The Senate passed the GOP tax reform bill along party lines early morning on Saturday. The passage means the Republican Party will likely deliver its major legislative achievement this year.

In fact, President Donald Trump wants to sign the tax reform legislation by Christmas as a gift to Americans. Last week, the President said, “We’re going to give the American people a huge tax cut for Christmas. Hopefully, that will be a great, big, beautiful Christmas present.”

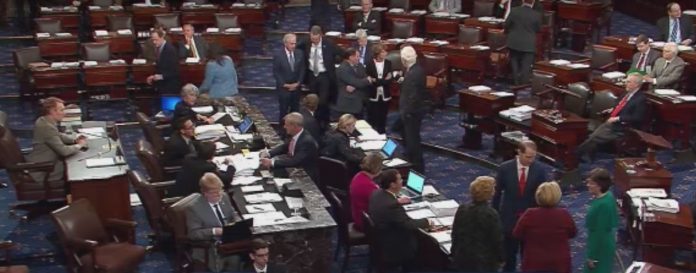

On Friday, Republican leaders spent all day and night making negotiations and amendments to the legislation before the final vote.

Senate Majority Leader Mitch McConnell told the Associated Press that the GOP tax reform bill is “just what the country needs to get growing again.” He also ignored the fact that the legislation has little public support. According to him, “Big bills are rarely popular. You remember how unpopular ‘Obamacare’ was when it passed?

Sen. Corker is the only Republican who voted against the tax reform bill

In the early hour on Saturday, the Senate voted 51-49 on the GOP tax reform bill. The only Republican who did not support the legislation was Senator Bob Corker of Tennessee.