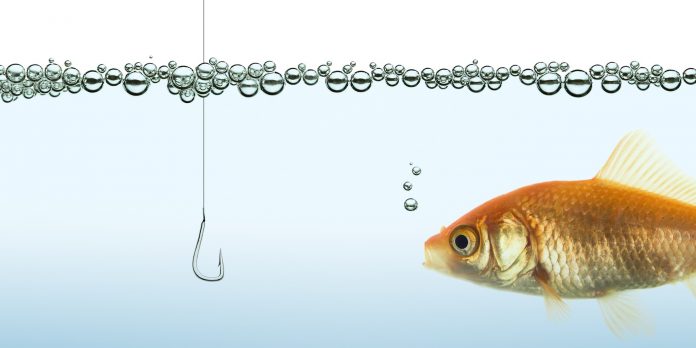

According to sources, Timothy Allen Patrick, a fly fishing business operator in Blue Ridge, Georgia, is accused of scamming investors. Is Mr. Patrick an honest business man or did he bait the hook to suit the fish, siphoning money from unwary investors? The USA Herald investigates.

Mr. Patrick allegedly borrowed significant amounts of money from investors (including family and friends) to launch a fly fishing business called “On the Fly Excursions.” Timothy Allen Patrick allegedly deceived his investors about his financial situation by painting a picture of success while obscuring his murky past.

Investors were allegedly unaware that Mr. Patrick had several liens and judgments against him in different states, failed to pay child support, and was previously arrested for a DUI and DWLSR (driving while license suspended or revoked) offenses.

Investors were allegedly unaware that Mr. Patrick had several liens and judgments against him in different states, failed to pay child support, and was previously arrested for a DUI and DWLSR (driving while license suspended or revoked) offenses.

Additionally, investors did not know that Mr. Patrick allegedly suffers from various types of mental health disorders and allegedly does not take his medication. Moreover some say Timothy Allen Patrick is an alcoholic that is a ticking time bomb waiting to go off.