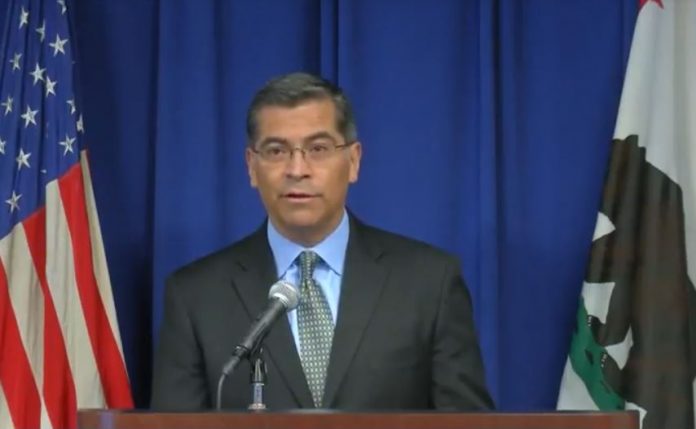

California Attorney General Xavier Becerra criticized the Consumer Financial Protection Bureau (CFBP) over its proposal to repeal certain provisions of the Obama-era Payday Lending Rule.

On Wednesday, CFPB announced its plan to rescind its final rule governing Payday, Vehicle Title, and Certain High-Cost Installment Loans. The bureau is specifically proposing to roll back the rule’s provision requiring lenders to determine whether a borrower is capable of repaying a loan.

In a statement, the bureau said its proposal “suggests there was insufficient evidence and legal support for the mandatory underwriting provisions in the 2017 final rule.

Additionally, the CFPB expressed its concern that “these provisions would reduce access to credit and competition in states that have determined that it is in their residents’ interests to be able to use such products, subject to state-law limitations.”

The bureau’s proposal is open to public comment for 90 days. It will evaluate the comments and weigh the evidence before making a decision whether to rescind or keep the rule, according to CFPB Director Kathy Kraninger.