Bitcoin and other cryptocurrencies suffered a steep decline as investors continue to worry about regulatory crackdown worldwide.

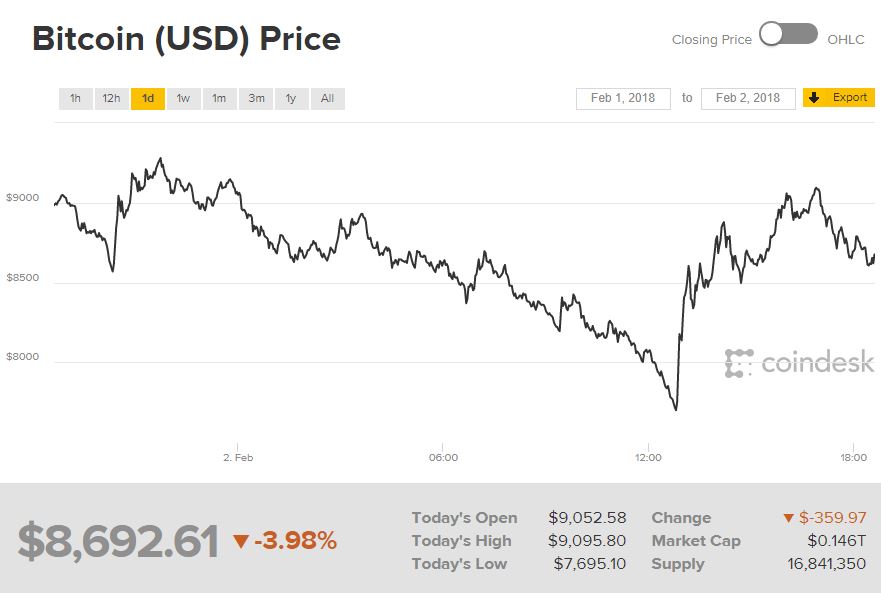

The price of bitcoin plummeted as low as $7,695.10 earlier on Friday, according to data from CoinDesk. It is the first time for the largest cryptocurrency to drop below the $8,000 level since November 24.

At the time of this writing, bitcoin managed to recover some of its losses. The digital currency was trading $8,692.61 around 1:53 PM Eastern Time. Based on its current trading price, the largest cryptocurrency lost 56% of its value from its all-time high of $19,783.21 in December.

On the other hand, ethereum also fell to as low as $757.98. The second largest cryptocurrency also recouped some of its earlier loses. It was trading $885.76—down nearly 15% over the past 24 hours.

Meanwhile, ripple, the third largest cryptocurrency, also plummeted to as low as $0.64 earlier today. It also regained some loses and was trading $0.83—down more than 14% over the past 24 hours.