Kelly Warner Law Firm Blames USA Herald for Arizona Bar Investigation

4/18/17 The Washington Post exposes another questionable Kelly Warner filing that involves former NFL Cheerleader Megan Welter: https://www.washingtonpost.com/news/volokh-conspiracy/wp/2017/04/18/another-trick-to-try-to-get-mainstream-media-articles-deindexed-by-google/?utm_term=.22e9e1615271 4/20/17 The USA…

By – USA HeraldAaron Kelly Law Firm Resorts To Attacking Former Client Again On KellyWarnerLaw.com – Pattern Recognized

In the affidavit, which was apparently signed by “Barri Grossman,” Grossman admits to all liability for the posting and absolved…

By – Jeff WattersonArizona Bar Opens Investigation on Attorney Aaron Kelly

Volokh, as part of his investigative work, had a private investigator research the defendants in some of theallegedly fraudulent…

By – Paul O'NealUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

How the Approval System Would Work The draft rules envision a tiered approval process based on the scale of computing…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Real Estate Giant Steps In The buyer behind the sweeping acquisition is EPR Properties, a real estate investment trust based…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Major Investors Back the Vision The financing round was led by Balerion Space Ventures, with participation from a roster of…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Defense: Playboy Lifestyle, Not Criminal Conduct During marathon closing arguments spanning Tuesday and Wednesday, defense attorneys urged jurors to look…

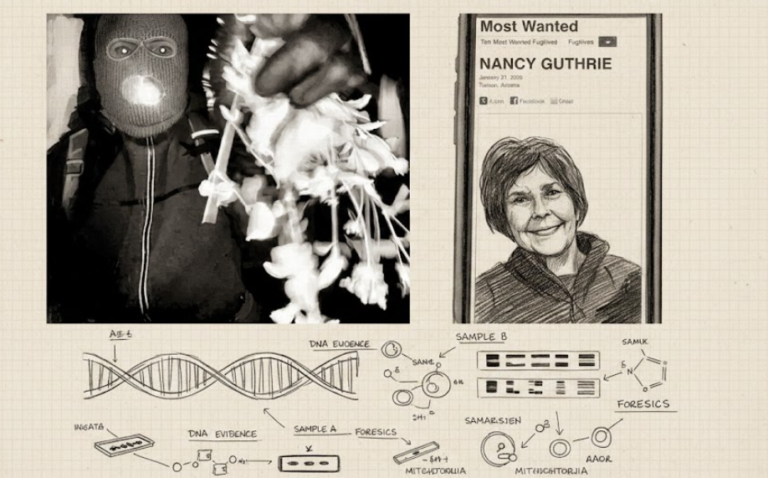

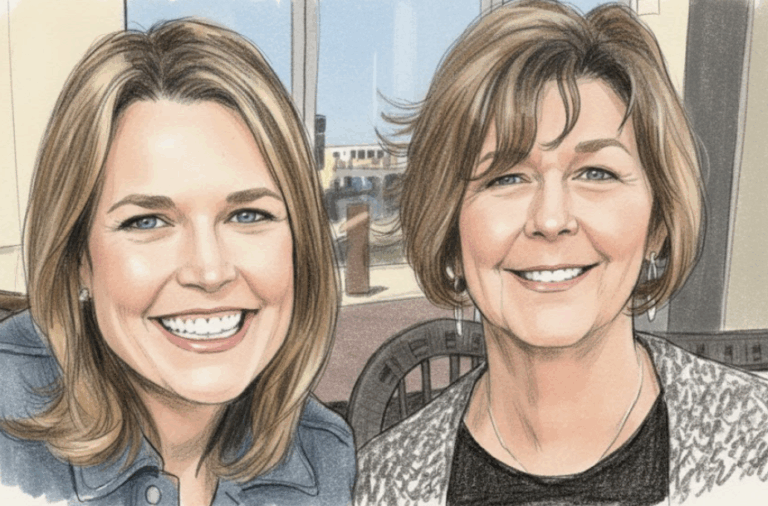

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Mystery Surrounds Disappearance of Nancy Guthrie The broadcaster has been absent from the air since late January, just days before…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Judge Orders Government to Issue Refunds The drama escalated Wednesday when the Manhattan-based trade court moved swiftly. Senior Judge Richard…

By – Rihem AkkoucheUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

How the Approval System Would Work The draft rules envision a tiered approval process based on the scale of computing…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Real Estate Giant Steps In The buyer behind the sweeping acquisition is EPR Properties, a real estate investment trust based…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Major Investors Back the Vision The financing round was led by Balerion Space Ventures, with participation from a roster of…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Defense: Playboy Lifestyle, Not Criminal Conduct During marathon closing arguments spanning Tuesday and Wednesday, defense attorneys urged jurors to look…

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Mystery Surrounds Disappearance of Nancy Guthrie The broadcaster has been absent from the air since late January, just days before…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Judge Orders Government to Issue Refunds The drama escalated Wednesday when the Manhattan-based trade court moved swiftly. Senior Judge Richard…

By – Rihem AkkoucheUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

How the Approval System Would Work The draft rules envision a tiered approval process based on the scale of computing…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Real Estate Giant Steps In The buyer behind the sweeping acquisition is EPR Properties, a real estate investment trust based…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Major Investors Back the Vision The financing round was led by Balerion Space Ventures, with participation from a roster of…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Defense: Playboy Lifestyle, Not Criminal Conduct During marathon closing arguments spanning Tuesday and Wednesday, defense attorneys urged jurors to look…

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Mystery Surrounds Disappearance of Nancy Guthrie The broadcaster has been absent from the air since late January, just days before…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Judge Orders Government to Issue Refunds The drama escalated Wednesday when the Manhattan-based trade court moved swiftly. Senior Judge Richard…

By – Rihem AkkoucheU.S. And Israel Launch Major Strikes On Iran — What It Means For America

A World on Edge The strikes have stirred bipartisan debate in Washington, with some lawmakers praising decisive action and others warning…

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

Writing for the panel, U.S. Circuit Judge Morgan B. Christen concluded that BNSF’s actions fell squarely within that exception. Federal…

By – Tyler BrooksMissing DNA Evidence May Limit Investigation Into Nancy Guthrie Case, Sources Suggest

As the investigation enters its fourth week, authorities have not publicly identified any suspect or person of interest. Law enforcement…

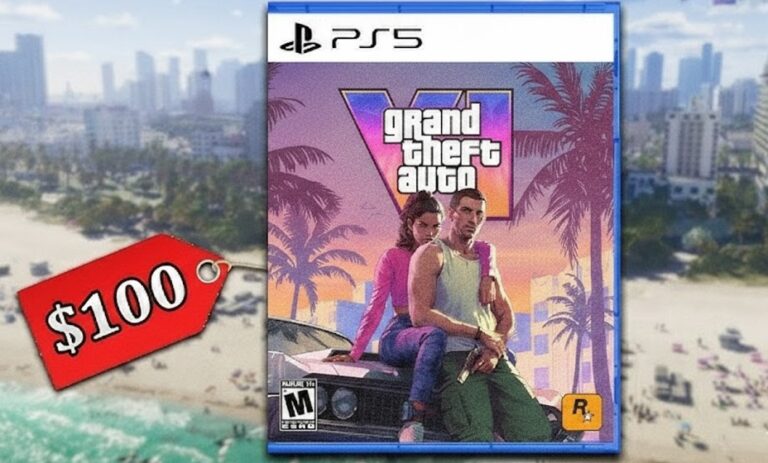

By – Ahmed BoughallebGrand Theft Auto 6 Targets November 2026 Launch as Price Leak Fuels $100 Debate

After years of speculation, teaser trailers and headline-making leaks, Grand Theft Auto VI now has a confirmed global release date:…

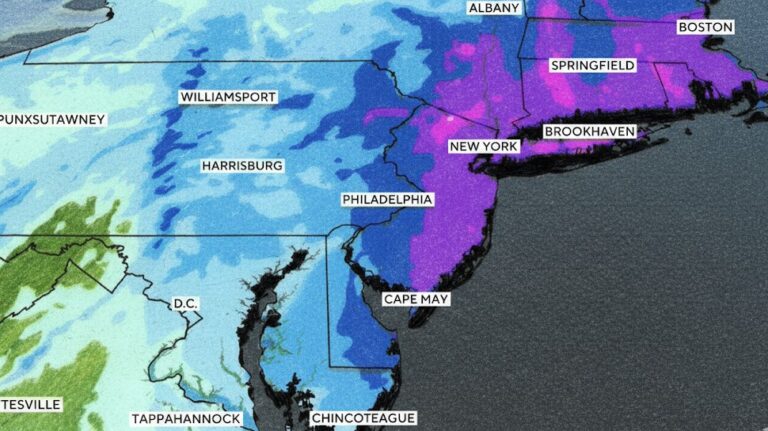

By – Ahmed Boughalleb40 Million Under Blizzard Warnings as Major Winter Storm Threatens U.S. East Coast

Weather experts said the storm is notable because of its scale across densely populated regions. Cody Snell, a meteorologist with…

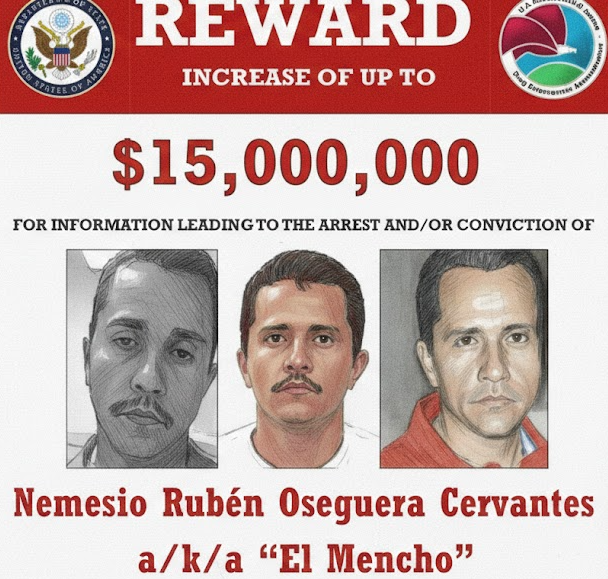

By – Tyler BrooksViolence Erupts Across Mexico After Cartel Leader “El Mencho” Killed in Military Raid, Triggering Roadblocks, Transport Disruptions, and Security Alert Across Several States

Several airlines adjusted schedules due to the security situation. Air Canada suspended flights to Puerto Vallarta because of ongoing safety…

By – Ahmed BoughallebUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

How the Approval System Would Work The draft rules envision a tiered approval process based on the scale of computing…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Real Estate Giant Steps In The buyer behind the sweeping acquisition is EPR Properties, a real estate investment trust based…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Major Investors Back the Vision The financing round was led by Balerion Space Ventures, with participation from a roster of…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Defense: Playboy Lifestyle, Not Criminal Conduct During marathon closing arguments spanning Tuesday and Wednesday, defense attorneys urged jurors to look…

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Mystery Surrounds Disappearance of Nancy Guthrie The broadcaster has been absent from the air since late January, just days before…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Judge Orders Government to Issue Refunds The drama escalated Wednesday when the Manhattan-based trade court moved swiftly. Senior Judge Richard…

By – Rihem AkkoucheWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

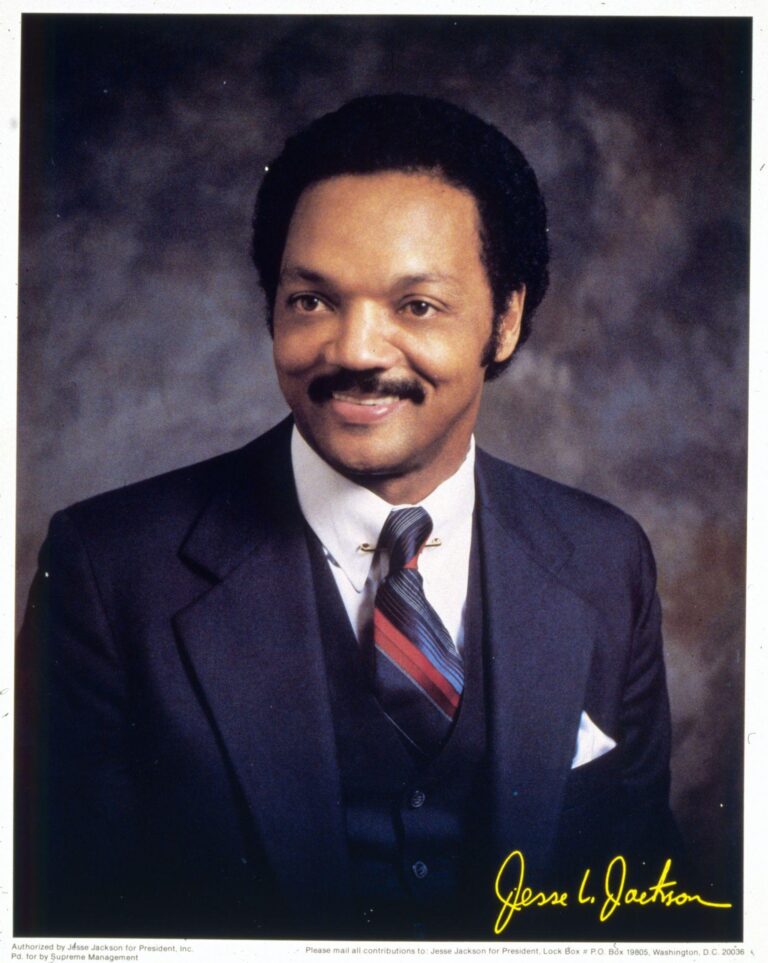

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

From Civil Rights Marches to Presidential Campaigns Jackson was not merely a witness to history — he sought to shape…

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

Savannah Guthrie Questions New Security System Footage The footage captured by the home’s “Security System” has become a focal point…

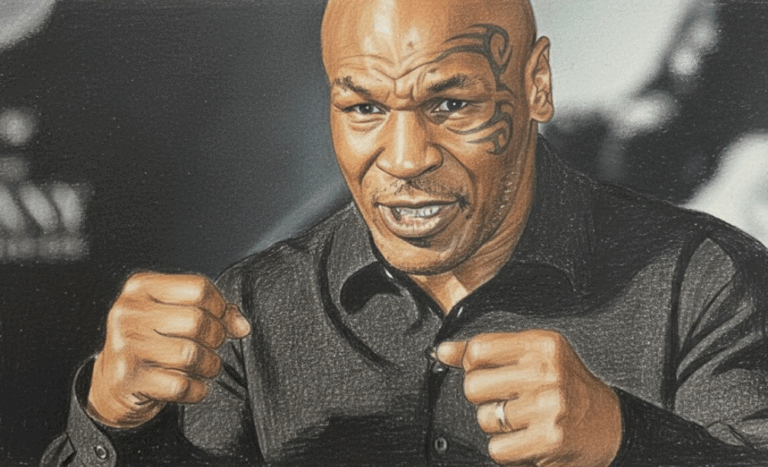

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

Team CEO Dan Towriss described the MAC-26 name as a reflection of Andretti’s pioneering spirit and the broader belief that…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

Upcoming Medal Events Medal competition continues Friday, February 20, with several key finals scheduled. Events awarding medals include: Women’s ski…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

By – Tyler Brooks

Olympic Villages Run Out of Condoms at 2026 Milan-Cortina Games

Condom supplies in the Olympic Villages at the 2026 Winter Games have been temporarily depleted, the Milan-Cortina organizing committee confirmed,…

By – Tyler BrooksArizona Authorities Escalate Search for Savannah Guthrie’s Mom to a Criminal Investigation

No other caregivers or family members are missing, and authorities say the family has been fully cooperative throughout the investigation.…

By – Jackie AllenWhat is Aegosexuality?

An aegosexual person might enjoy sexual thoughts, fantasies, or erotic material — but without imagining themselves as an active participant.…

By – Jackie AllenNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!