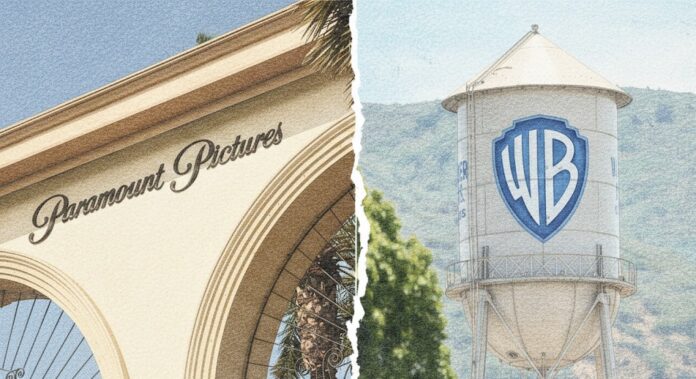

Warner Bros Discovery is considering whether to reopen sale negotiations with rival Hollywood studio Paramount Skydance following a revised takeover proposal, according to a Bloomberg News report citing people familiar with the matter.

The company’s board is said to be discussing whether Paramount’s updated offer could deliver greater long-term value to shareholders than its existing agreement with Netflix. No formal decision has been made, and directors could ultimately opt to proceed with the previously announced Netflix transaction.

Reuters has not independently verified the report. Warner Bros Discovery, Paramount Skydance and Netflix did not immediately respond to requests for comment.

Paramount recently enhanced its hostile bid without increasing its base price. The company reaffirmed its $30-per-share offer, valuing Warner Bros Discovery at approximately $108.4 billion including debt. However, it introduced additional financial incentives designed to make the proposal more attractive.

Among those enhancements is a quarterly “ticking fee” of 25 cents per share in cash beginning in 2027 for every quarter the deal remains unclosed. The added payment would amount to roughly $650 million annually if closing is delayed. Paramount also offered to cover the $2.8 billion breakup fee Warner Bros Discovery would owe Netflix should it terminate their agreement.

The revised structure appears aimed at addressing concerns over regulatory timing and execution risk, while keeping pressure on Warner Bros Discovery’s board to reconsider its position.

Strategic Assets at Stake

Both Netflix and Paramount are pursuing Warner Bros Discovery for its extensive entertainment portfolio. The company controls major film and television production studios, a deep content library and globally recognized franchises including Game of Thrones, Harry Potter and DC Comics properties such as Batman and Superman.

Warner Bros Discovery also owns valuable cable assets, including CNN and TNT, which remain central to the strategic calculations of potential buyers despite the ongoing shift toward streaming platforms.

For Netflix, acquiring Warner Bros Discovery would significantly expand its intellectual property portfolio and strengthen its competitive position in the global streaming market. For Paramount, a combination would create a more consolidated traditional and streaming media powerhouse, potentially generating cost synergies and enhanced bargaining power in content distribution.

Investor Pressure Mounts

The situation has drawn increased scrutiny from shareholders. Activist investor Ancora Holdings, which has accumulated a nearly $200 million stake in Warner Bros Discovery, recently said it intends to oppose the Netflix deal. Ancora argues that the board did not sufficiently engage with Paramount regarding its rival proposal and should more thoroughly evaluate alternatives that may offer higher value.

The board’s deliberations come at a time of heightened consolidation in the media sector, as companies face intensifying competition, rising content production costs and shifting consumer viewing habits.

Market Impact and Next Steps

If Warner Bros Discovery reopens negotiations with Paramount, it could delay the current transaction timeline and potentially trigger additional legal or financial implications tied to the Netflix agreement. The inclusion of the breakup fee coverage in Paramount’s revised bid suggests the company is attempting to mitigate such risks and make a transition between deals financially feasible.

Any change in direction would likely have significant implications not only for shareholders but also for employees, talent contracts and distribution partnerships across the entertainment ecosystem.

For now, the outcome remains uncertain as Warner Bros Discovery’s board continues evaluating its options amid competing offers and mounting investor pressure.