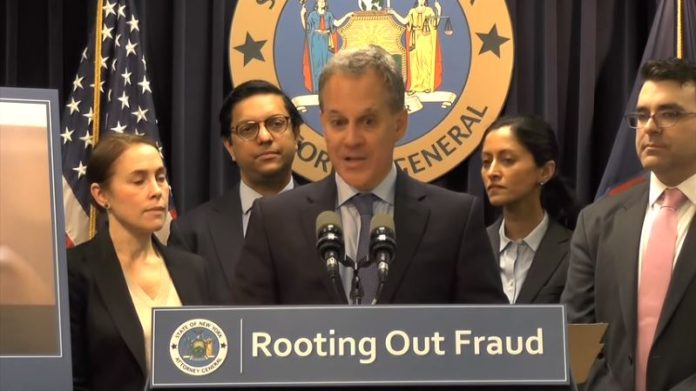

New York Attorney General Eric Schneiderman announced that the victims of Western Union Wire Transfer Scam can now apply for compensation.

On Monday, the attorney general said scammers deceived more than 30,000 New Yorkers into sending money through Western Union. New Yorkers collectively lost around $35 million from transfer scams.

According to Schneiderman, the victims of fraud money transfers using Western Union between January 1, 2004 and January 19, 2017 are eligible to receive compensation.

Western Union settled multistate probe

Earlier this year, Western Union agreed to pay $589 million to settle a multistate investigation into consumer complaints. The company is facing allegations that its third-parties used its wire transfer service to defraud consumers.

The Department of Justice’s Victim Asset Recovery Program is administering the distribution of the $586 million fund for fraud victims.

In a statement, Schneiderman said, “I’m pleased that this fund will allow thousands of New York fraud victims to receive the compensation they deserve. I encourage New Yorkers to remain vigilant when receiving solicitations and report potential fraud to my office.”