Despite President Trump’s daily white house briefings describing the rollout of Small Business Association (SBA) loans as “flawless” and “without glitches,” Trump supporters, along with the rest of Americans, are becoming more and more frustrated with the lack of funding.

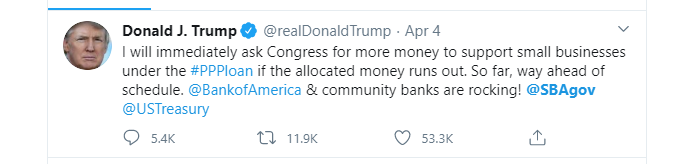

The $350 billion small business loan program was launched Friday, April 3, and has suffered a slew of technical issues and lacked clarity on loan requirements. A program that was supposed to provide much needed aid to small businesses across the country has fallen short of expectations, though Trump continues to sing its praises at every opportunity, recently tweeting about being “way ahead of schedule.”

Banks have received tens of thousands of applications for billions of dollars in loan amounts and have quickly been overwhelmed. Lacking direction from the Department of Treasury, banks began to sort through applications, prioritizing those that met their own standards. Basically, giving priority to those applicants who not only banked with them, but also had a prior credit history — leaving many applicants without access to critical funding.