On the other hand, Senate Majority Leader Mitch McConnell said he will “bring the must-pass legislation to the floor for further debate and open consideration” after Thanksgiving. He also promised to the millions of hard-working Americans that help is on the way.

The Senate tax reform bill, as modified by the Finance Committee chairman, will cut taxes for individuals temporarily. The tax cuts will expire after 2025. It will permanently reduce the corporate tax rate to 20% from 35%. The child tax credit increases to $2,000. In addition, it will repeal individual mandate under the Obamacare.

Democrats strongly reject the GOP tax reform bill

Democrats continue to criticize the GOP tax reform bill as gift to corporations and the wealthy. They said millions middle class will actually suffer from tax increases.

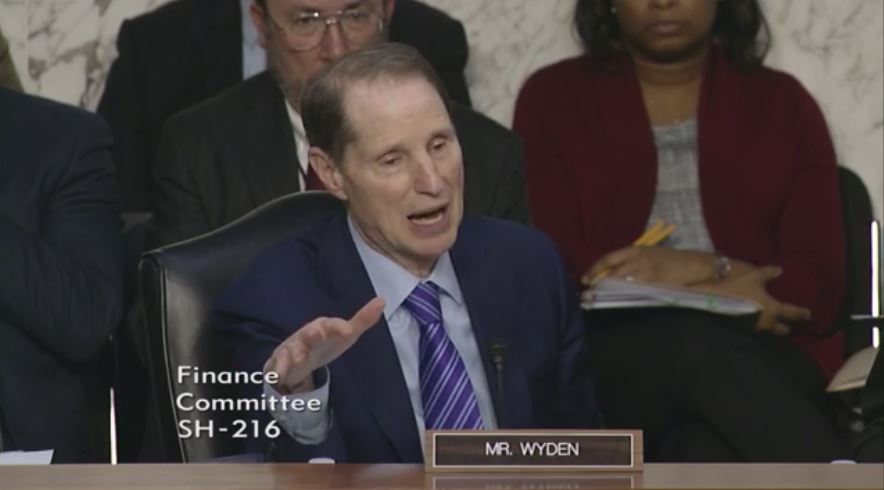

Democratic Sen. Ron Wyden, a Ranking Member of the Senate Finance Committee said the legislation is “indefensible” and “partisan.”

During the deliberation, Wyden highlighted the latest figures from JCT indicating that families earning $30,000 will be hit by a tax hike in 2021. The collective tax increase on low-income families is nearly $6 billion to pay for handout for multinational corporations.