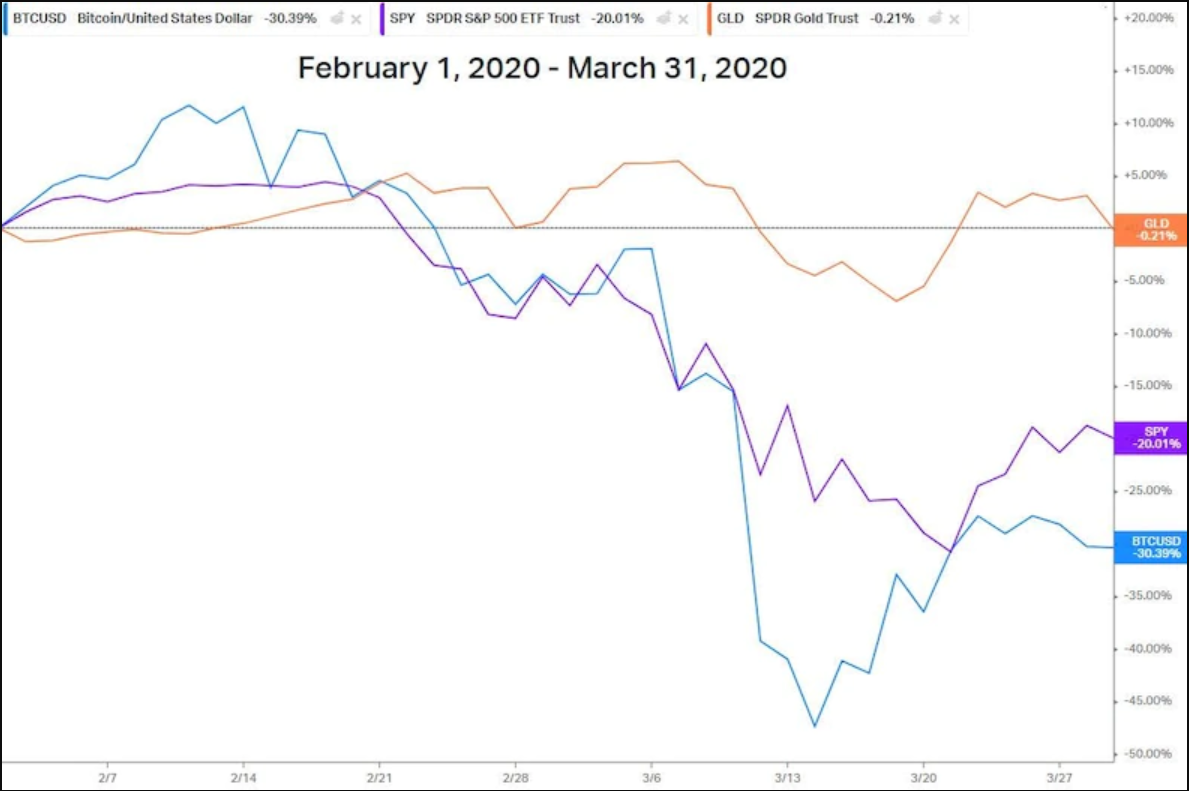

Today, following a 7% plunge in the S&P 500 since the start of 2022, Bitcoin plummeted 17% while gold is flat. These data charts can’t be wrong and are the best proof that Bitcoin is less of a hedge against inflation and more of a volatile risk-on asset that imitates stocks.

Technical analyst Katie Stockton of Fairlead Strategies highlighted this fact in a note on Friday.

“The correlation between bitcoin and high-growth benchmark ARKK still stands at ~60% year-to-date, versus ~14% for the price of gold, reminding us to categorize bitcoin and altcoins as risk assets rather than safe-havens,” she said.

Gold acts as a reliable safe haven for several reasons. One reason why it does is that it has a history of thousands of years holding some form of value. Bitcoin on the other hand has turned 13 years old just lately.

When it comes to evidence-based investing, investors value more data than less, and gold has the data to back up its standing as a safe-haven asset, whereas bitcoin does not.