Longwood Management Corporation, the operator of 27 skilled nursing facilities in California, agreed to pay $16.7 million to settle allegations of Medicare fraud.

According to the Department of Justice (DOJ), Longwood and its skilled nursing facilities allegedly systematically increased its Medicare billings.

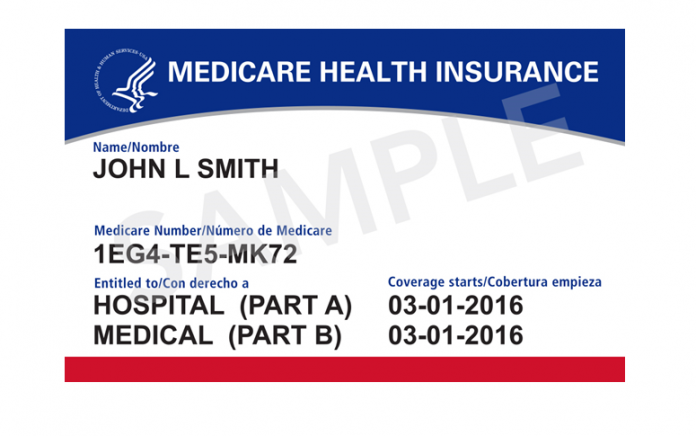

Medicare reimburses skilled nursing facilities for payments to health professionals such as physical or speech therapists providing therapy or nursing care to qualifying patients.

Skilled nursing facilities receive the highest level of reimbursement from the agency for “Ultra High” therapy patients, who require a minimum of 720 minutes of two types of skilled therapy (e.g. physical, occupational, or speech therapy). One of the therapies must be provided to patients five days a week.

Whistleblowers filed lawsuits against Longwood and its nursing facilities

Longwood allegedly knowingly submitted or caused the submission of false and fraudulent claims to Medicare for unreasonable or unnecessary Ultra-high levels of rehabilitation services for Medicare Part A patients.