Once considered a poor bet for investment, the African continent is now attracting the attention of the world’s major players. Surprisingly, it’s China leading the way, not traditional economic powerhouses such as the US or the EU. As Western investors wake up to the reality of this new economic order, they face challenges in their efforts to make up lost ground.

It may not be easy to pinpoint why the West has fallen behind, but it has a lot to do with complacency. Countries such as the US have kept to traditional markets. They’ve made only limited efforts at expansion into emerging markets. As these emerging markets look to expand their economies, they’re welcoming investment from willing partners such as China.

This allows China to find new sources for the natural resources they so desperately need. It also gives them greater influence around the globe.

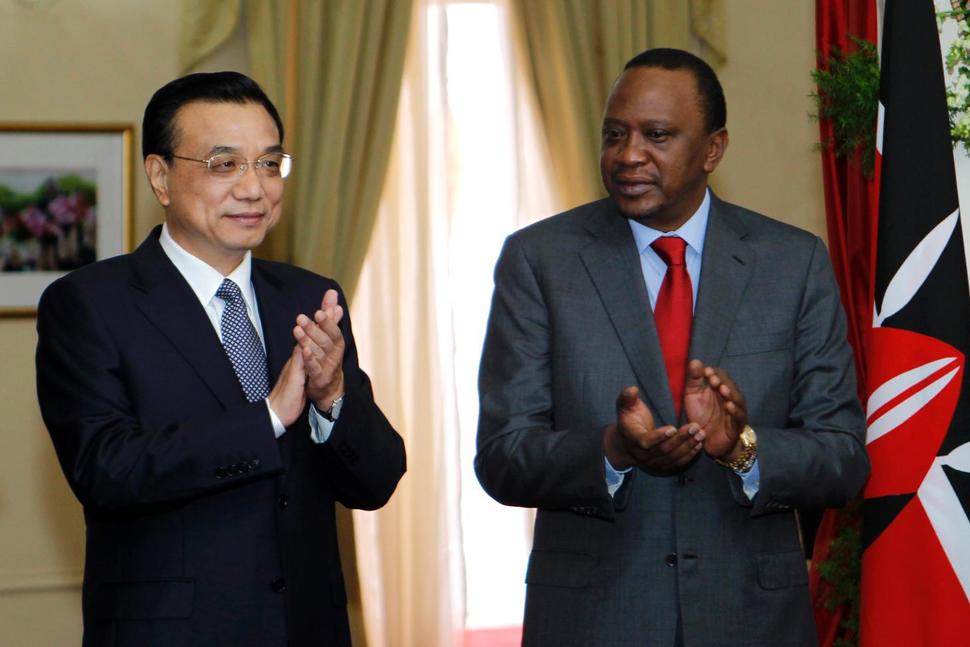

Chinese Investment Reaches $1 Trillion