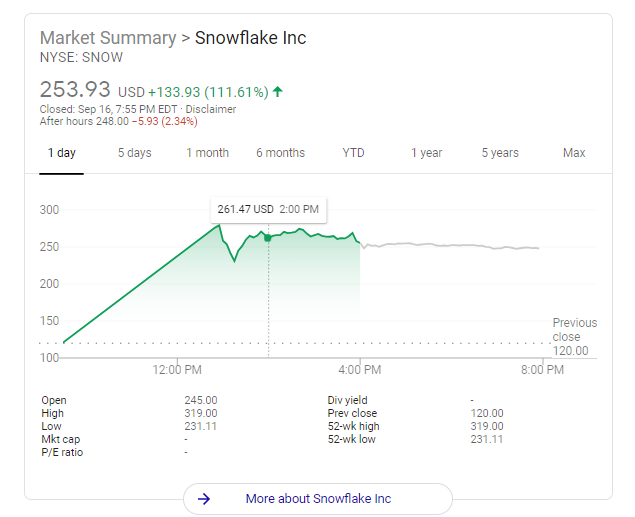

The stock price of cloud computing company Snowflake skyrocketed during its initial public offering (IPO) on the New York Stock Exchange (NYSE) on Wednesday.

Snowflake priced its stock at $120 per share, higher than its estimated price range of $100 to $110 per share on Monday. Its IPO price was significantly more than its proposed price range of $75 to $85 per share.

During its market debut, Snowflake, trading under the ticker “SNOW” surged more than 111% to $253.93 per share. The cloud computing company’s valuation at the end of the trading was $70.4 billion, more than its $12.4 billion market value in February.

“A stock is worth exactly what somebody wants to pay for it. It’s like talking about the weather, it is what it is. Tomorrow’s another day, we’ll see what it brings,” said Snowflake CEO Frank Slootman to CNBC right after the cloud computing company started its first day of trading.

Snowflake’s target was to $2.2 billion during its first trading day. The cloud computing company exceeded its goal as it raised $3 billion, the most for a software company.