Kelly Warner Law Firm Blames USA Herald for Arizona Bar Investigation

4/18/17 The Washington Post exposes another questionable Kelly Warner filing that involves former NFL Cheerleader Megan Welter: https://www.washingtonpost.com/news/volokh-conspiracy/wp/2017/04/18/another-trick-to-try-to-get-mainstream-media-articles-deindexed-by-google/?utm_term=.22e9e1615271 4/20/17 The USA…

By – USA HeraldAaron Kelly Law Firm Resorts To Attacking Former Client Again On KellyWarnerLaw.com – Pattern Recognized

In the affidavit, which was apparently signed by “Barri Grossman,” Grossman admits to all liability for the posting and absolved…

By – Jeff WattersonArizona Bar Opens Investigation on Attorney Aaron Kelly

Volokh, as part of his investigative work, had a private investigator research the defendants in some of theallegedly fraudulent…

By – Paul O'NealStrike on Iranian Primary School Investigated as War Crime, According to HRW

se The Strike Pattern Tells Its Own Story Human Rights Watch researchers analyzed 14 verified videos and photographs taken in…

By – Rochdi RaisIPIC Theaters Files for Bankruptcy as Luxury Cinema Chain Seeks Lifeline

A Premium Theater Concept Under Pressure Founded in 2010, iPic set out to reinvent moviegoing with a high-end formula—plush seating,…

By – Rachel MooreUS Cuba Economic Deal Emerges as Trump Administration Eyes Major Policy Shift

Strategy Differs From Obama-Era Policy Former President Barack Obama had previously eased several restrictions on Cuba during the final years…

By – Rachel MooreAmazon FCC Denial of SpaceX Plan Urged in Satellite Showdown

Deployment Could Take Centuries, Amazon Says Launch Capacity Seen as Major Obstacle Amazon’s filing emphasizes that even if every rocket…

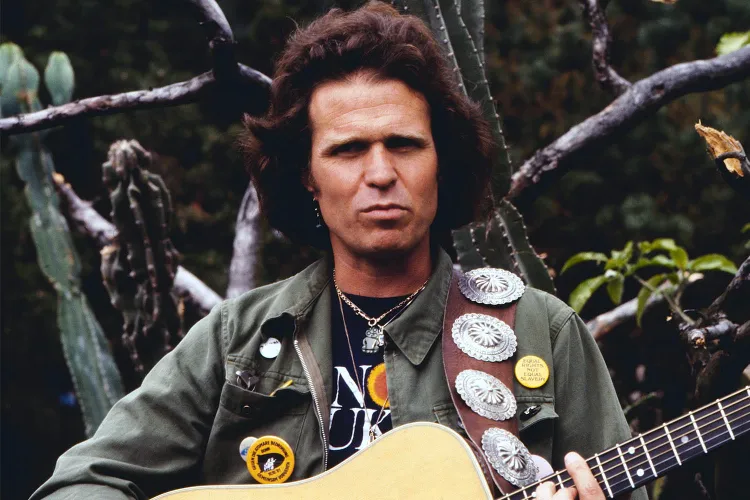

By – Rihem AkkoucheCountry Joe McDonald Died at 84, Woodstock Legend and Protest Voice Falls Silent

Woodstock Moment That Echoed Through History Infamous Cheer Became Cultural Flashpoint McDonald’s most legendary moment arrived in 1969 at the…

By – Rihem AkkoucheThe Northern Lights Return

NOAA’s view line for the aurora on Tuesday NOAA The Best Way to View the Northern Lights Experts at NOAA…

By – Jackie AllenStrike on Iranian Primary School Investigated as War Crime, According to HRW

se The Strike Pattern Tells Its Own Story Human Rights Watch researchers analyzed 14 verified videos and photographs taken in…

By – Rochdi RaisIPIC Theaters Files for Bankruptcy as Luxury Cinema Chain Seeks Lifeline

A Premium Theater Concept Under Pressure Founded in 2010, iPic set out to reinvent moviegoing with a high-end formula—plush seating,…

By – Rachel MooreUS Cuba Economic Deal Emerges as Trump Administration Eyes Major Policy Shift

Strategy Differs From Obama-Era Policy Former President Barack Obama had previously eased several restrictions on Cuba during the final years…

By – Rachel MooreAmazon FCC Denial of SpaceX Plan Urged in Satellite Showdown

Deployment Could Take Centuries, Amazon Says Launch Capacity Seen as Major Obstacle Amazon’s filing emphasizes that even if every rocket…

By – Rihem AkkoucheCountry Joe McDonald Died at 84, Woodstock Legend and Protest Voice Falls Silent

Woodstock Moment That Echoed Through History Infamous Cheer Became Cultural Flashpoint McDonald’s most legendary moment arrived in 1969 at the…

By – Rihem AkkoucheThe Northern Lights Return

NOAA’s view line for the aurora on Tuesday NOAA The Best Way to View the Northern Lights Experts at NOAA…

By – Jackie AllenIPIC Theaters Files for Bankruptcy as Luxury Cinema Chain Seeks Lifeline

A Premium Theater Concept Under Pressure Founded in 2010, iPic set out to reinvent moviegoing with a high-end formula—plush seating,…

By – Rachel MooreUS Cuba Economic Deal Emerges as Trump Administration Eyes Major Policy Shift

Strategy Differs From Obama-Era Policy Former President Barack Obama had previously eased several restrictions on Cuba during the final years…

By – Rachel MooreAmazon FCC Denial of SpaceX Plan Urged in Satellite Showdown

Deployment Could Take Centuries, Amazon Says Launch Capacity Seen as Major Obstacle Amazon’s filing emphasizes that even if every rocket…

By – Rihem AkkoucheCountry Joe McDonald Died at 84, Woodstock Legend and Protest Voice Falls Silent

Woodstock Moment That Echoed Through History Infamous Cheer Became Cultural Flashpoint McDonald’s most legendary moment arrived in 1969 at the…

By – Rihem AkkoucheThe Northern Lights Return

NOAA’s view line for the aurora on Tuesday NOAA The Best Way to View the Northern Lights Experts at NOAA…

By – Jackie AllenMalaysia Airlines MH370 Disappearance Remains Unsolved After New Ocean Search

$70 Million Search Hinges on Discovery Malaysia authorized the renewed search effort last year under a “no-find, no-fee” agreement with…

By – Rihem AkkoucheThe Northern Lights Return

NOAA’s view line for the aurora on Tuesday NOAA The Best Way to View the Northern Lights Experts at NOAA…

By – Jackie AllenFebruary Unemployment Up as Job Losses Surprise Economists

The ADP National Employment Report indicated that private sector employers added 63,000 jobs in February, exceeding expectations of 50,000 new…

By – Jackie AllenLate-Night Attack by Venezuelan National at Florida Beach

“Random acts of violence like this are some of the most difficult crimes to solve – and that’s exactly what…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

Leading the effort in the Senate is Tim Kaine (D-Va.), who has long argued that Congress must vote before U.S.…

By – Jackie AllenU.S. And Israel Launch Major Strikes On Iran — What It Means For America

A World on Edge The strikes have stirred bipartisan debate in Washington, with some lawmakers praising decisive action and others warning…

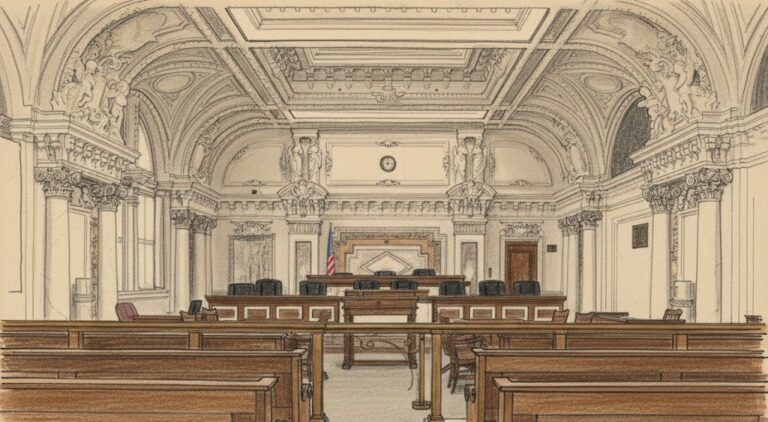

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

Writing for the panel, U.S. Circuit Judge Morgan B. Christen concluded that BNSF’s actions fell squarely within that exception. Federal…

By – Tyler BrooksIPIC Theaters Files for Bankruptcy as Luxury Cinema Chain Seeks Lifeline

A Premium Theater Concept Under Pressure Founded in 2010, iPic set out to reinvent moviegoing with a high-end formula—plush seating,…

By – Rachel MooreUS Cuba Economic Deal Emerges as Trump Administration Eyes Major Policy Shift

Strategy Differs From Obama-Era Policy Former President Barack Obama had previously eased several restrictions on Cuba during the final years…

By – Rachel MooreAmazon FCC Denial of SpaceX Plan Urged in Satellite Showdown

Deployment Could Take Centuries, Amazon Says Launch Capacity Seen as Major Obstacle Amazon’s filing emphasizes that even if every rocket…

By – Rihem AkkoucheCountry Joe McDonald Died at 84, Woodstock Legend and Protest Voice Falls Silent

Woodstock Moment That Echoed Through History Infamous Cheer Became Cultural Flashpoint McDonald’s most legendary moment arrived in 1969 at the…

By – Rihem AkkoucheThe Northern Lights Return

NOAA’s view line for the aurora on Tuesday NOAA The Best Way to View the Northern Lights Experts at NOAA…

By – Jackie AllenMalaysia Airlines MH370 Disappearance Remains Unsolved After New Ocean Search

$70 Million Search Hinges on Discovery Malaysia authorized the renewed search effort last year under a “no-find, no-fee” agreement with…

By – Rihem AkkoucheWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

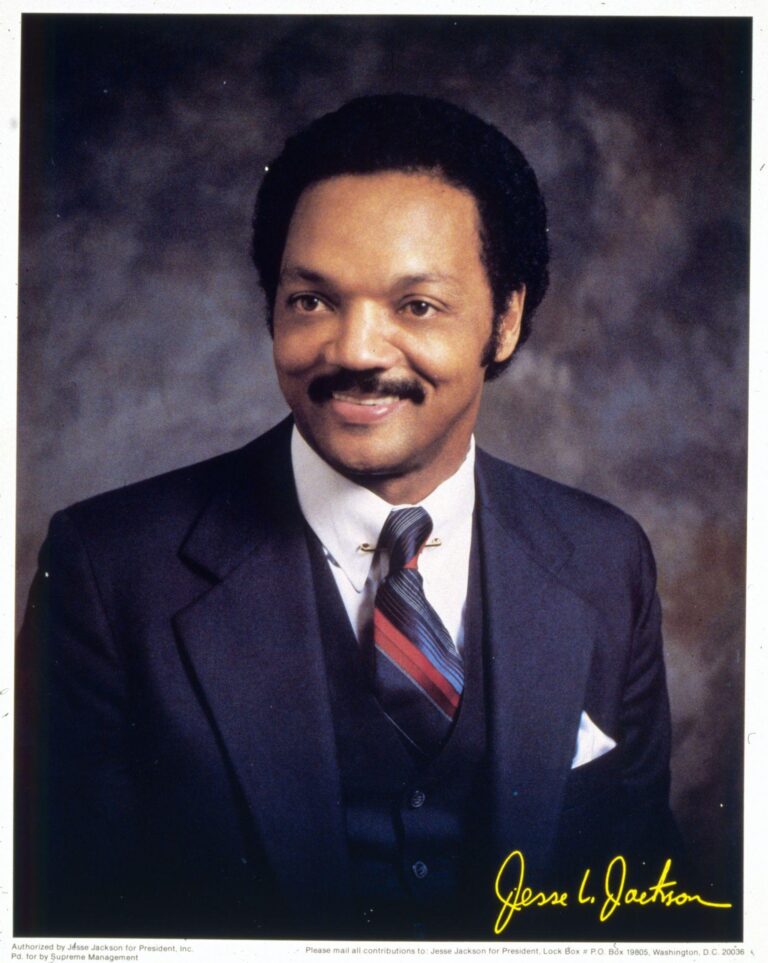

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

From Civil Rights Marches to Presidential Campaigns Jackson was not merely a witness to history — he sought to shape…

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

Savannah Guthrie Questions New Security System Footage The footage captured by the home’s “Security System” has become a focal point…

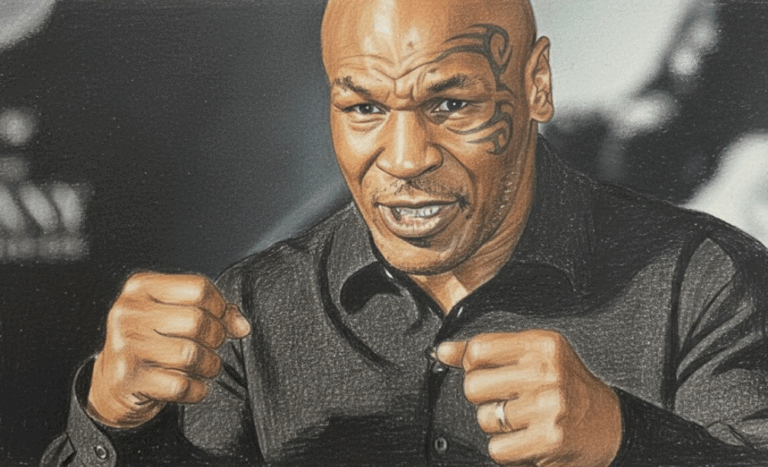

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksFebruary Unemployment Up as Job Losses Surprise Economists

The ADP National Employment Report indicated that private sector employers added 63,000 jobs in February, exceeding expectations of 50,000 new…

By – Jackie AllenLate-Night Attack by Venezuelan National at Florida Beach

“Random acts of violence like this are some of the most difficult crimes to solve – and that’s exactly what…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

Leading the effort in the Senate is Tim Kaine (D-Va.), who has long argued that Congress must vote before U.S.…

By – Jackie AllenCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

Team CEO Dan Towriss described the MAC-26 name as a reflection of Andretti’s pioneering spirit and the broader belief that…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

Upcoming Medal Events Medal competition continues Friday, February 20, with several key finals scheduled. Events awarding medals include: Women’s ski…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

By – Tyler Brooks

No posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!