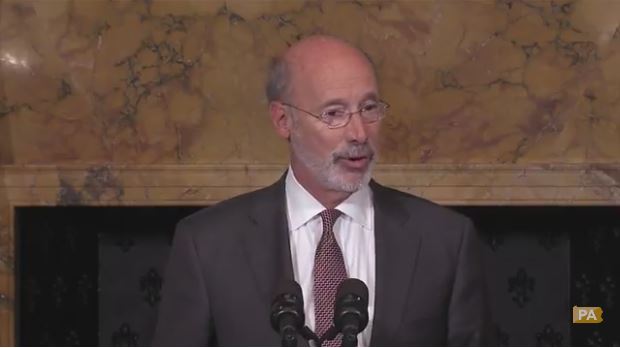

Governor Tom Wolf encouraged two Republican members of the Pennsylvania congressional delegation to vote against the GOP tax plan.

On Wednesday, Gov. Wolf encouraged Congressmen Patrick Meehan and Mike Kelly to vote no on the GOP tax legislation. Both representatives are members of the House Ways and Means Committee.

Last week, Cong. Meehan said the Tax Cuts and Jobs Act will provide tax relief to hardworking Pennsylvania taxpayers. Cong. Kelly shared the same view that the legislation lowers taxes for the middle and lower-income Americans.

Gov. Wolf says GOP tax plan is for the interest of the wealthy

In a statement, the governor criticized the GOP’s plan to eliminate federal tax deductions important to Pennsylvania workers and families.

According to Gov. Wolf, “Hardworking Pennsylvanians, seniors, and students should not be forced to fund tax breaks for the rich. Instead of prioritizing the middle class, the bill drafted by House Republicans behind closed doors caters to the wealthy and large corporations.”