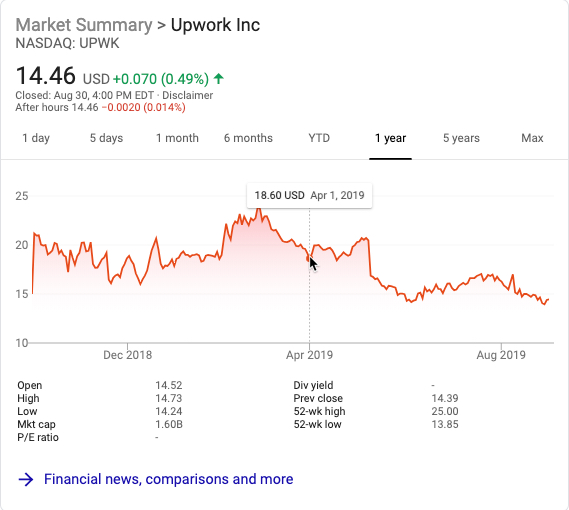

And that’s where we are, as warned by Don Dion of Seeking Alpha:

“When the Upwork IPO lockup period expires on April 1, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted stock.

- More than 91 million shares are subject to the lockup period. Just 12.3 million shares are trading pursuant to the IPO.

- Significant sales could flood the secondary market for UPWK and cause a sharp, short-term decline in share price when the lockup expires.

- Insiders might be particularly interested in cashing in on some of their profits with UPWK shares having a 33% return from IPO.

- Aggressive, risk-tolerant investors should consider shorting shares of UPWK ahead of the IPO lockup expiration.“

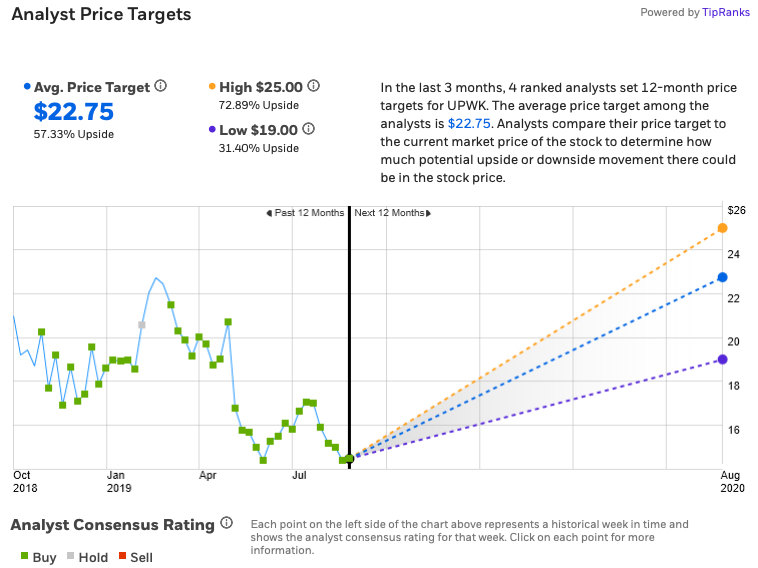

There’s an overall consensus of a buy for UPWK, and one bear that recommends a hold:

In a report issued on August 8, Mark Mahaney from RBC Capital maintained a Buy rating on Upwork Inc (UPWK – Research Report), with a price target of $25. The company’s shares closed on Friday at $15.15, close to its 52-week low of $14.08.