Bitcoin plummeted below $10,000 amid the broad weakness in the cryptocurrency market on Monday. Other digital currencies including ethereum, ripple, litecoin, and stellar also suffer steep declines.

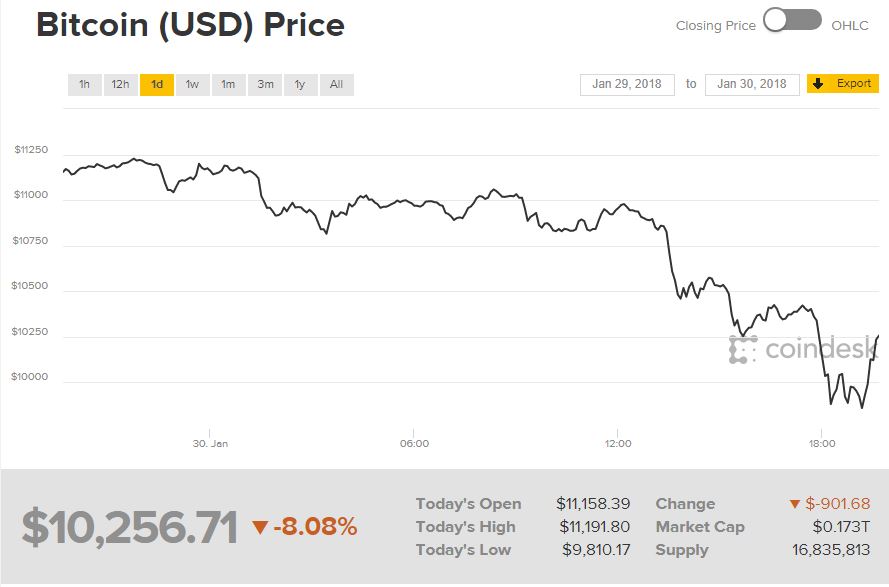

Bitcoin traded as low as $9,810.17 earlier today, according to data from CoinDesk. The largest digital currency by market capitalization managed to regain some of its losses—it was trading $10,256.71 around 3:00 PM Eastern Time. Its price is still down by more than 8%.

On the other hand, ethereum, the second largest cryptocurrency, plunges as low as $1,058.97. It was trading $1,101.92 at the time of this writing, down by more than 6%.

Ripple declined 11% to $1.19. Litecoin fell 7% to $168.68. Stellar tanked 14% to around $0.50, according to CoinMarket Cap.

Negative reports cause sell-off in bitcoin, other cryptocurrencies

In January, cryptocurrencies have been suffering massive sell-off primarily due to increasing regulatory scrutiny and negative reports worldwide.

Last week, Wall Street veteran Peter Bookvar predicted that bitcoin will fall as low as $1,000 next year. According to him, “When something goes parabolic like this has, it typically ends up to where that parabola began. I wouldn’t be surprised if over the next year it’s down to $1,000 to $3,000.”