The stock price of Advanced Micro Devices (NASDAQ: AMD) surged on Tuesday after Wall Street analysts predicted that it will gain market share, primarily due to its new high-performance 7nm-based computing and graphics products.

AMD shares closed $29.03 each, up by 9.80 percent and climb by another 0.28 percent to $29.11 a piece after hours.

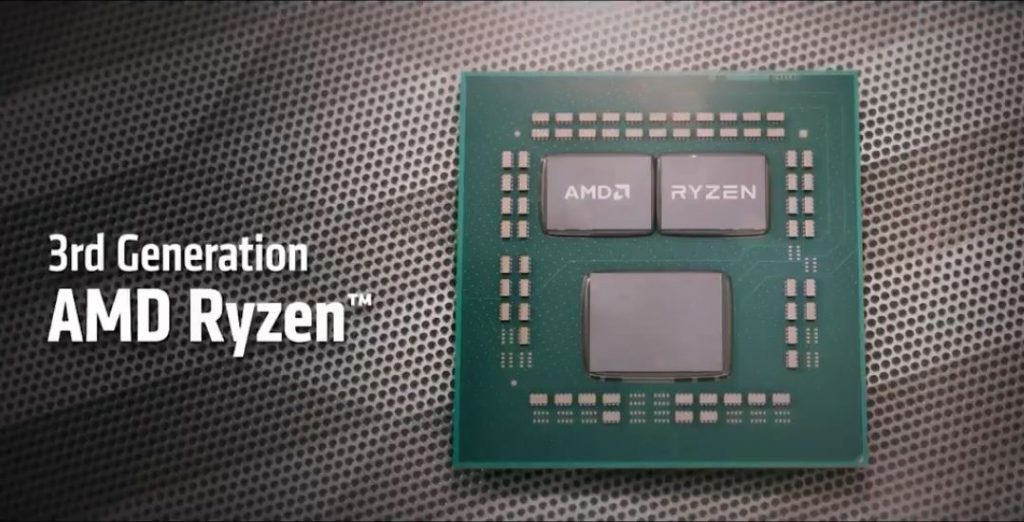

3rd Gen AMD Ryzen desktop processors outperform Intel’s chips

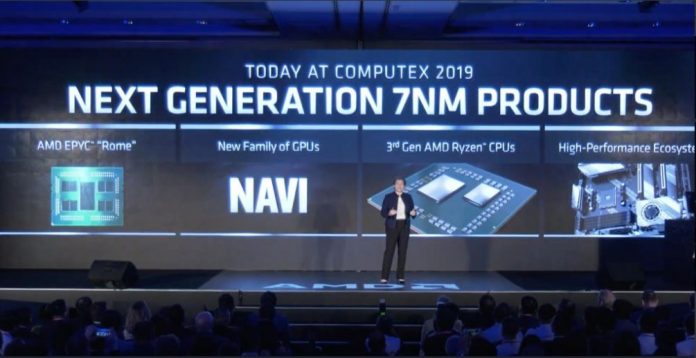

During the Computex Industry show on Sunday, AMD President and CEO Dr. Lisa Su unveiled the company’s new Zen 2 CPU core powering the 3rd Gen AMD Ryzen desktop processors and EPYC processors.

Dr. Su also announced the AMD X570 chipset for socket AM4, RDNA gaming architecture and 7nm AMD Radeon RX 5700-series gaming graphics card family featuring high-speed GDDR6 memory and support for the PCIe 4.0 interface.

At the event, Dr. Su highlighted the 3rd Gen AMD Ryzen desktop processors’ remarkable performance across gaming, productivity and content creation applications. She demonstrated that 3rd Gen AMD Ryzen desktop processors beat the performance of Intel processors.