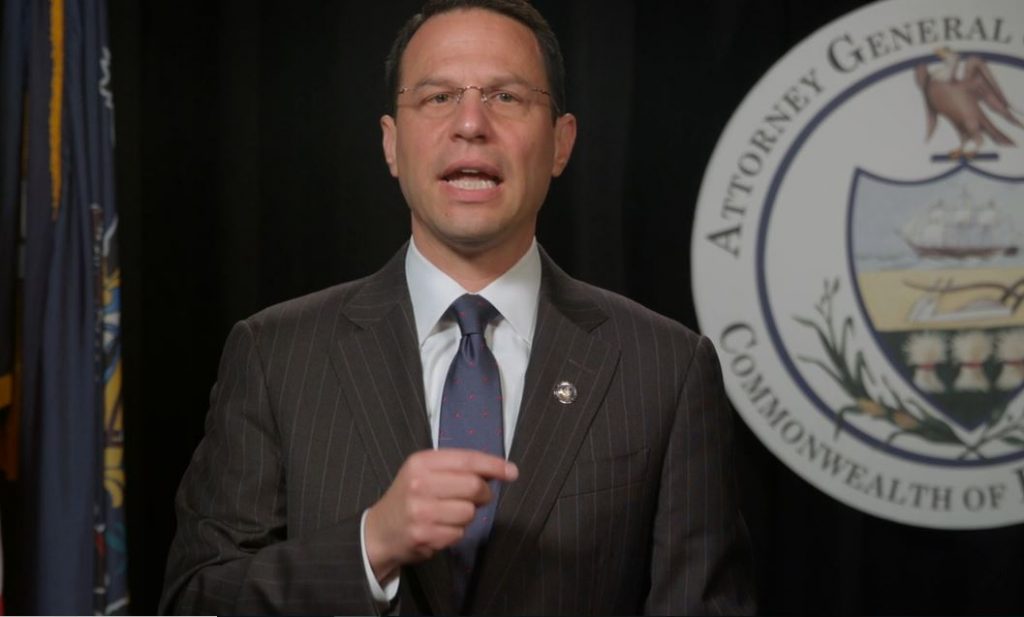

“This is a model of how aggressive enforcement by one state can lend itself to nationwide relief for consumers. Our Bureau of Consumer Protection will hold accountable anyone who tries to exploit Pennsylvania consumers by charging illegal interest rates,” said AG Shapiro.

Allegations against Think Finance and Victory Park Advisors

Think Finance allegedly targeted consumers nationwide including 80,000 Pennsylvanians using three websites— Plain Green Loans, Great Plains Lending and Mobiloans. The online payday lender allegedly allowed borrowers to sign up for loans and lines of credit while charging effective interest rates as high as 448 percent.

In Pennsylvania, it is illegal to charge interest rates higher than 200 or 300 percent, according to the Attorney General’s office.

Additionally, Think Finance’s websites allegedly operated under the guise of Native American tribes and the First Bank of Delaware. It was part of their effort to try to evade federal and state laws.

Attorney General Josh Shapiro said the online payday lender’s actions violated the Pennsylvania Unfair Trade Practices and Consumer Protection Law, the Pennsylvania Corrupt Organizations Act, the Pennsylvania Fair Credit Extension Uniformity Act. It also violated the federal Consumer Financial Protection Act of 2010.