The cryptocurrency market value declined more than $60 billion in 24 hours as the sell-off of bitcoin and other major digital currencies continues.

Early morning Thursday, the cryptocurrency market cap was around $310.4 billion, down from $372.9 billion the previous day, according to data from Coinmarketcap.com.

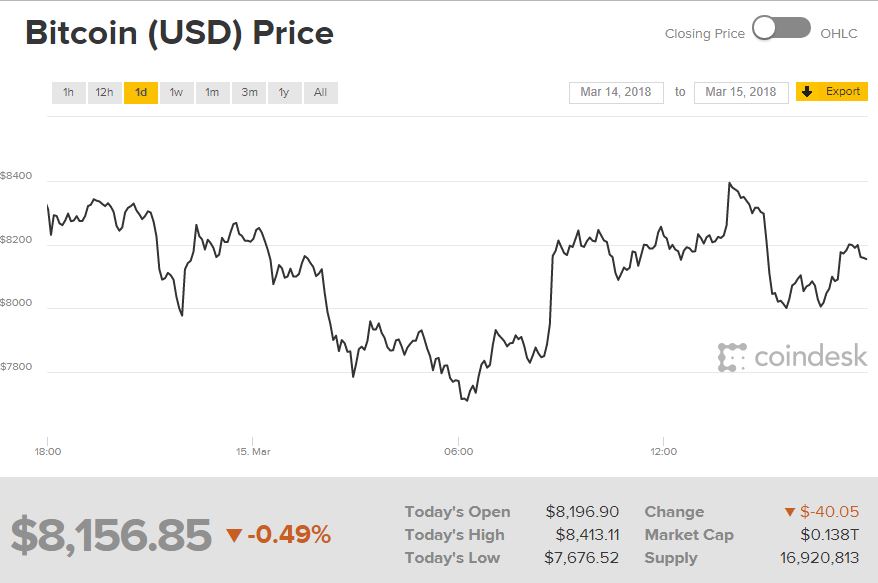

Bitcoin declined to as low as $7,667.52 on Thursday—the lowest price since February 8, based on data from CoinDesk. However, bitcoin managed to recover some of its losses in the afternoon trading. As of 2:06 PM Eastern Time, the price of the world’s largest cryptocurrency was $8,156.85.

Several factors triggered the cryptocurrency market sell-off

A number of factors caused the cryptocurrency sell-off including the ongoing regulatory scrutiny worldwide.

In the United States, the Securities and Exchange Commission (SEC) is investigating the cryptocurrency market. It inquiry is focused on initial coin offerings (ICOs).

In the United Kingdom, Bank of England Mark Carney called for increased regulation on cryptocurrencies.