Newark, NJ – The current and former top executives of Nigerian fintech company Tingo Group Inc. have been hit with a derivative suit in New Jersey federal court over revelations of fraud at the company, which has led to other litigation, including actions launched by the U.S. Securities and Exchange Commission (SEC) and the U.S. Department of Justice (DOJ).

Plaintiff Jia Cheng filed a complaint Thursday against Tingo’s founder, interim CEO, chief financial officer, and several board members, alleging that the conduct of the individual defendants cost stockholders “substantial sums” of money.

Cheng said Tingo has been described as a “worthless and brazen fraud that should serve as a humiliating embarrassment for all involved.”

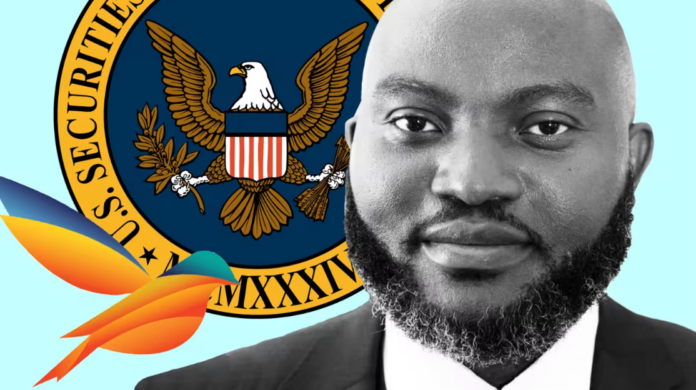

According to the complaint, Tingo is a holding company that claimed to be a leader in African financial technology and agricultural financial technology. However, Cheng said Tingo’s rise was built on a series of lies engineered by its founder, Dozy Mmobuosi.

The complaint states that beginning in 2019, Mmobuosi, who is originally from Nigeria, began positioning one of Tingo’s entities, Tingo Mobile, to access U.S. capital markets. He eventually achieved success in 2021 when a public company named iWeb Inc. acquired Tingo Mobile and renamed itself Tingo Inc. and then later Agri-Fintech Holdings Inc.