As the COVID-19 pandemic continues to decimate many businesses across the nation, zombie companies have become a very popular topic of conversation. But to those who do not emerge in the financial world on a daily basis, this leaves one question. What is a zombie company?

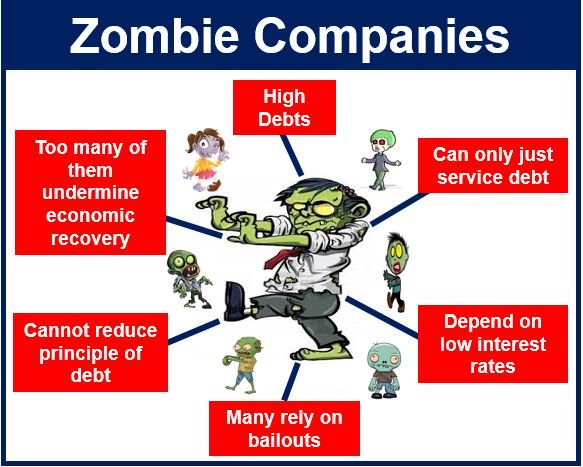

To put plainly, a zombie company is a company that is heavily indebted and only generates enough cash flow to cover the interest payments on their debts. Such a company does not generate enough to pay down the principal. This means they stay stagnant and unchanging since they do not have the excess cash to invest and grow.

Zombie companies are trading stocks in the U.S. stock markets

This has become a problem for many businesses, both public and private, that rely on easy, affordable access to credit. A 2013 study conducted by Deutsche Bank Securities showed about one in five publicly traded U.S. companies is a zombie. It is estimated that figure has doubled since and is well up from the 1990s when there were almost no zombies in the market place.