The American economy can’t afford an unstable banking system. Our national debt now exceeds $20 trillion. That’s an unprecedented number and any kind of financial difficulty in the banking sector could make the situation worse. Corporate and government partners need to work together to develop clear strategies to ensure that there’s transparency and trust in the system.

Long-term Consequences

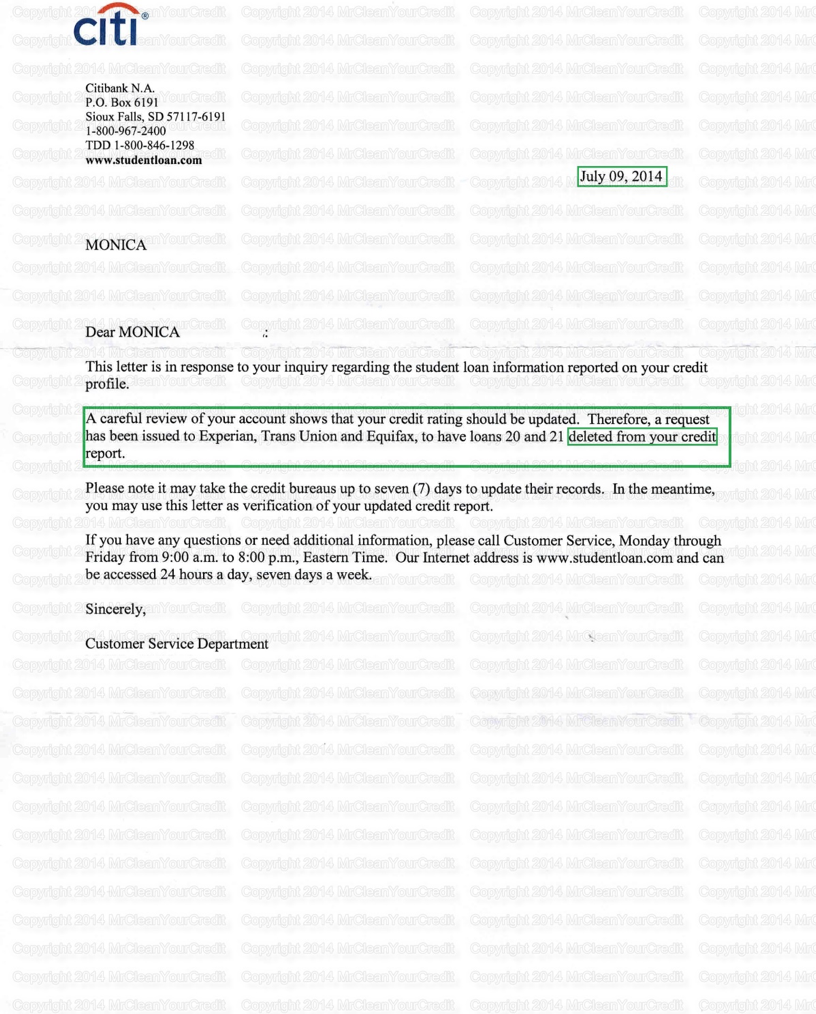

In Citibank’s case, the news of its misleading tactics with student borrowers couldn’t have come at a worse time. The bank seemed to be making substantial progress in its return to respectability after the mortgage crisis. It has increased its core capital and its cash reserves significantly in the last few years. Its overall revenues did dip about 2% in 2016, but it remains profitable and there are encouraging signs that it’s poised for a major upturn in its fortunes.

All of this positive progress is good news for Citibank’s investors, but news of the company having to pay fines for misleading practises will not sit well with them. Reputation is important in the banking industry and in a competitive field it doesn’t take much to convince an investor to jump ship. Citibank will have to work hard to recover from this damage.