No one knows what the financial future holds for Muncie Community Schools, especially with school of choice continuing to draw children away from the public schools. MCS is funded through tax dollars collected by the State of Indiana and they are only given to MCS based on enrollment. Complicating matters, the MCS budget has to pay for more than just the schools and the salaries of its employees. School budget funding is incredibly complicated, but the MCS budget can be fixed.

No one knows what the financial future holds for Muncie Community Schools, especially with school of choice continuing to draw children away from the public schools. MCS is funded through tax dollars collected by the State of Indiana and they are only given to MCS based on enrollment. Complicating matters, the MCS budget has to pay for more than just the schools and the salaries of its employees. School budget funding is incredibly complicated, but the MCS budget can be fixed.

I have several ideas that the new MCS emergency managers could implement to fix the budget without having to cut schools. I have 11 suggestions that other districts have used in varying combinations to move their districts out of deficit spending.

1.) “PILOTing” the currently tax-exempt buildings within the MCS border:

PILOTs or payments in lieu of taxation has helped other municipalities internalize the costs of these services from hospitals, universities, and technical colleges. Because there are so many tax-exempt properties within the MCS boundaries, extra revenues need to be raised from the properties that are not tax exempt. With PILOT, these tax-exempt facilities pay a service fee that would be distributed to local civil taxing units. If public schools in Indiana were reclassified as civil taxing units, they could benefit from PILOT programs by receiving the fees the tax-exempt agencies would pay. This would need to be handled by the state government.

2.) Force consolidation of nearby school districts to dilute the effects of these valuable properties not paying taxes:

This is an issue that has arisen all over the country. Every school district is required to provide its own services and small districts have suffered from the costs. But, if school districts within the same county or in nearby locales were to combine, the costs of administrations, transportation, and other services would shrink. One large, combined school district only needs one superintendent, one transportation director, etc., while several small districts each need their own. With one large district, the property tax revenue for that district would encompass an area that would make funding no longer an issue.

3.) Implement a distressed district program to the one already operational in Lake and Dearborn Counties:

Two counties in Indiana are already working together to solve funding issues. Distressed urban areas struggle to raise funding for schools, but a distressed district program would allow supplemental levies on the wealthy outlying areas.

4.) File for a referendum that would allow Delaware County to bypass the property tax caps;

MCS could let the public know it is unable to job of educating children in the area, which would allow the district to ask the public for a referendum to change the caps on property taxes. Unfortunately for MCS, its voters did reject a referendum to help the bus fleet. So, it could be a risky venture to do it again.

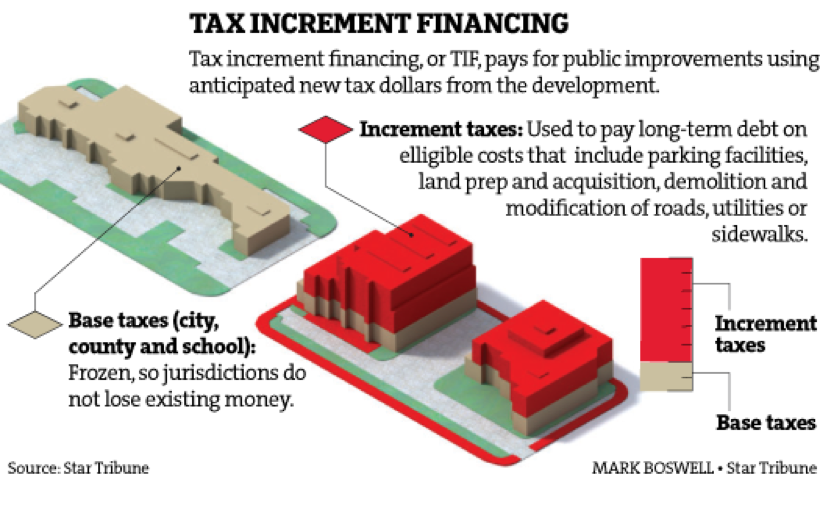

5.) Create a TIF or BID district specifically to assist MCS:

Muncie could use Tax Increment Financing (TIF) that would help bring more money into the school district. Adding Business Improvement Districts (BID) to Muncie would help develop fee-based parcels to increase funding. If these units were developed, the city of Muncie could allocate funds from them for schools.

6.) Partner with private or other public entities to repair facilities or to buy underused MCS buildings

There are several techniques that other school districts have used to make money off their properties. The Muncie Fieldhouse, which badly needs repair, could have naming rights sold. Those rights could be tied to the buyer investing in those repairs. Avon High School’s Andy Mohr Automotive Athletic Complex is an example of lucrative naming rights sold by school districts.

There are several techniques that other school districts have used to make money off their properties. The Muncie Fieldhouse, which badly needs repair, could have naming rights sold. Those rights could be tied to the buyer investing in those repairs. Avon High School’s Andy Mohr Automotive Athletic Complex is an example of lucrative naming rights sold by school districts.

7.) Partner with the State of Indiana in their new TAP program

The Teacher Advancement Program (TAP) is a grant program that MCS teachers could apply for to bring more money into the district. Another Indiana school district brought in about $7 million in the TAP program. The state is renovating Ivy Tech at Muncie to the tune of a fairly sizable addition to the tune of $38.7 million.

8.) Partner with the Federal Government in the heavily funded upcoming TSLIP program

The Federal Government has a grant program called the Teacher and School Leader Incentive Program (TSLIP), which has over $468 million available for 2017. Teachers can use these grants for their professional advancement. Teacher and School Leader (formerly Teacher Incentive Fund) federal grant applications are have a matching fund requirement from the state and more information can be found here: https://innovation.ed.gov/what-we-do/teacher-quality/teacher-and-school-leader-incentive-program/.

9.) Seek a write-off of the $10 million special education cooperative “debt” to MCS itself

There are some imbalances in the MCS budget regarding the general fund and special education funding. With some legally creative accounting, the State of Indiana could reassign the deficit and remove it from the MCS books.

10.) Pass a local sales or income tax to assist the schools

This is another potentially easy solution that would need some up-front work. Delaware County could shift tax dollars to help ease the financial burden on MCS. This would involve adjusting the county option income tax so that money generated from taxes within the county could go to MCS.

11.) Utilize two foreign exchange student programs to pay tuition.

Districts around the country have learned that foreign exchange students want to come to the US and they are willing to pay tuition to attend US schools. The school district in Kokomo, Indiana charges exchange students $17,500 to attend the district and with over 30 exchange students in Kokomo, nearly $700,000 has been added to the revenue stream. These students need places to live while attending schools, and school districts have also made money by renting living quarters to these students, too.