The problem also prompted him to return incentive compensation valued at around $28 million to Wells Fargo, effectuated in part through the bank’s non-payment of his retirement funds.

Aside from Stumpf, Wells Fargo’s former Chief Administrative Officer and Human Resources Director Hope Hardison and former Chief Risk Officer Michael Loughlin agreed to settle.

Hardison and Loughlin agreed to pay $2,250,000 and $1,250,000 in civil money penalty, respectively. They agreed to follow all laws and regulations when affiliated or employed in any depositary institution. They also agreed to cooperate fully and promptly with the OCC in any OCC investigation, OCC litigation, or OCC administrative proceeding.

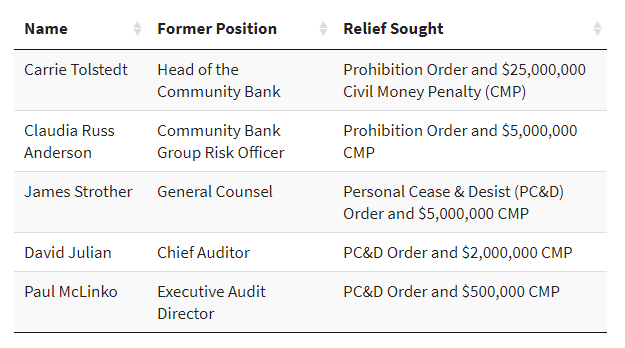

Five former Wells Fargo executives still facing similar charges

The OCC filed charges against five other former Wells Fargo executives including the following:

In a statement, Comptroller of the Currency Joseph Otting, said, “The actions announced by the OCC today reinforce the agency’s expectations that management and employees of national banks and federal savings associations provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.”