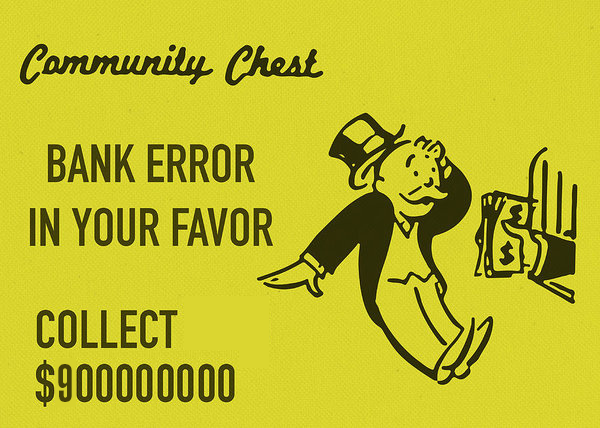

Citigroup scored a victory in the form of a temporary court order freezing $175 million that Brigade Capital Management failed to return to the bank. The money is part of more than $900 million was accidentally transferred to Brigade and others as a loan payment on behalf of Revlon.

On Monday, the Mayer Brown law firm filed a breach-of-contract lawsuit in the New York Southern District Court on behalf of Citibank.

An estimated $900 million, the amount of the full principal value of the loan, including accrued interest was sent to the lenders’ bank accounts last week. Citigroup wired the payments, in error, to about 40 funds that use Brigade as an investment manager, the lawsuit claims.

Citigroup said it was supposed to make an interest payment on Revlon’s behalf but, because of a clerical error, instead sent 100x more than the payment should have been.

Some of the funds were returned to Citigroup, others including Brigade Capital Management, HPS Investment Partners, and Symphony Asset Management have declined to return the money, since Revlon has been in default of several of their loans and the money was owed anyway.