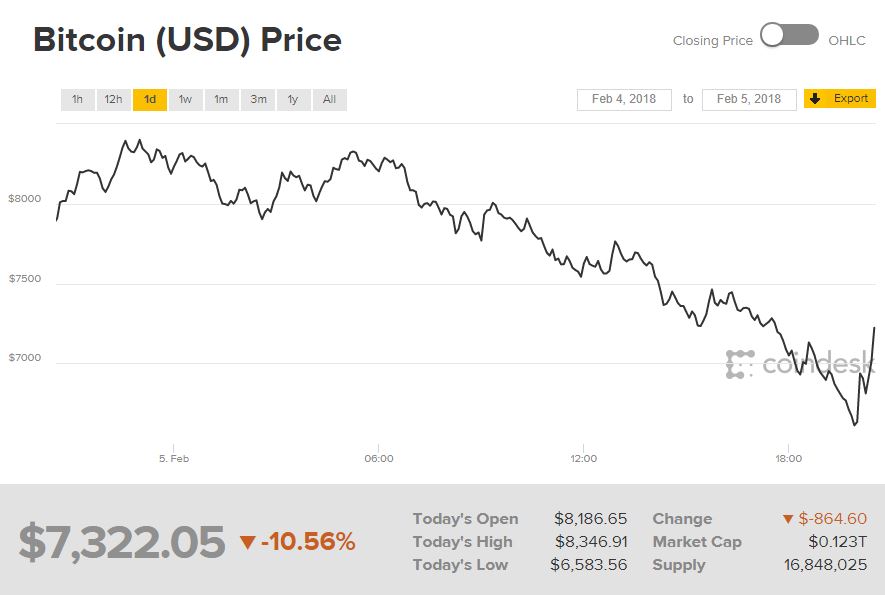

Bitcoin plummeted below $7,000, its lowest level since November 15 as the sell-off in the cryptocurrency market continues.

On Monday, bitcoin hit as low as $6,583.56 from its opening price of $8,186.65, according to data from CoinDesk. The largest cryptocurrency by market capitalization lost more than 19%.

However, it was able to recover some loses. Bitcoin was trading $7,322.05 at the time of this writing around 3:02 PM Eastern Time. The price is still down more than 10%.

The entire cryptocurrency market lost nearly 60% from its highest level in early January. At the time, its overall market capitalization was around $800 billion. Its capitalization is now around $332 billion, according to data from CoinMarketCap. The increasing regulatory crackdown worldwide was the primary reason behind the sell-off, which market analysts believe will continue.

Three major banks ban bitcoin purchases using credit cards

On Friday, three major banks including Bank of America, Citigroup, and J.P. Morgan Chase decided to ban bitcoin and other cryptocurrency purchases using credit cards.