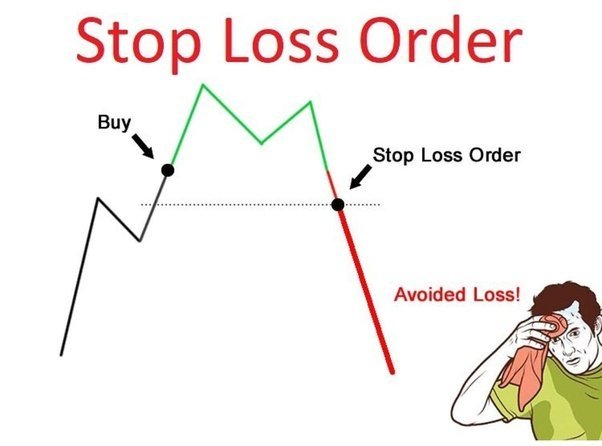

Bitcoin (BTC) reached record highs on various exchanges on Nov. 30, reaching a high of $19,786.24. The BTC market is becoming more appealing to investors as cryptocurrency goes mainstream. Then the market may have experienced a stop-loss-run.

Kraken, the San Francisco-based cryptocurrency exchange appears to have experienced some unusual volatility on Monday. The activity is being identified as a classic stop-loss-run.

The Kraken exchange is a pioneer, of sorts. It is the first cryptocurrency company in the U.S. to become a bank. In September, the Wyoming Division of Banking’s general counsel approved Kraken’s special purpose depository institution (SPDI) application, making it the first new charter bank in the state.

Kraken BTC stop-loss-run?

Data shows that Kraken’s BTC/USD hit its highest ever price on Monday. Then it dropped unexpectedly to $16,600 within seconds. Last week, it traded to as low as $16,600.

In the classic “stop-loss run,” large-volume traders intentionally place big sell orders at a specific price point. They are targeting where they think a large number of stop-loss positions are located.