Bitcoin enthusiasts and traders often describe cryptocurrency as an alternative to gold. However, the historical price action of Bitcoin might tell us otherwise. In fact, according to Bitcoin’s historical price action, the crypto is more closely related to stocks.

Investors believed that Bitcoin could serve as a hedge against inflation. But, these two charts below that depict relative performance amid recent stock market corrections explain that Bitcoin is more correlated to equities.

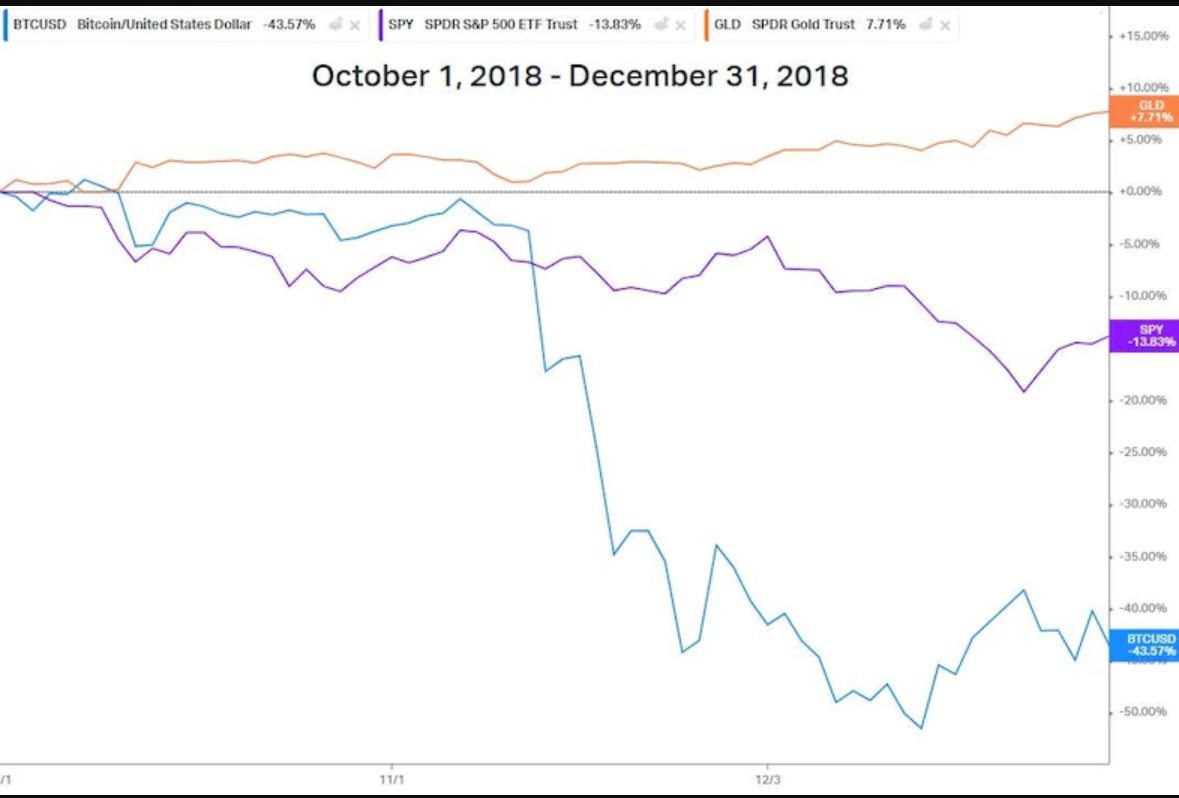

The first chart illustrates that when stocks plunged almost 20% in the fourth quarter of 2018, Bitcoin fell as much as 50%. Meanwhile, gold traded up nearly 8%. Back then, the market volatility was caused by a hawkish Federal Reserve, and rising concerns about slowing economic growth because of trade tariffs.

The second chart illustrates how the Covid pandemic in early 2020 caused Bitcoin to shed 50% of its value, while stocks plunged as much as 34%. On the other hand, gold traded flat stood as a safe-haven asset.