The House Republicans finally unveiled their tax plan on Thursday after weeks of internal conflict and negotiations.

During a press conference, House Speaker Paul Ryan said, “This plan is for all those middle-class families who deserve a break. It is for all the families that are living paycheck to paycheck who just keep getting squeezed.”

According to him, under the GOP tax plan, a typical family of four will save $1,182 on their taxes per year. Loopholes for specials interest will be eliminated, and people can “file their tax returns on a piece of paper the size of a postcard.”

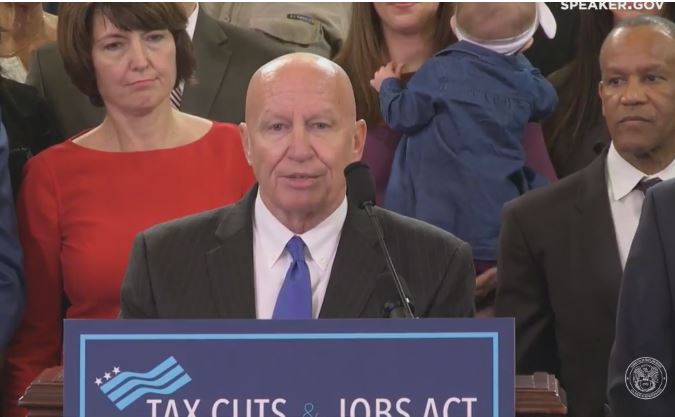

On the other hand, House Ways and Means Committee Chairman Kevin Brady said, “This is our chance to deliver the most transformative tax cuts in a generation. Let’s not let the Washington special interest, the TV pundits, or the pessimists fool you. None of them thought we’d get this far with tax reform and they’re wrong.”

Speaker Ryan and Cong. Brady co-sponsored the Tax Cuts and Jobs Act.

Here are the key details of the GOP tax plan:

1. The House legislation reduces the federal income tax brackets from seven to four

• 12% on the first $45,000 of taxable income for individuals; $90,000 for married couples filing jointly

• 25% starts at $45,000 for individuals; $90,000 for married couples)

• 35% starts at $200,000 for individuals; $260,000 for married couples

• 39.6% starts at $500,000 for individuals; $1 million for married couples