Robinhood Markets Inc priced its stock at $38 per share for its initial public offering (IPO) on Thursday. The online brokerage firm set its price at the bottom of its expected range of between $38 and $42 per share.

The online brokerage firm’s trading debut on NASDAQ under the ticker HOOD was considered one of the most anticipated this year by Wall Street analysts. Its shares opened at $38 per share, in line with its IPO price.

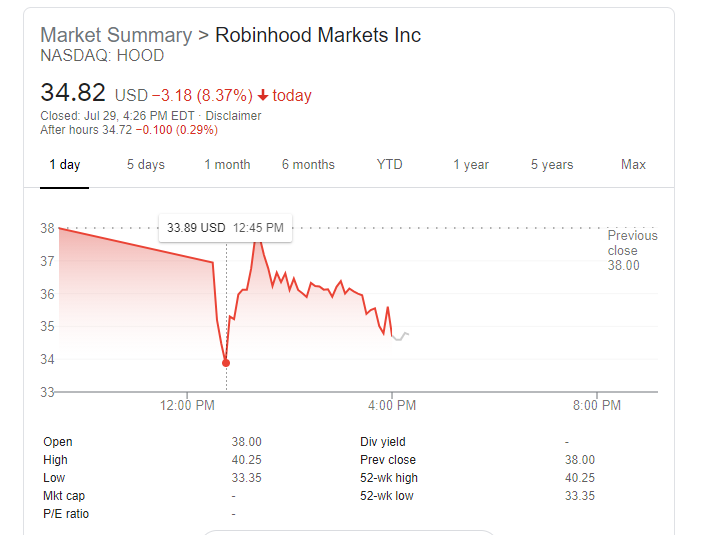

Robinhood’s stock price suddenly plunged by 10.8% to $33.89 per share around $12:45 p.m. in New York. The stock recovered some of its value and closed at $34.82 per share, down more than 8%. After-hours, HOOD shares are trading lower.

Robinhood raised nearly $2 billion after selling 52.4 million shares during its trading debut. Its current market value is around $32 billion. In September last year, the online brokerage firm was valued at $11.7 billion.

Many anticipated that Robinhood will deliver a strong IPO performance given its rapid growth. The online brokerage firm is very popular among novice and younger investors. In the second quarter of 2021, it has 22.5 million users and is now the third-largest brokerage firm based on the number of funded funds.

Regulatory investigations affect Robinhood IPO performance

Contrary to Wall Street’s expectations, Robinhood had a weak trading debut. The company and its underwriters priced its IPO at the low end of its range to avoid poor performance, according to the Wall Street Journal based on information from people familiar with the matter.