- A bold idea resurfaces from overseas

- A claim of presidential approval meets regulatory reality

- Detroit weighs cost, safety, and consumer demand

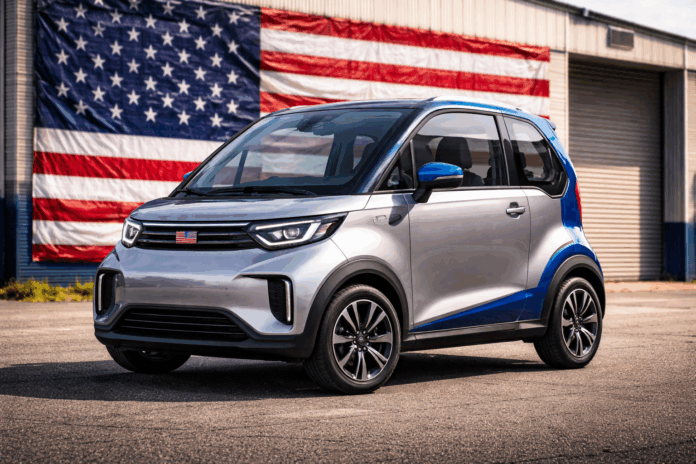

USA Herald – In the final months of 2025, President Donald Trump reignited a long-dormant debate in the American auto industry by publicly urging U.S. automakers to build tiny, ultra-affordable cars modeled after Japan’s popular “kei” vehicles. The push, framed as both an affordability solution and a domestic manufacturing play, immediately drew attention — and skepticism — from industry experts who say the idea faces steep regulatory and market hurdles.

Trump’s comments came after he encountered Japan’s kei cars during a recent overseas trip. These compact vehicles, ubiquitous in Japanese cities, are prized for their low cost, fuel efficiency, and ease of use in dense urban environments. Returning home, Trump argued that similar cars could help American consumers struggling with rising vehicle prices while revitalizing U.S. manufacturing.

“We need smaller, cheaper, more efficient cars made right here in America,” Trump said in a Truth Social post, stating he had “just approved” tiny vehicles for domestic production and asserting that automakers “have long wanted to do this.”

The announcement quickly gained traction online, but it also raised immediate questions about what — if anything — had actually changed.

At its core, Trump’s vision centers on introducing a new class of small, low-cost vehicles into the U.S. market, inspired by Japan’s kei car segment. In Japan, kei cars benefit from relaxed size limits, lower taxes, and reduced insurance costs, making them especially attractive to budget-conscious drivers.

Trump suggested that American versions could be powered by gasoline, electricity, or hybrid systems, tying the proposal into his broader criticism of strict fuel economy and emissions standards. He framed the idea as a direct response to what he has repeatedly described as an affordability crisis, arguing that average Americans are being priced out of new vehicles.

While Trump’s language implied executive action, experts were quick to clarify that there has been no formal approval process preventing small cars from being built in the United States.

“There was never a ban on small cars,” one auto policy analyst noted. “The issue has always been economics and safety compliance.”

The most significant obstacle facing kei-style cars in the U.S. is safety regulation. American vehicle standards, particularly those governing side-impact protection, crash structures, and occupant safety, are far stricter than Japan’s kei car rules.

As a result, existing kei models could not simply be imported or lightly modified for U.S. sale. Manufacturers would need to substantially redesign them — reinforcing frames, adding airbags, and increasing structural mass — changes that would inevitably raise costs and potentially undermine the very affordability Trump is seeking.

Importantly, Trump’s administration did not remove safety requirements for small vehicles. Instead, previous policy shifts focused on rolling back fuel economy standards, which automakers say had made it harder to profitably produce low-margin vehicles at scale.

Beyond regulation, automakers face a more fundamental question: demand.

While a vocal group of enthusiasts has long advocated for ultra-compact cars in the U.S., history offers cautionary examples. The Smart Car, once touted as a solution for urban mobility, ultimately failed to gain widespread traction in the American market despite its compact size and efficiency.

Industry analysts note that American consumers tend to favor larger vehicles, both for perceived safety and versatility. Convincing buyers to embrace significantly smaller cars would likely require not just lower prices, but a cultural shift in how vehicles are valued and used.

Major U.S. automakers responded cautiously to Trump’s remarks. Statements from Detroit emphasized commitments to affordability, consumer choice, and innovation — but stopped short of confirming any plans to develop kei-style vehicles.

Behind the scenes, executives acknowledge that introducing a new vehicle class would require billions in retooling, engineering, and marketing, all for a segment with uncertain demand.

Still, some experts see a potential opening.

“If manufacturers can redesign small vehicles to meet U.S. standards while keeping prices low, there could be niche markets — especially in urban areas,” one industry consultant said. “But it won’t happen overnight.”

Stay informed with USA Herald

Sign up for our exclusive USA Herald newsletter for in-depth reporting on politics, industry, and the policies shaping America’s economic future.