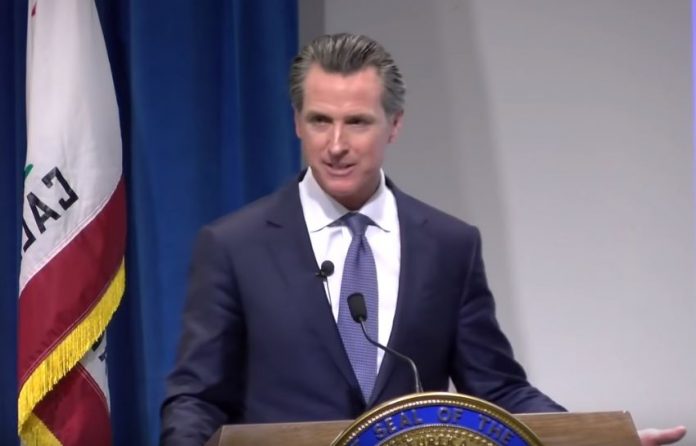

California Governor Gavin Newsom signed into law a bill requiring marketplace facilitators such as Amazon, Ebay and Etsy to collect sales and use tax on behalf of online and out-of-state retailers even if they have no physical presence in the state.

On Thursday, Newsom announced he approved AB 147, which was co-authored by Assembly member Autumn Burke and state Senator Mike McGuire.

California is implementing a Supreme Court decision

The lawmakers worked with state Treasurer Fiona Ma on the legislation to implement the U.S. Supreme Court’s decision in the South Dakota v. Wayfair Inc.

In Wayfair ruling last year, the Supreme Court authorizes states to begin collecting sales and use tax from online and out-of-state retailers.

After the U.S. Supreme Court’s ruling on the case, California required retailers with a least $100,000 of sales to register with the state and collect sales tax. The state’s existing law was a one-size fits all approach modeled after the South Dakota law.

Burke and McGuire believe that a one-size fits all law is “not necessarily appropriate for a state with 40 million residents. Their legislation requires marketplace facilitators to collect sales tax on behalf of retailers with a least $500,000 of annual sales tax in California.