Kelly Warner Law Firm Blames USA Herald for Arizona Bar Investigation

5/17/17 Based on the information released in The Washington Post article on 5/17/17, the USA Herald publishes another in-depth article that…

By – USA HeraldAaron Kelly Law Firm Resorts To Attacking Former Client Again On KellyWarnerLaw.com – Pattern Recognized

Professor Volokh thereafter filed a bar complaint against Dan Warner with the Arizona Bar. This eventually led the ABA to…

By – Jeff WattersonArizona Bar Opens Investigation on Attorney Aaron Kelly

USA Herald recently reported on a developing story involving Attorneys Daniel Warner and Aaron Kelly. Both Warner and Kelly have…

By – Paul O'NealWinklevoss Twins’ Bitcoin Transfer Sparks Market Speculation

Turbulence and Strategic Changes at Gemini The Winklevoss twins’ Bitcoin transfer also comes during a period of internal transition at…

By – Rachel MooreMedtronic to Buy Scientia Vascular in $550 Million Neurovascular Deal

Leaders See Expanded Global Impact For Scientia, the acquisition opens the door to a much larger stage. “Scientia has developed…

By – Rihem AkkoucheGoogle and Tesla Power Grid Initiative Targets Lower Energy Costs

Tech Industry Promises to Address Costs Technology companies have recently begun pledging to help prevent those costs from falling on…

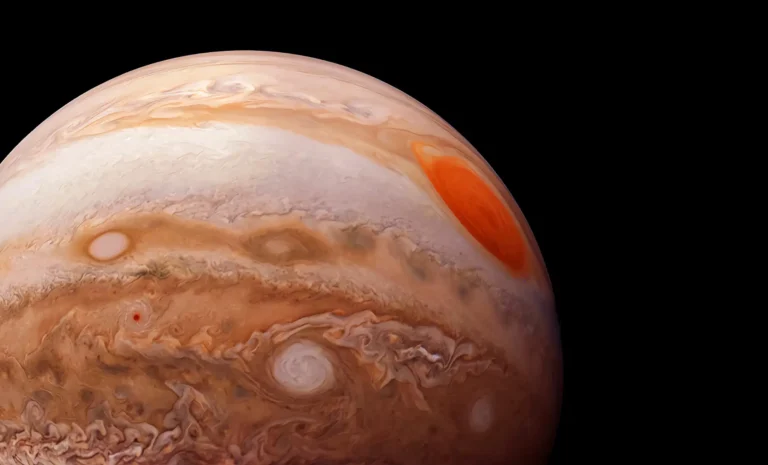

By – Rihem AkkoucheJupiter’s Shift Direction Lights Up the Night Sky Again

A Reminder of the Solar System’s Dance For astronomers and backyard stargazers alike, Jupiter’s shift direction is another reminder that…

By – Rihem AkkoucheLux Aeterna $10M Seed Funding Fuels Ambitious Reusable Satellite Vision

Hypersonic testing On-orbit computing In-space manufacturing The startup has also signed multiple partnerships with U.S. government organizations exploring reusable spacecraft…

By – Rihem AkkoucheNasa Satellite to Crash to Earth as Spacecraft Re-enters Atmosphere

Meteor Strike in Germany Adds to Cosmic Drama The satellite’s predicted descent comes just days after another celestial surprise. On…

By – Rihem AkkoucheWinklevoss Twins’ Bitcoin Transfer Sparks Market Speculation

Turbulence and Strategic Changes at Gemini The Winklevoss twins’ Bitcoin transfer also comes during a period of internal transition at…

By – Rachel MooreMedtronic to Buy Scientia Vascular in $550 Million Neurovascular Deal

Leaders See Expanded Global Impact For Scientia, the acquisition opens the door to a much larger stage. “Scientia has developed…

By – Rihem AkkoucheGoogle and Tesla Power Grid Initiative Targets Lower Energy Costs

Tech Industry Promises to Address Costs Technology companies have recently begun pledging to help prevent those costs from falling on…

By – Rihem AkkoucheJupiter’s Shift Direction Lights Up the Night Sky Again

A Reminder of the Solar System’s Dance For astronomers and backyard stargazers alike, Jupiter’s shift direction is another reminder that…

By – Rihem AkkoucheLux Aeterna $10M Seed Funding Fuels Ambitious Reusable Satellite Vision

Hypersonic testing On-orbit computing In-space manufacturing The startup has also signed multiple partnerships with U.S. government organizations exploring reusable spacecraft…

By – Rihem AkkoucheNasa Satellite to Crash to Earth as Spacecraft Re-enters Atmosphere

Meteor Strike in Germany Adds to Cosmic Drama The satellite’s predicted descent comes just days after another celestial surprise. On…

By – Rihem AkkoucheWinklevoss Twins’ Bitcoin Transfer Sparks Market Speculation

Turbulence and Strategic Changes at Gemini The Winklevoss twins’ Bitcoin transfer also comes during a period of internal transition at…

By – Rachel MooreMedtronic to Buy Scientia Vascular in $550 Million Neurovascular Deal

Leaders See Expanded Global Impact For Scientia, the acquisition opens the door to a much larger stage. “Scientia has developed…

By – Rihem AkkoucheGoogle and Tesla Power Grid Initiative Targets Lower Energy Costs

Tech Industry Promises to Address Costs Technology companies have recently begun pledging to help prevent those costs from falling on…

By – Rihem AkkoucheJupiter’s Shift Direction Lights Up the Night Sky Again

A Reminder of the Solar System’s Dance For astronomers and backyard stargazers alike, Jupiter’s shift direction is another reminder that…

By – Rihem AkkoucheLux Aeterna $10M Seed Funding Fuels Ambitious Reusable Satellite Vision

Hypersonic testing On-orbit computing In-space manufacturing The startup has also signed multiple partnerships with U.S. government organizations exploring reusable spacecraft…

By – Rihem AkkoucheNasa Satellite to Crash to Earth as Spacecraft Re-enters Atmosphere

Meteor Strike in Germany Adds to Cosmic Drama The satellite’s predicted descent comes just days after another celestial surprise. On…

By – Rihem AkkoucheThe Northern Lights Return

The Northern Lights have a chance to be visible from several northern U.S. states on Tuesday night, forecasters at the…

By – Jackie AllenFebruary Unemployment Up as Job Losses Surprise Economists

According to the BLS: Producer prices rose 2.9% year-over-year through January 2026 Core PPI increased 3.6%, excluding food and energy…

By – Jackie AllenLate-Night Attack by Venezuelan National at Florida Beach

Officials noted that the suspect had overstayed his work visa at the time of the attack. For more details on…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

On the Republican side, most lawmakers appear to back Trump’s strategy. Sen. Tom Cotton (R-Ark.), chair of the Senate Intelligence…

By – Jackie AllenU.S. And Israel Launch Major Strikes On Iran — What It Means For America

Continuation of military strikes if Iran persists in retaliatory attacks. Diplomacy or ceasefire negotiations if international pressure increases. A broader…

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

BNSF declined to comment on the decision. Judges Consuelo M. Callahan, Morgan B. Christen and Andrew D. Hurwitz sat on…

By – Tyler BrooksWinklevoss Twins’ Bitcoin Transfer Sparks Market Speculation

Turbulence and Strategic Changes at Gemini The Winklevoss twins’ Bitcoin transfer also comes during a period of internal transition at…

By – Rachel MooreMedtronic to Buy Scientia Vascular in $550 Million Neurovascular Deal

Leaders See Expanded Global Impact For Scientia, the acquisition opens the door to a much larger stage. “Scientia has developed…

By – Rihem AkkoucheGoogle and Tesla Power Grid Initiative Targets Lower Energy Costs

Tech Industry Promises to Address Costs Technology companies have recently begun pledging to help prevent those costs from falling on…

By – Rihem AkkoucheJupiter’s Shift Direction Lights Up the Night Sky Again

A Reminder of the Solar System’s Dance For astronomers and backyard stargazers alike, Jupiter’s shift direction is another reminder that…

By – Rihem AkkoucheLux Aeterna $10M Seed Funding Fuels Ambitious Reusable Satellite Vision

Hypersonic testing On-orbit computing In-space manufacturing The startup has also signed multiple partnerships with U.S. government organizations exploring reusable spacecraft…

By – Rihem AkkoucheNasa Satellite to Crash to Earth as Spacecraft Re-enters Atmosphere

Meteor Strike in Germany Adds to Cosmic Drama The satellite’s predicted descent comes just days after another celestial surprise. On…

By – Rihem AkkoucheWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

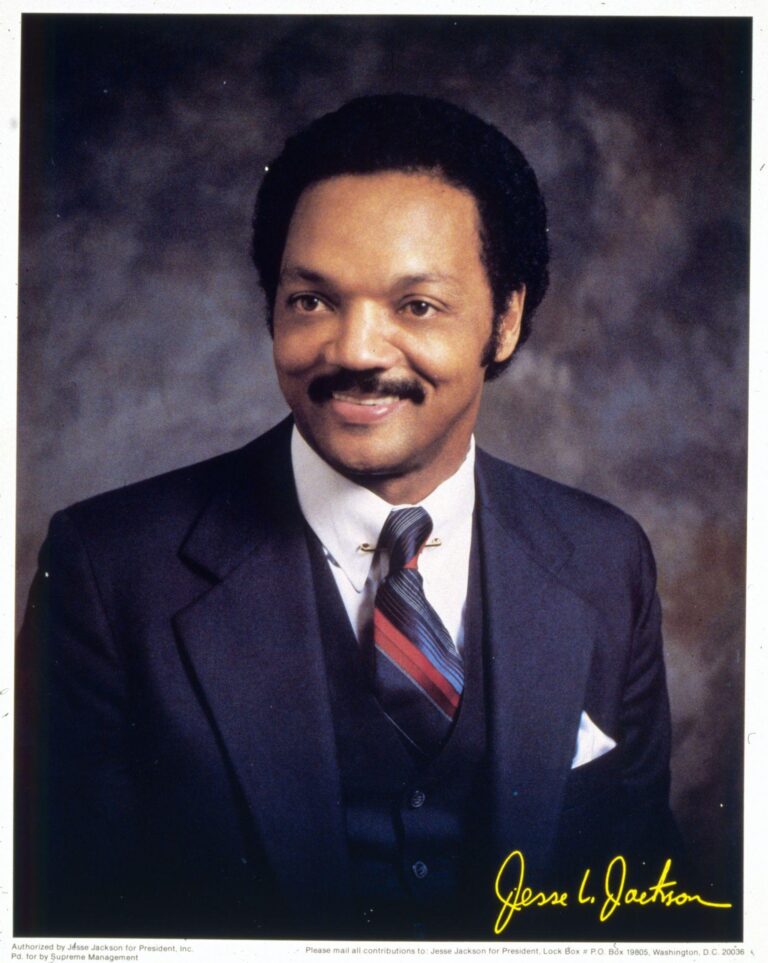

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

Even in later years, as illness softened his voice and slowed his step, Jackson remained active. In 2021, he was…

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

Community Support Grows as Search Continues As the investigation intensifies, the local community has rallied around the family. Neighbors and…

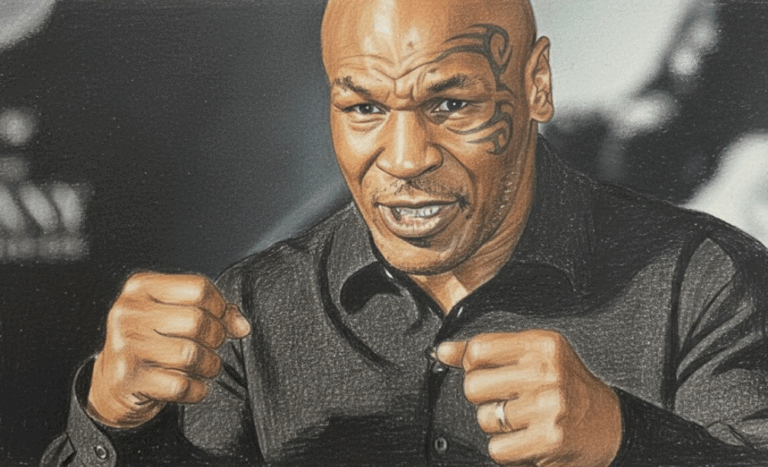

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksFebruary Unemployment Up as Job Losses Surprise Economists

According to the BLS: Producer prices rose 2.9% year-over-year through January 2026 Core PPI increased 3.6%, excluding food and energy…

By – Jackie AllenLate-Night Attack by Venezuelan National at Florida Beach

Officials noted that the suspect had overstayed his work visa at the time of the attack. For more details on…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

On the Republican side, most lawmakers appear to back Trump’s strategy. Sen. Tom Cotton (R-Ark.), chair of the Senate Intelligence…

By – Jackie AllenCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

Lowdon has previously spoken about Andretti’s early encouragement during the team’s formation stages, noting that the racing legend asked him…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

With 13 days complete at the 2026 Milan Cortina Winter Olympics, Norway sits atop the overall medal standings, collecting 34…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

When Amber Glenn finishes her routine, the arena usually rises with her. The music builds, her blades carve a tight…

By – Tyler BrooksNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!