State governments across the country continue to struggle funding their pension plans. The unfunded liabilities of public pension plans reached more than $6 trillion this year, up $433 billion from last year.

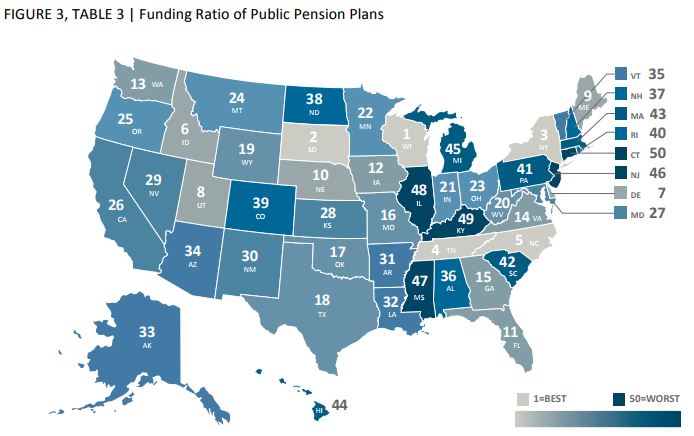

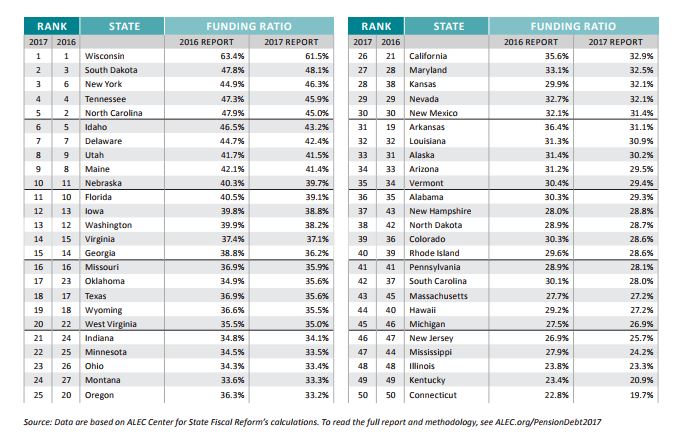

The national funding average is just 33.7% or $18,676 of unfunded liabilities per U.S. resident, according to a report published by the American Legislative Exchange Council (ALEC).

In the report, ALEC noted that majority of state governments consistently fail to make their annual require contribution (ARC). In fact, some states skip their ARC payments. As a result, the unfunded liabilities of public pension funds surge.

In terms of funding ratio, Connecticut is the worst with only 19.7%, down by 3.1% from last year. It is one of the four states to set retiree benefits through collective bargaining.

This year, Connecticut’s unfunded pension liability is $127.7 billion, up from $99.2 billion in 2016. The debt from the public pension plan is $35,721 per person in the state.

Pension fund mismanagement

Thurston Powers, co-author of the report, said, “These figures represent a history of pension fund mismanagement.” He also stated that it the result of “an ongoing unwillingness to pursue meaningful reform.”