi Noem,…

By – Rihem AkkoucheCable Trade Group Challenges Copyright Office Rule Over Retransmission Royalty Calculations

The cable industry’s leading lobbying organization has filed suit in federal court in Washington, D.C., accusing the U.S. Copyright Office…

By – Tyler BrooksWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

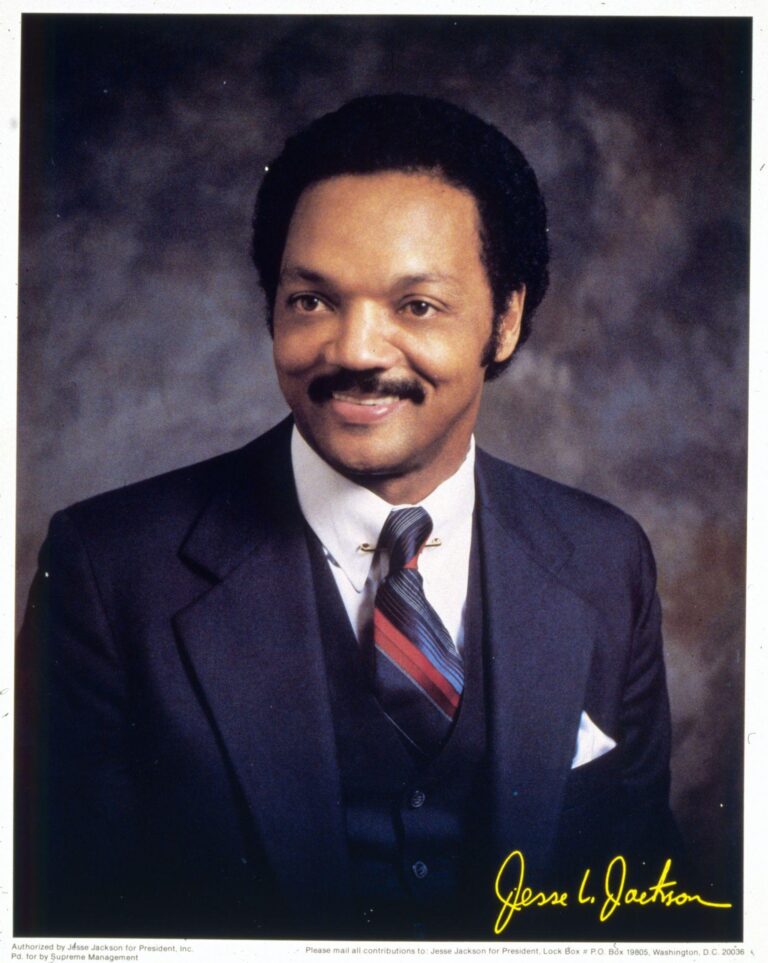

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

[USA HERALD] — The Rev. Jesse Jackson, a towering figure of the American civil rights movement whose career spanned more than…

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

The disappearance of the mother of Savannah Guthrie has taken a dramatic turn as investigators focus on digital clues tied…

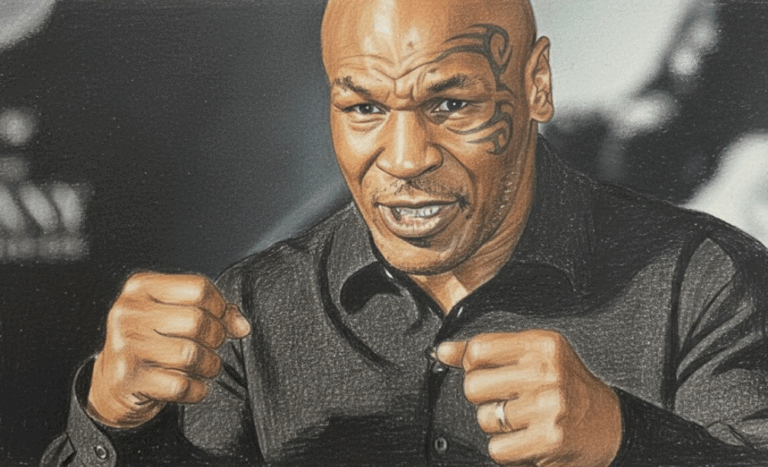

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

Cadillac has officially revealed the name of its first Formula 1 challenger, confirming that its 2026 car will be called…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

With 13 days complete at the 2026 Milan Cortina Winter Olympics, Norway sits atop the overall medal standings, collecting 34…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

When Amber Glenn finishes her routine, the arena usually rises with her. The music builds, her blades carve a tight…

By – Tyler BrooksOlympic Villages Run Out of Condoms at 2026 Milan-Cortina Games

Condom supplies in the Olympic Villages at the 2026 Winter Games have been temporarily depleted, the Milan-Cortina organizing committee confirmed,…

By – Tyler BrooksArizona Authorities Escalate Search for Savannah Guthrie’s Mom to a Criminal Investigation

In Arizona, police are intensifying their investigation into the disappearance of Nancy Guthrie, Savannah Guthrie’s Mom. The 84-year-old mother of…

By – Jackie AllenWhat is Aegosexuality?

As conversations around sexuality continue to expand, so does the language we use to describe it. Sexuality terms are gaining…

By – Jackie AllenNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!