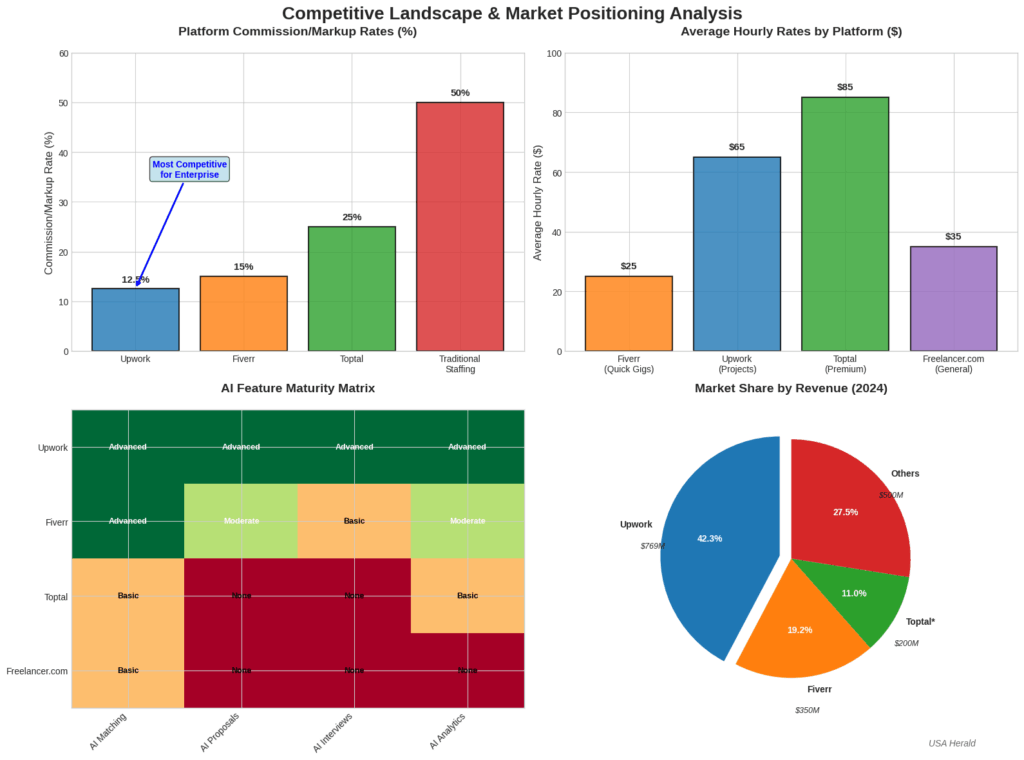

Traditional Staffing Firms vs. Online Platforms: A significant “competitor” to Upwork – though in a different form – is the traditional staffing and consulting industry. Firms like Adecco, ManpowerGroup, Randstad, Robert Half, and countless specialized staffing agencies still dominate much of the contingent labor market (worth hundreds of billions globally). These firms have begun adopting AI in limited ways, primarily to improve recruiting efficiency: for instance, using AI software to scan resumes, rank candidates, or even schedule interviews. However, their business model remains heavily human-driven – recruiters match candidates to client job openings, and the workers are often engaged as employees of the agency (or on their payroll) for the contract duration. This model incurs higher overhead and markup costs (staffing firms typically charge clients a ~50% markup on a contractor’s pay to cover benefits and their margin). Upwork’s model contrasts starkly: by connecting clients directly with independent contractors (who handle their own taxes/benefits), Upwork’s “take rate” of ~10-15% ends up much leaner for clients than a traditional agency markup. Upwork’s platform approach, enhanced by AI, also speeds up the process – a client can post a job and hire a freelancer within hours, versus days or weeks through an agency. That said, traditional firms still offer services that marketplaces typically don’t, such as on-site staffing, full payroll handling, and deep candidate vetting for local roles. They also have long-standing relationships with large enterprises for bulk hiring. In terms of AI and product features, traditional firms are playing catch-up. Some have invested in online portals or even acquired freelance marketplaces (e.g. Adecco acquired a platform called Vettery, and Randstad acquired twago in Europe), recognizing the shift. But they haven’t fundamentally transformed their model yet. Notably, even the definition of “staffing” is evolving – Zacks Investment Research grouped Upwork with “staffing stocks” benefiting from AI and flexible work trends. It noted that companies like Upwork are gaining traction as AI and skills-based hiring reshape the job market. This suggests that from an investor perspective, Upwork’s digital marketplace is seen as the next-generation staffing solution, meeting companies’ need for fast, flexible, remote talent. Upwork’s CEO, Hayden Brown, has explicitly targeted the $500+ billion traditional staffing industry, arguing that a digital platform with AI-driven matching can deliver talent faster and more cost-effectively than old-school agencies. As AI further automates the process of finding and managing workers, platforms like Upwork and Fiverr are poised to pull more business away from traditional intermediaries.